This document summarizes a meeting to discuss changes to the Global Financial Model of AIESEC. Key points include:

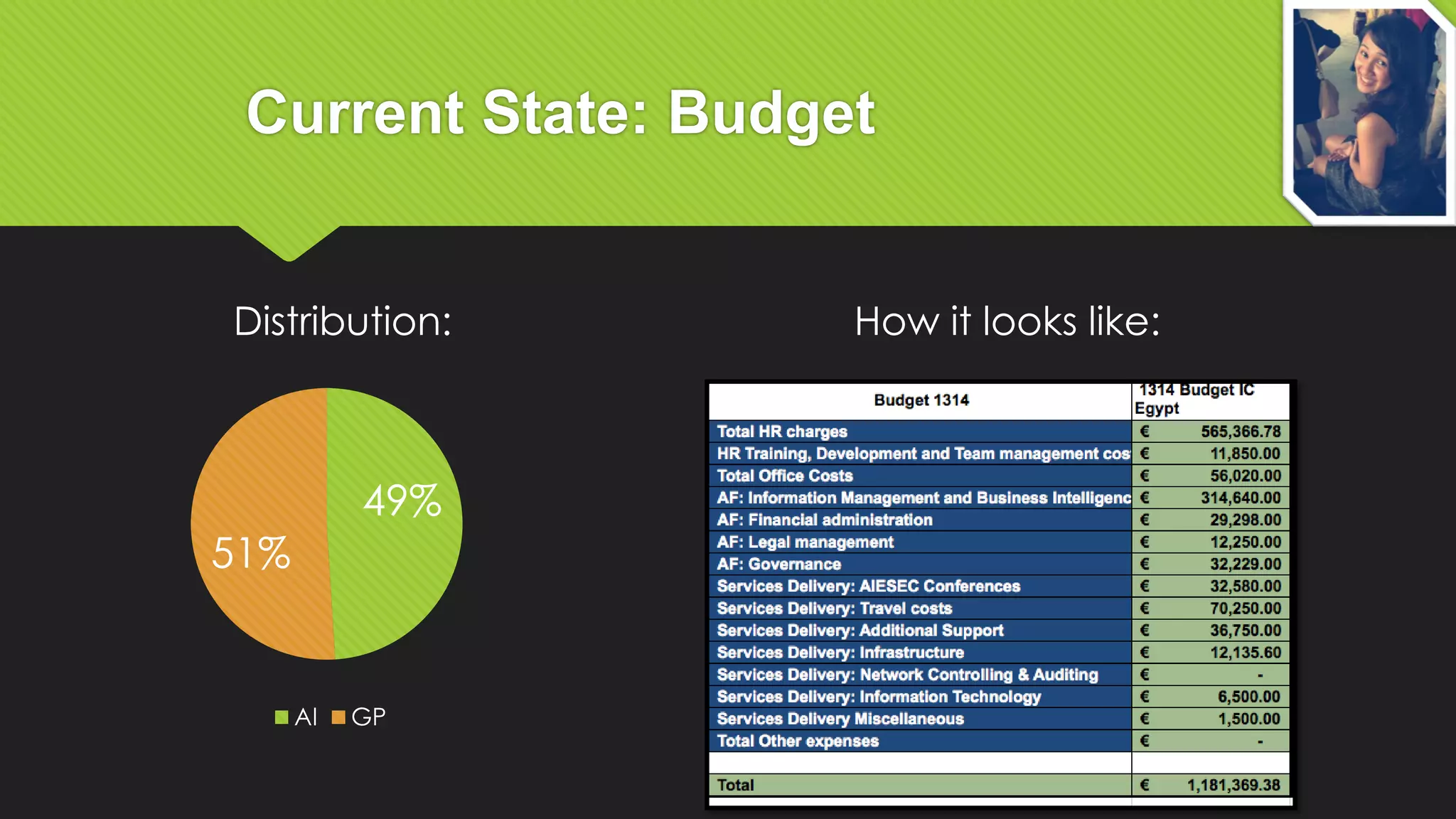

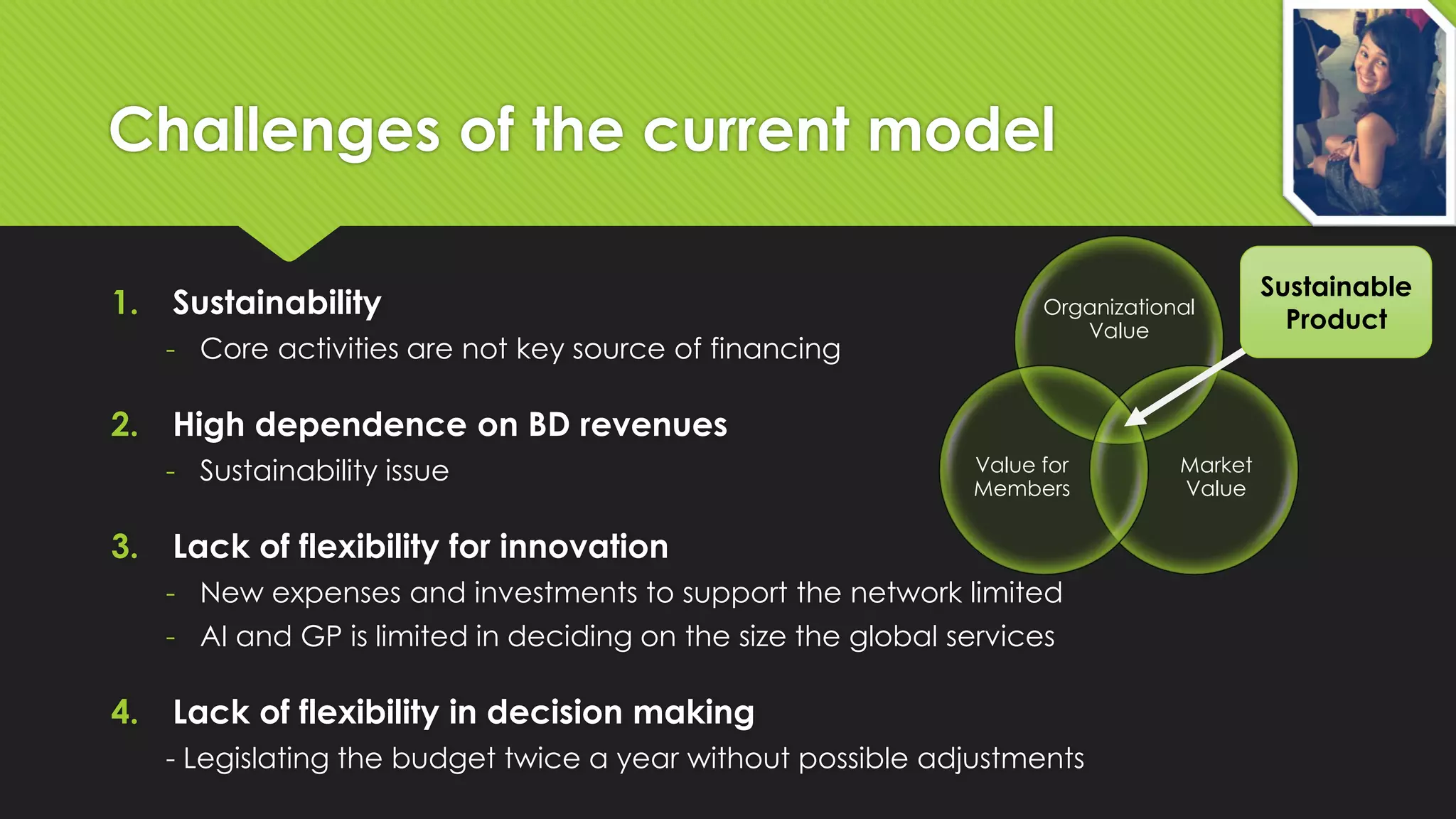

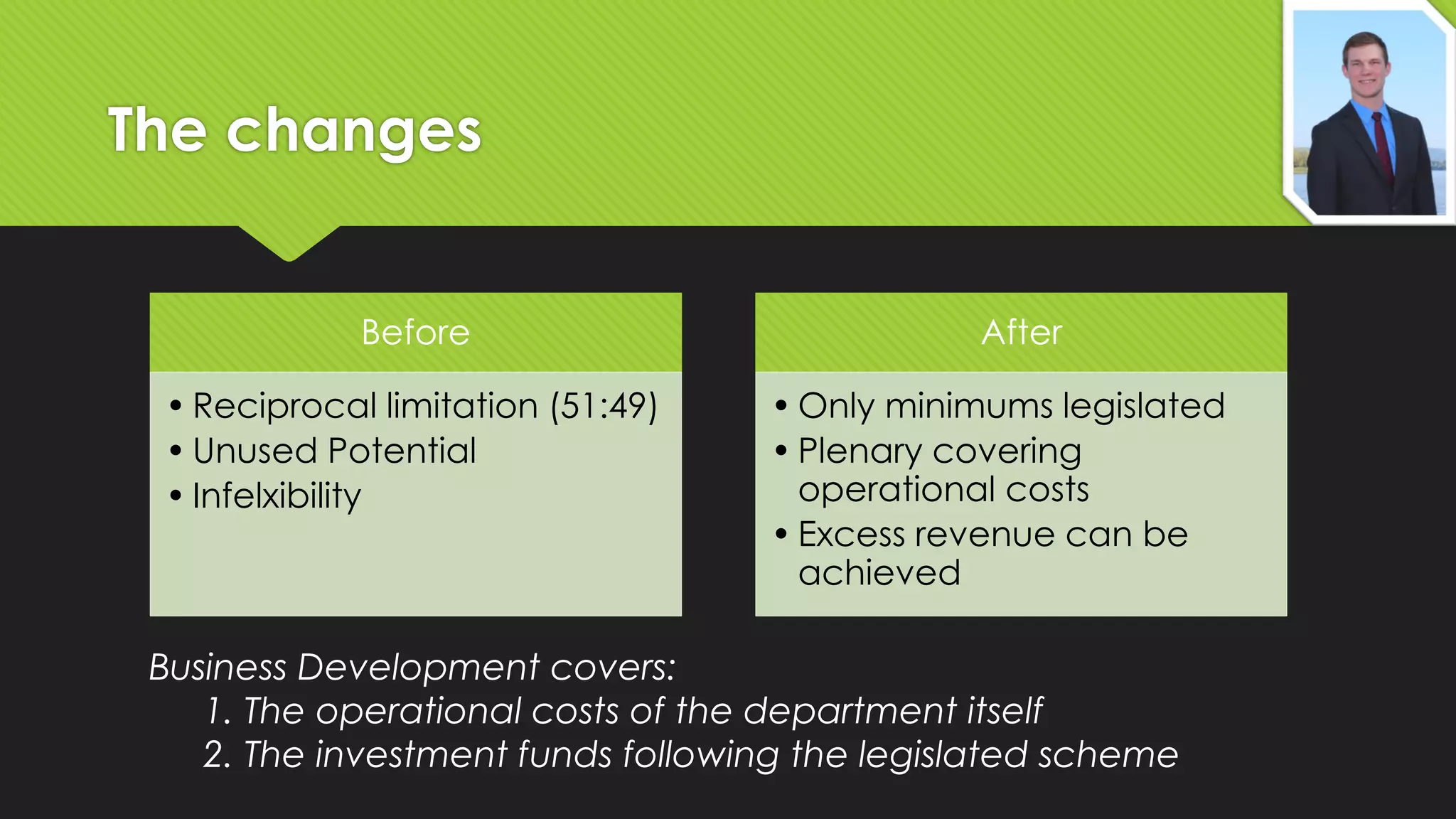

- The current model has challenges like lack of sustainability, flexibility, and high dependence on business development revenues.

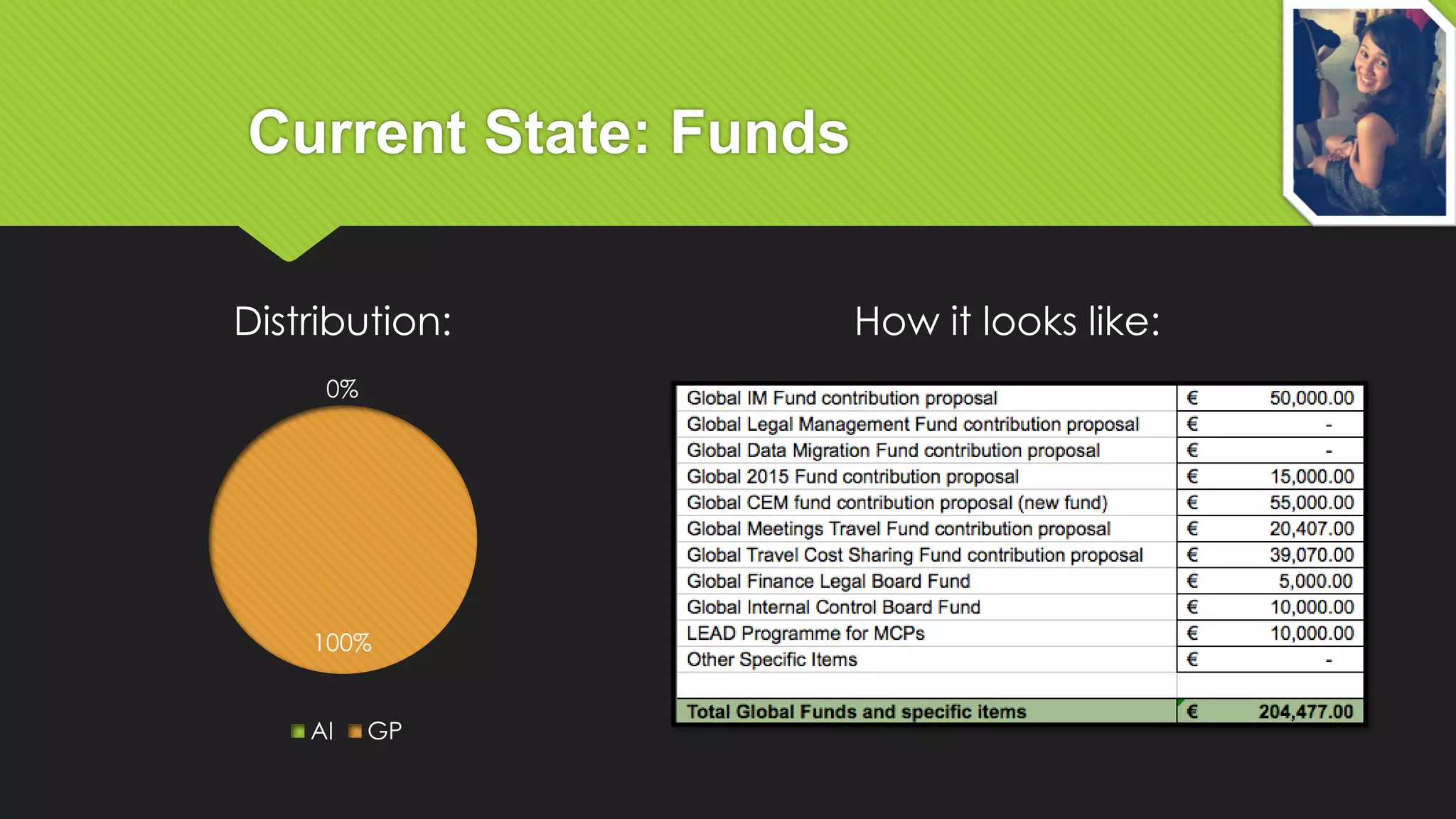

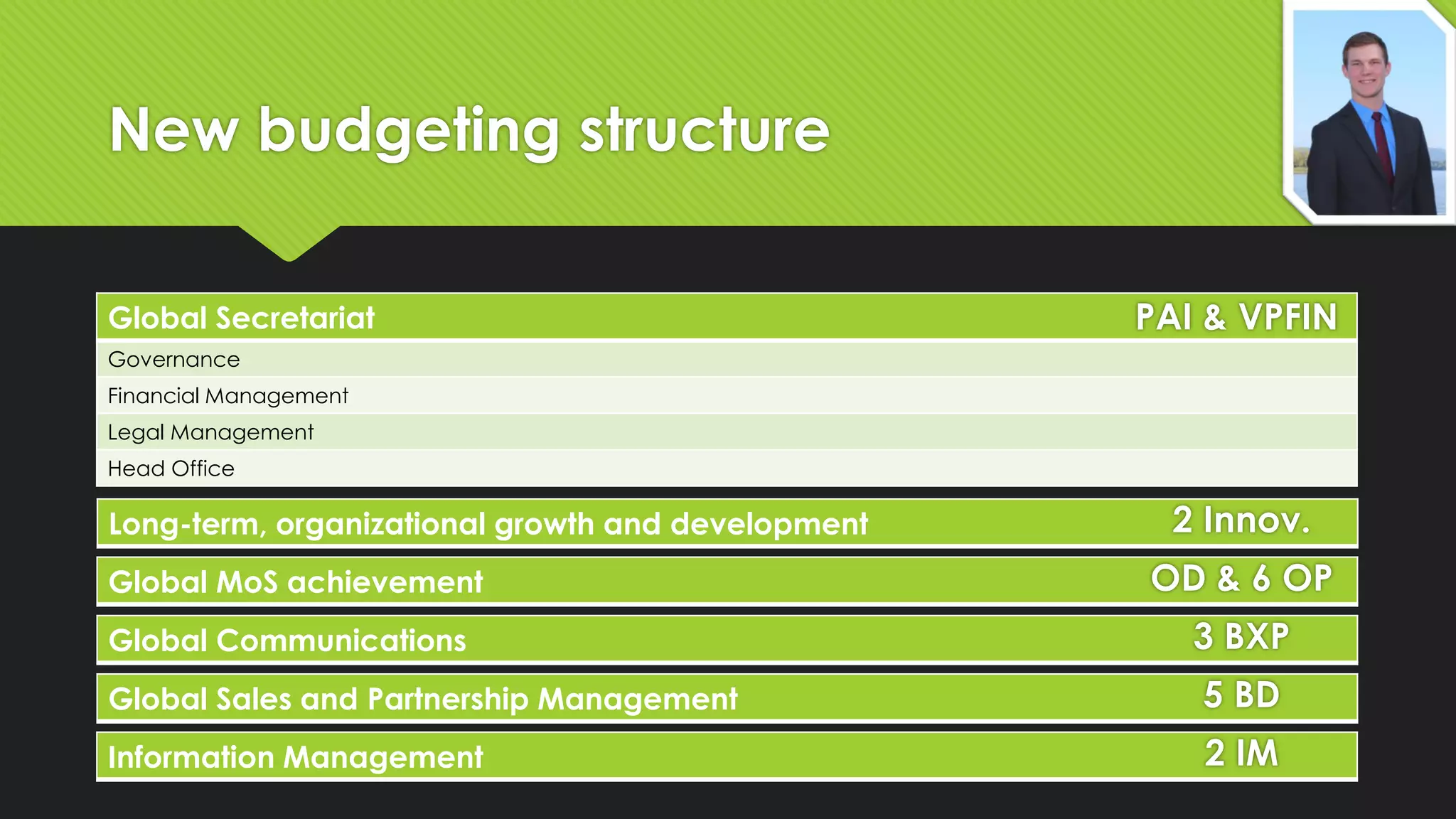

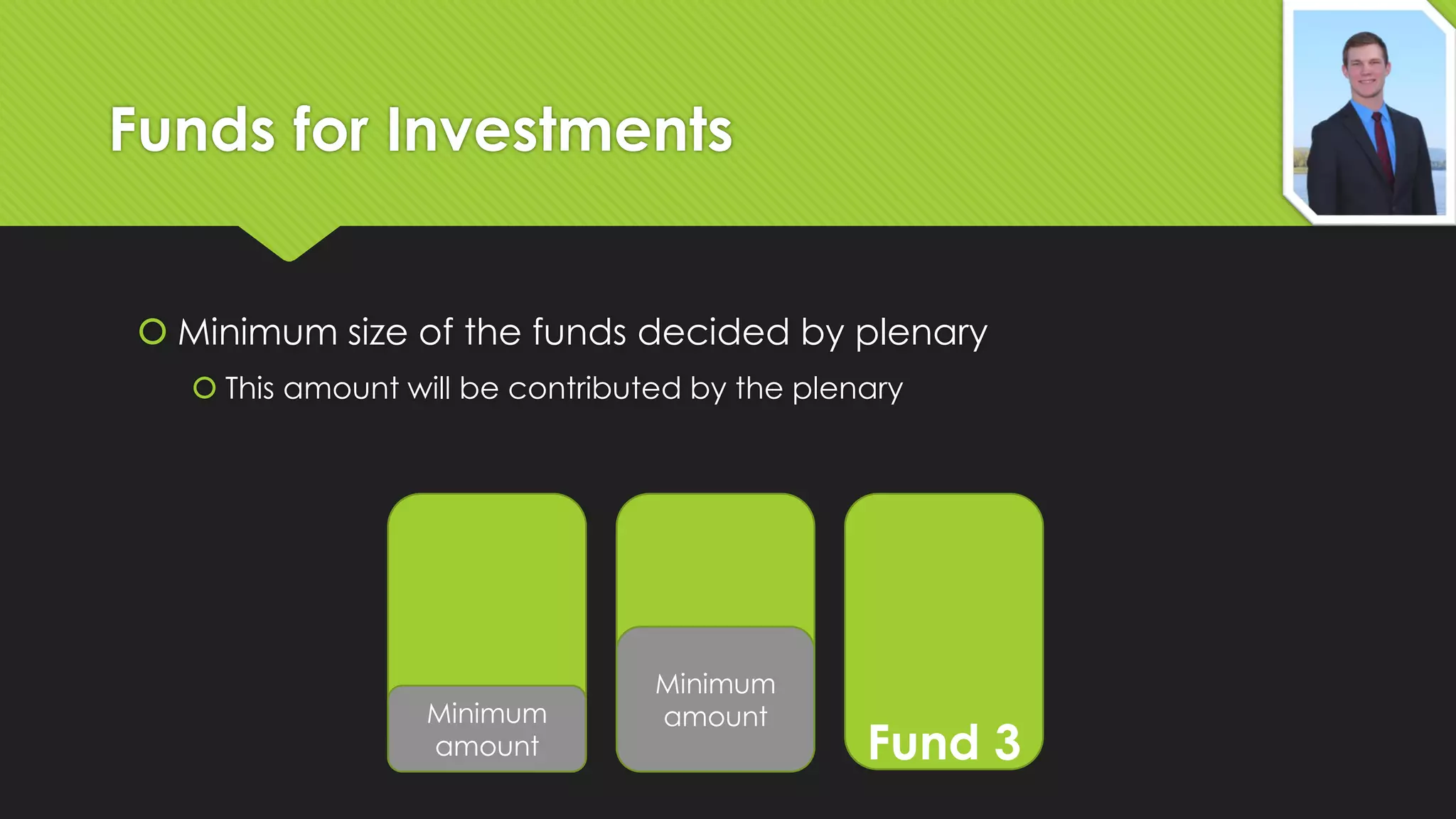

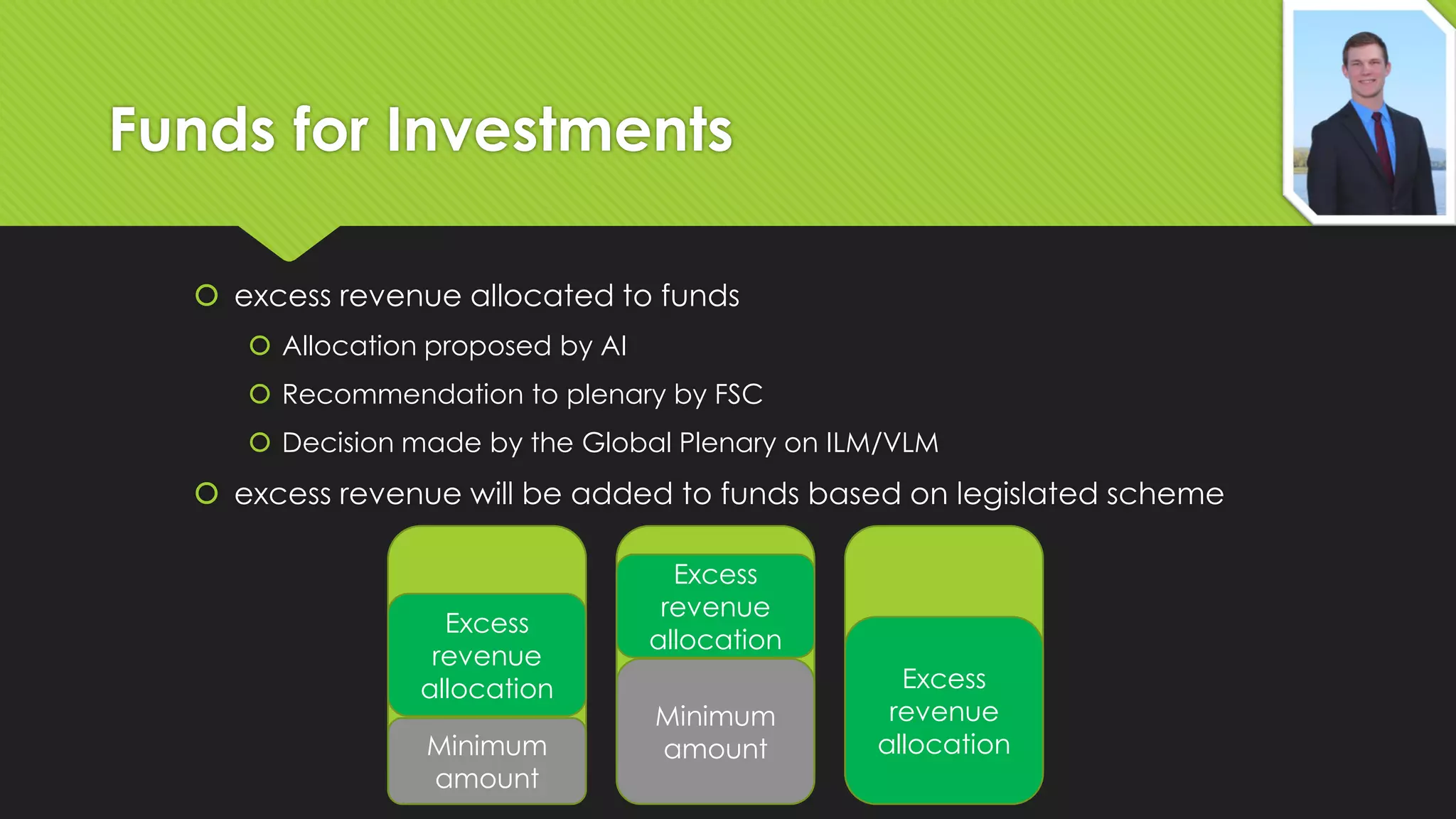

- The proposed new model would cluster services, have cost centers contribute based on the value received, establish investment funds, and allow for more flexible budget adjustments.

- Business development would cover its own operational costs and contribute excess revenues to investment funds, while the Global Plenary would cover other services' operational costs.

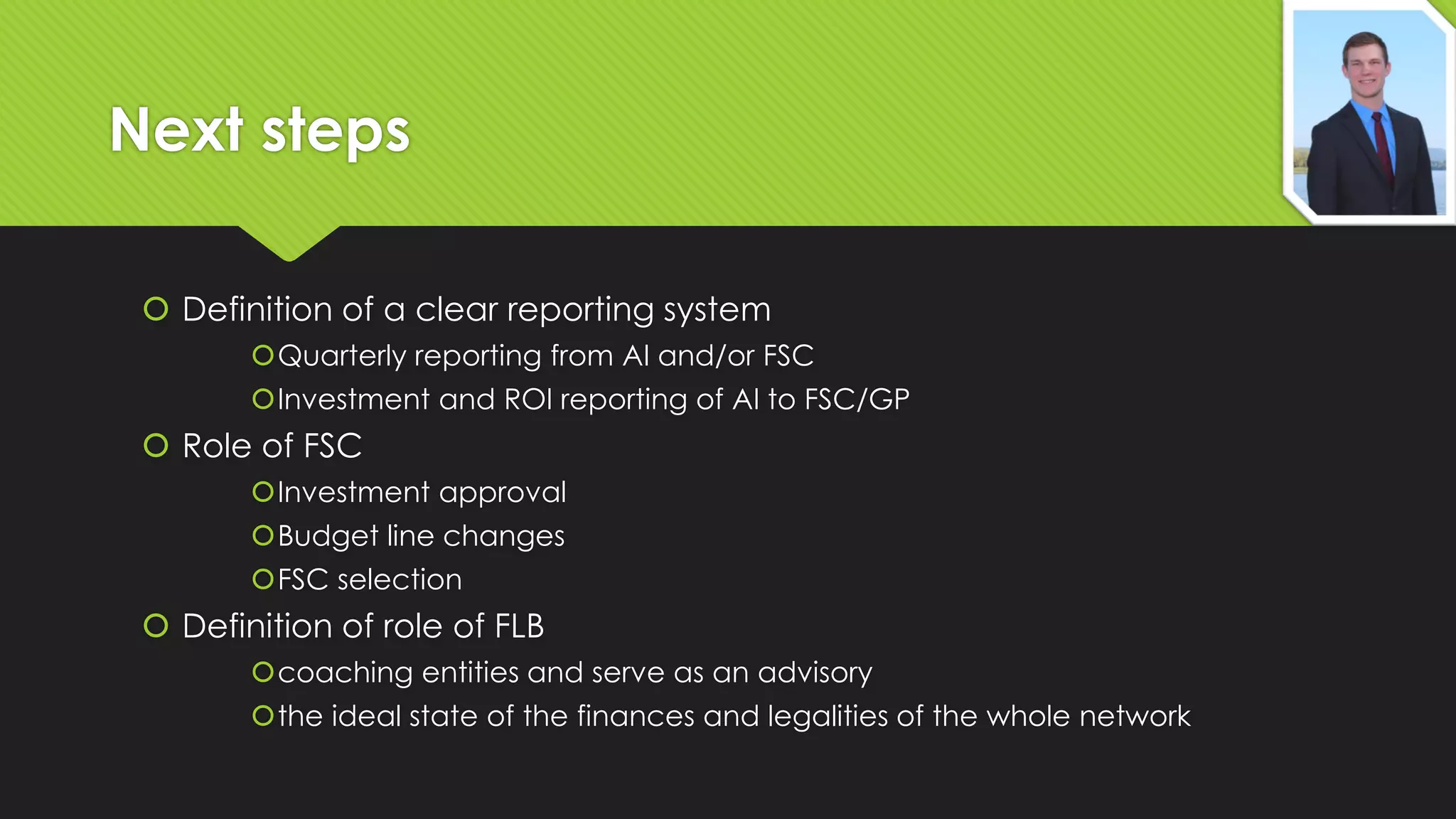

- Next steps are defining clear reporting, the roles of the Financial Steering Committee, and how the Finance Legal Board can support entities.