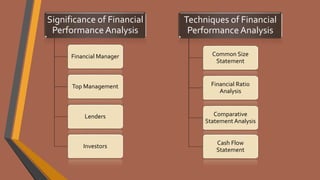

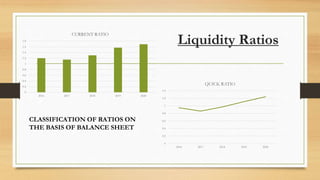

This document analyzes the financial performance of Radico Khaitan Ltd over several years using ratio analysis. It begins with an introduction and outlines the company profile. The analysis then calculates and compares various liquidity, profitability, and turnover ratios from 2016-2020. Key findings include the company's satisfactory but improving liquidity and profitability positions. The document concludes with recommendations to maintain profits and control costs, while acknowledging limitations of only considering monetary financial data.