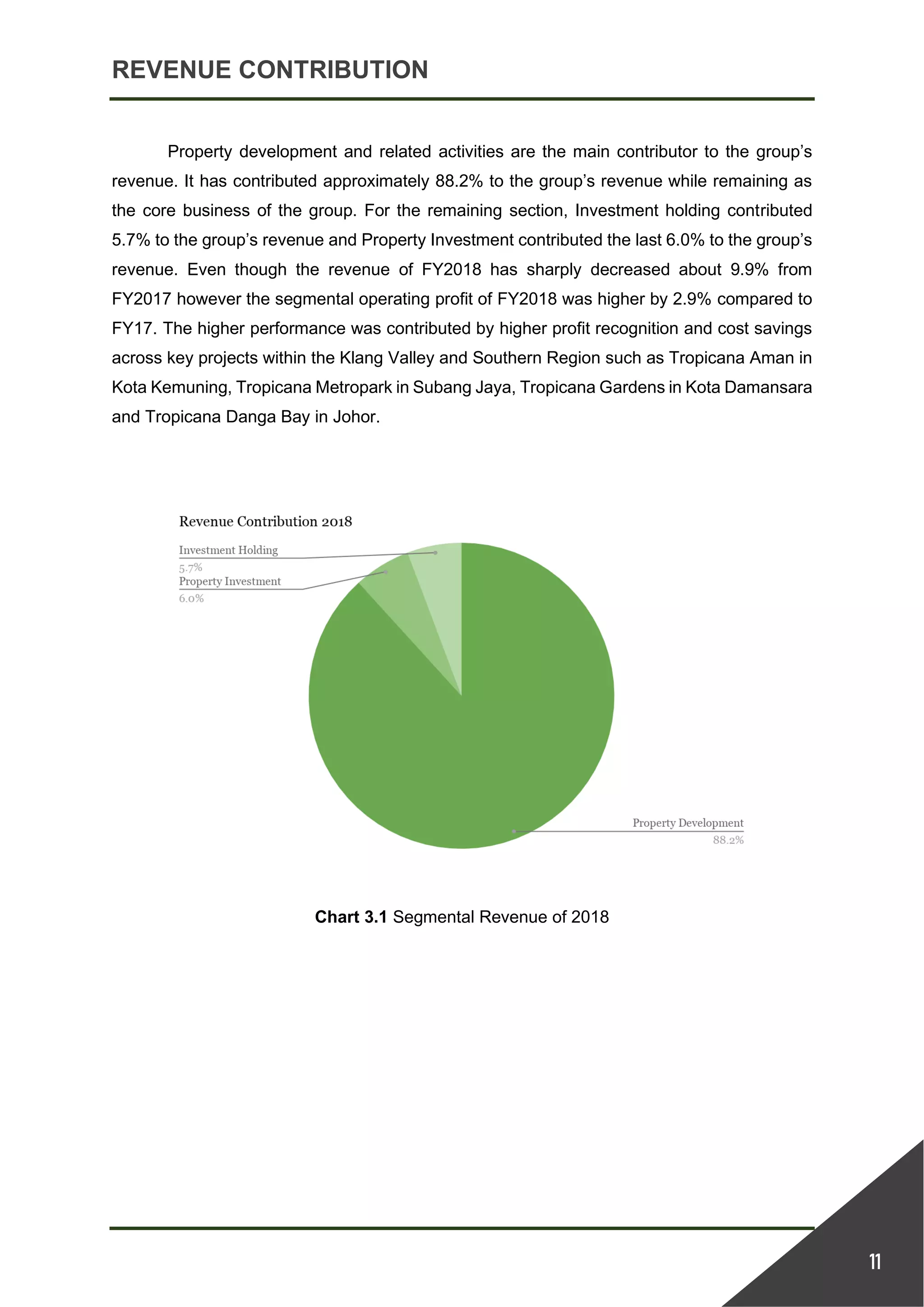

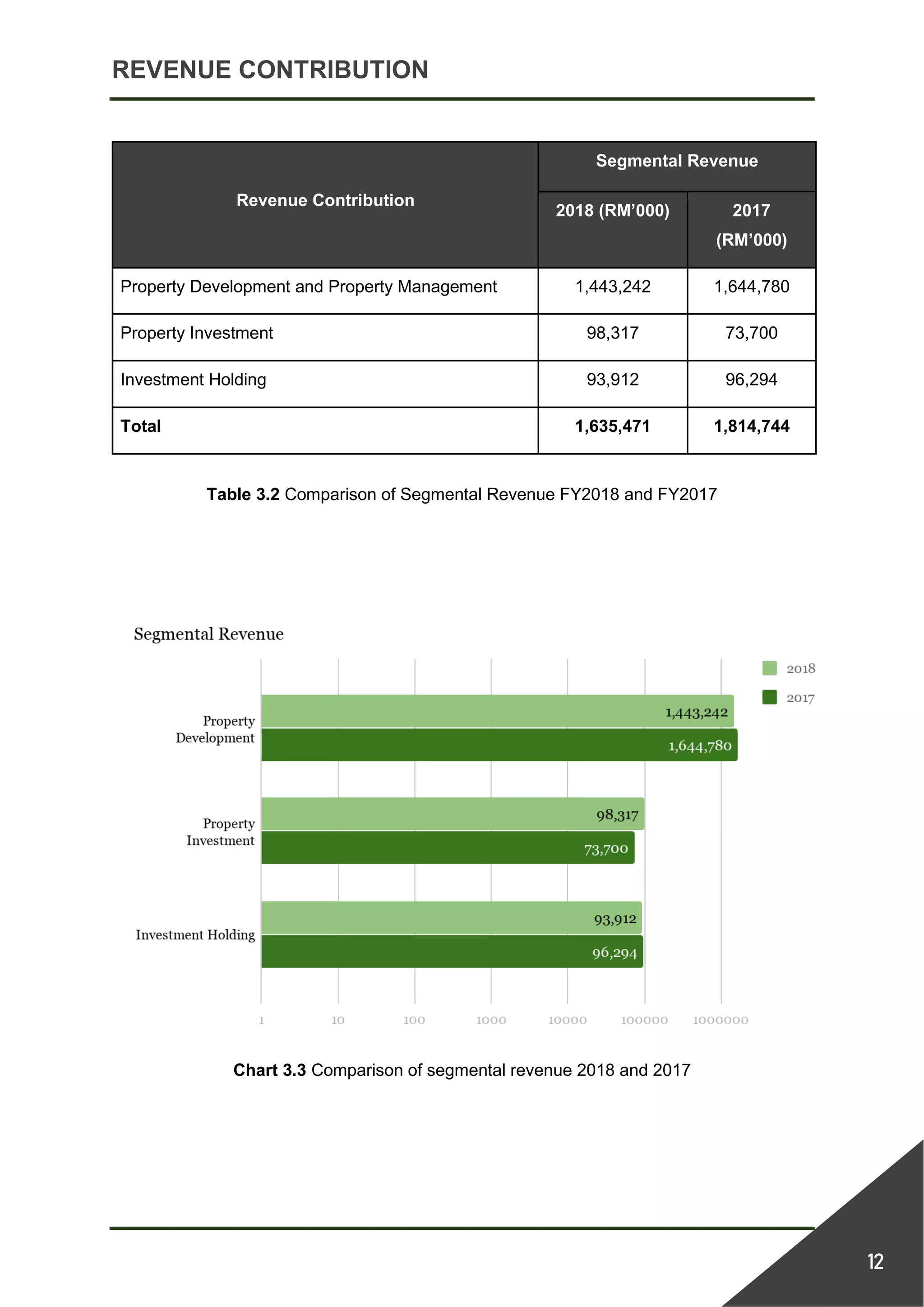

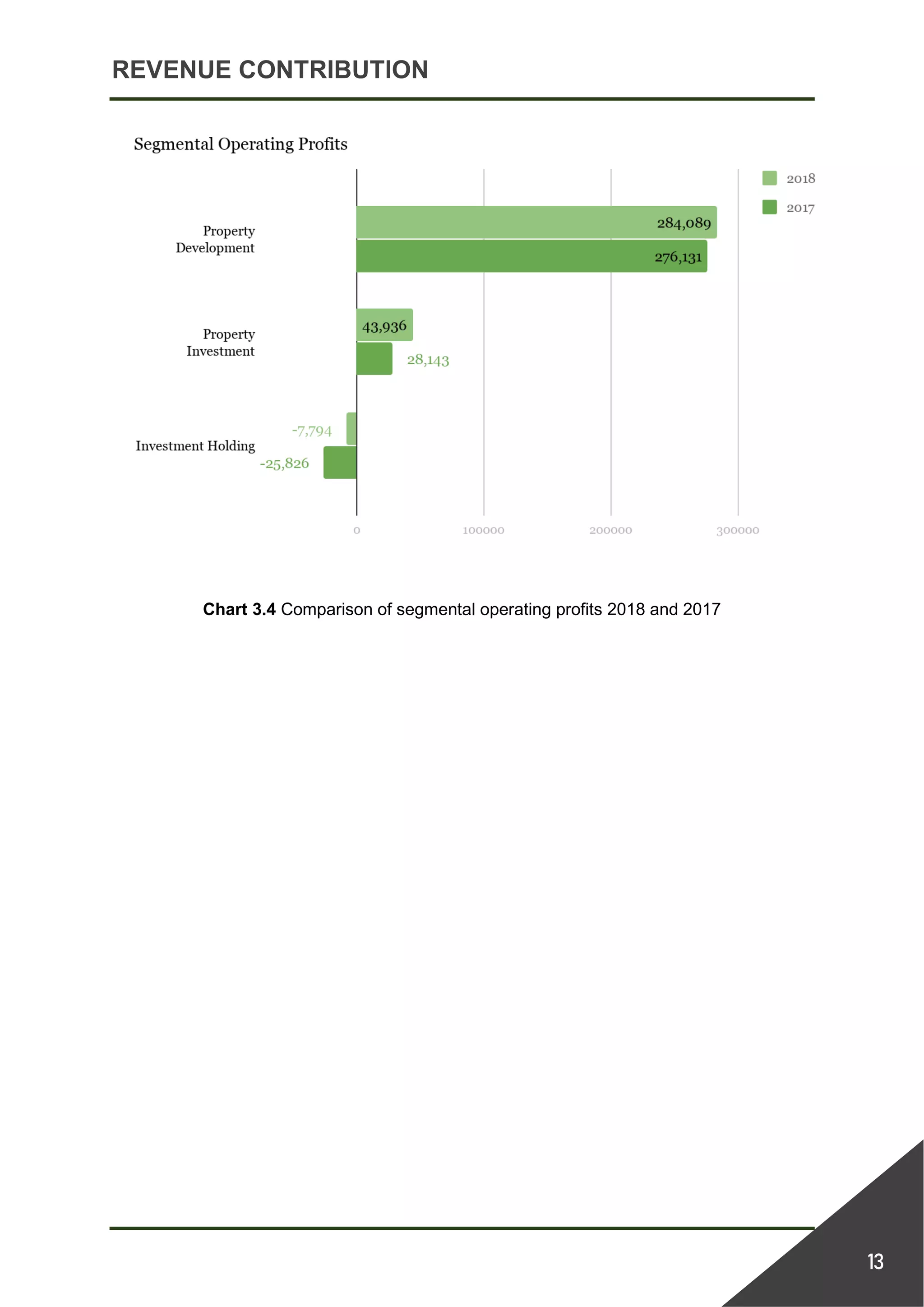

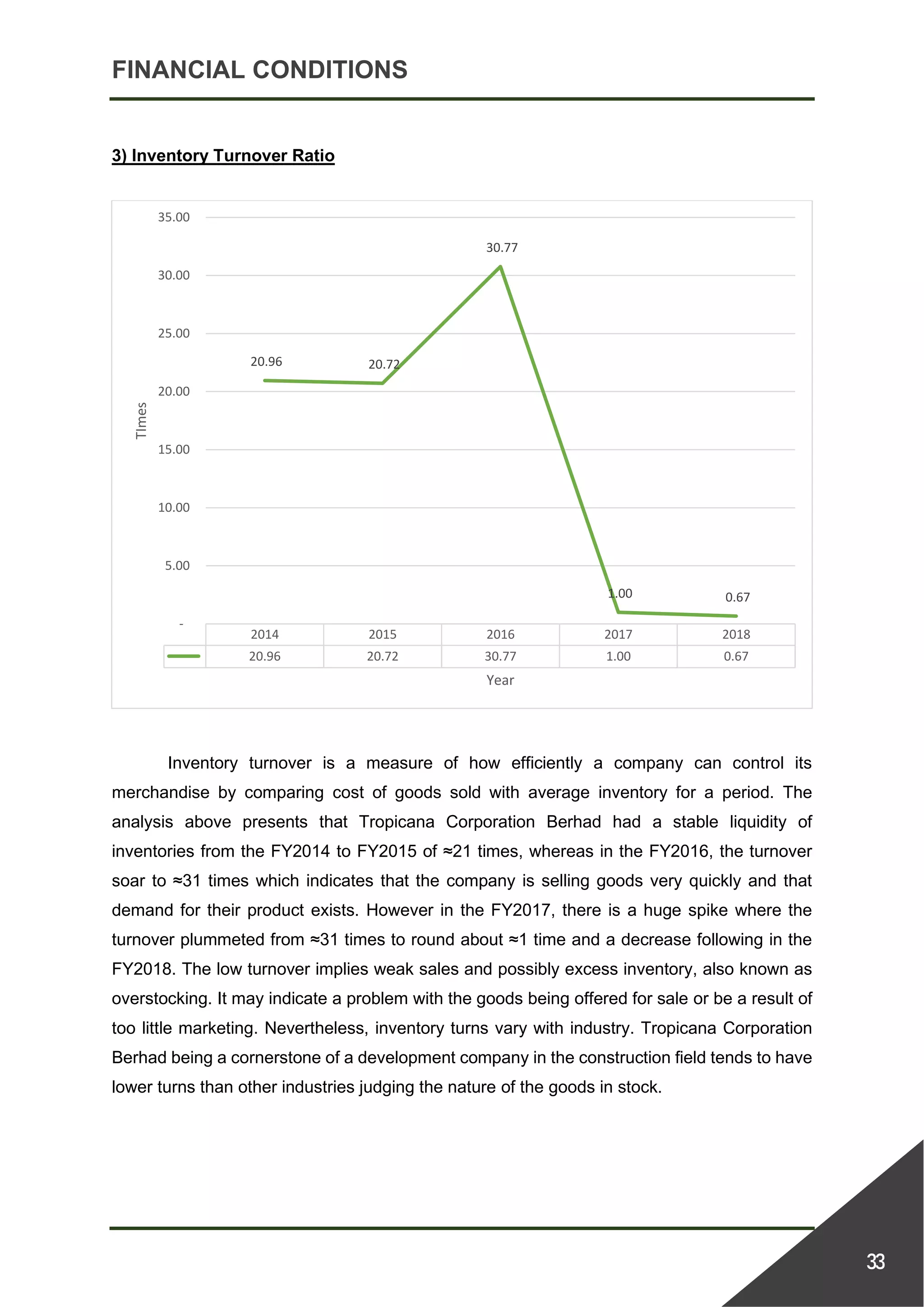

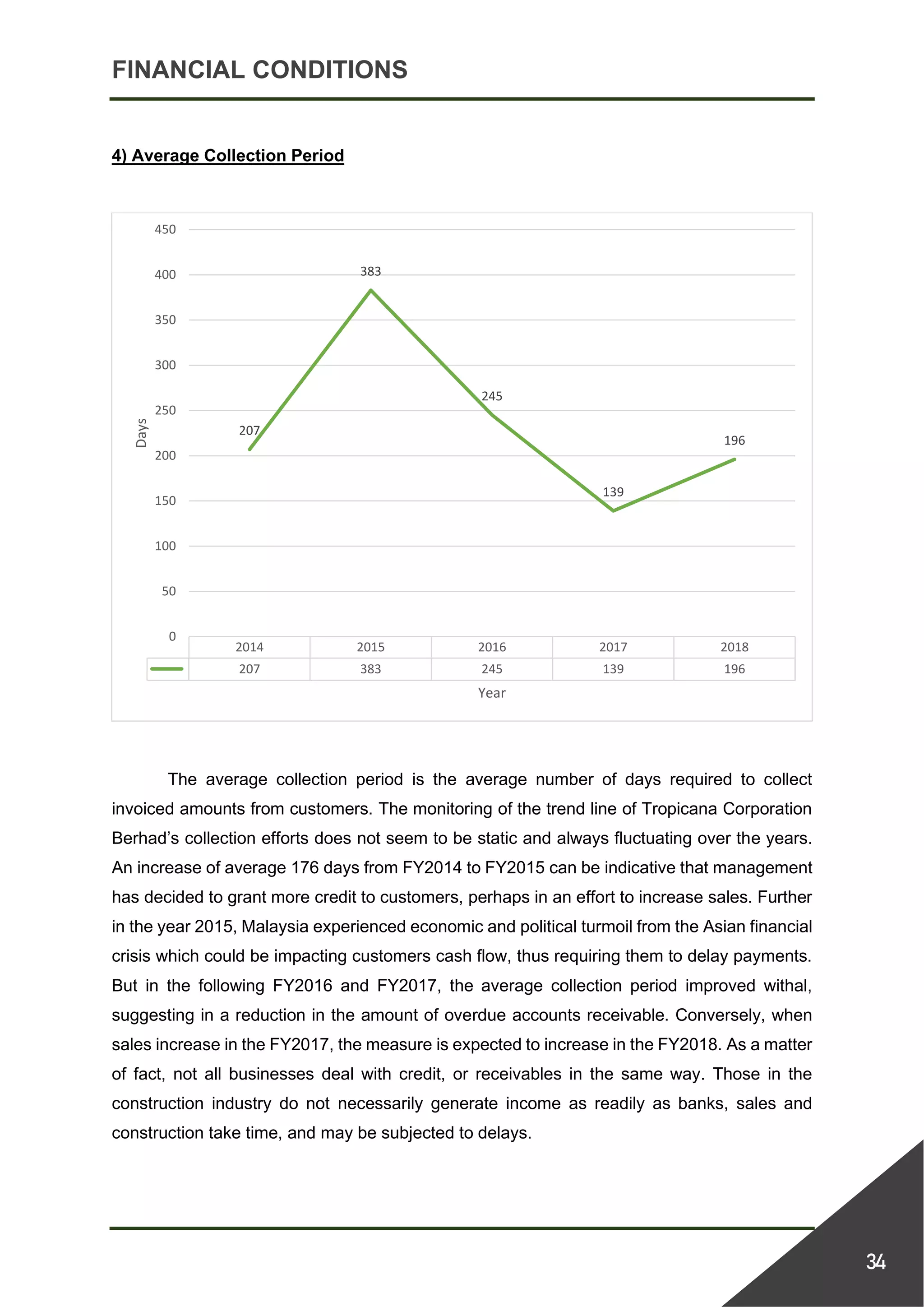

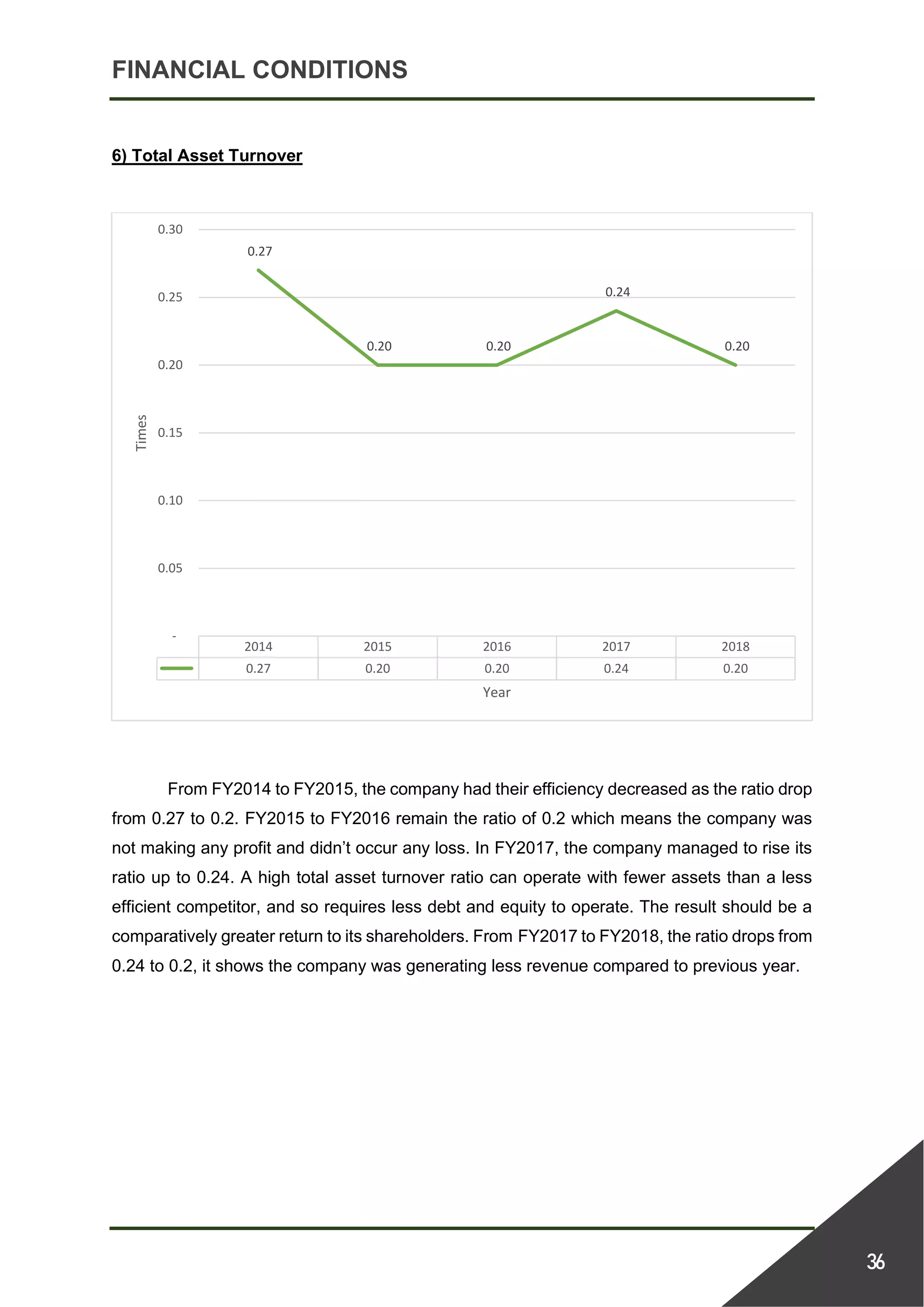

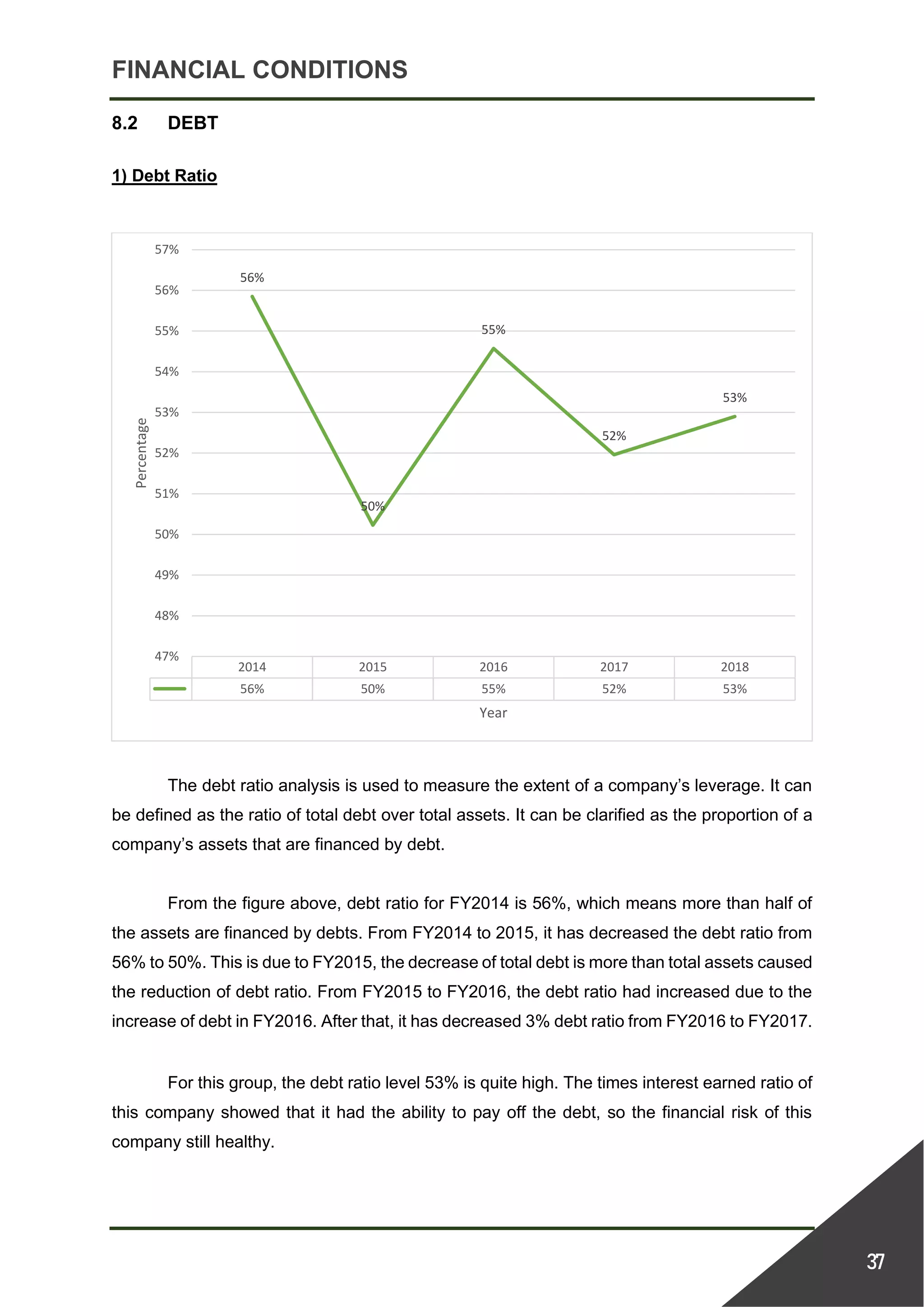

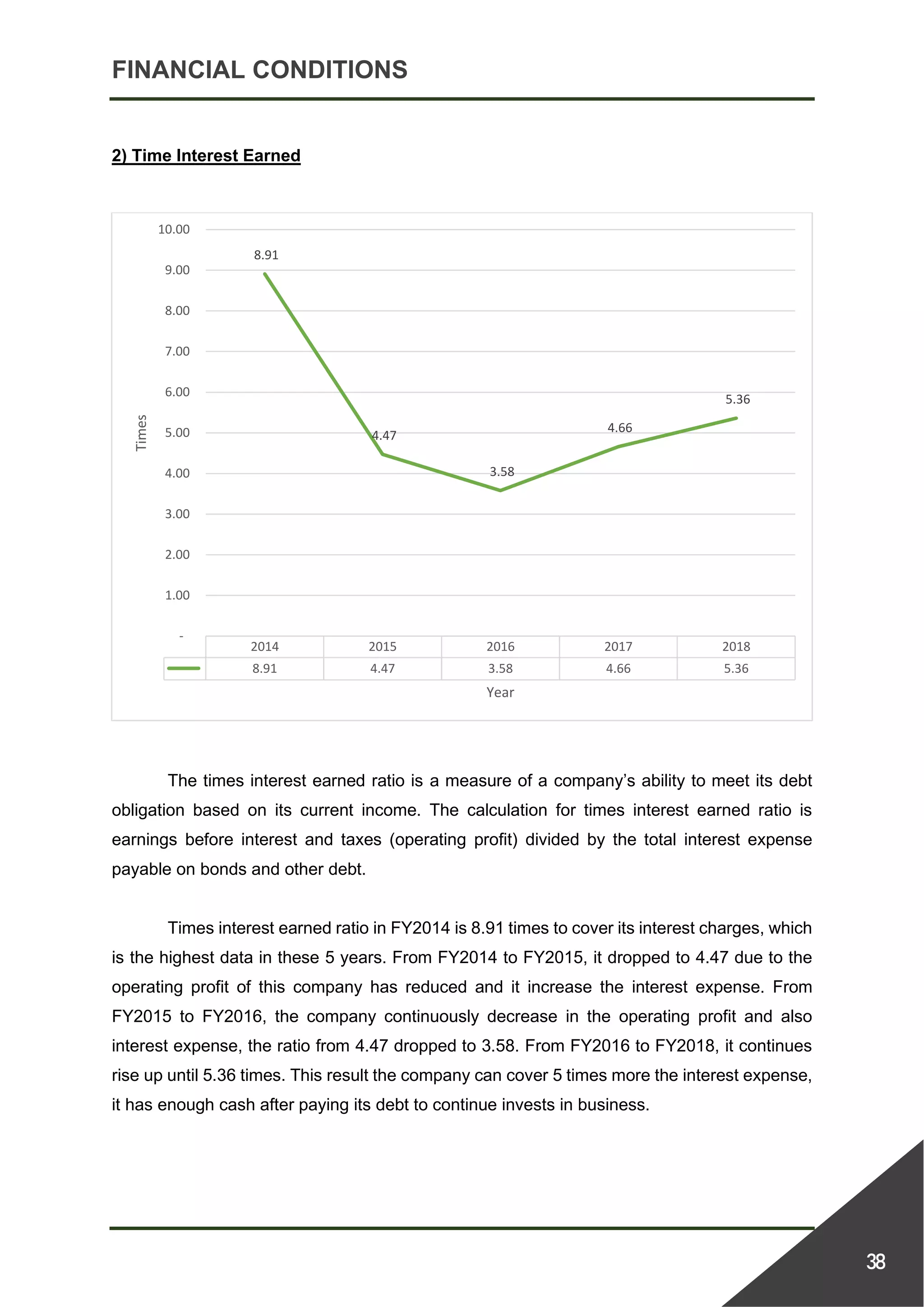

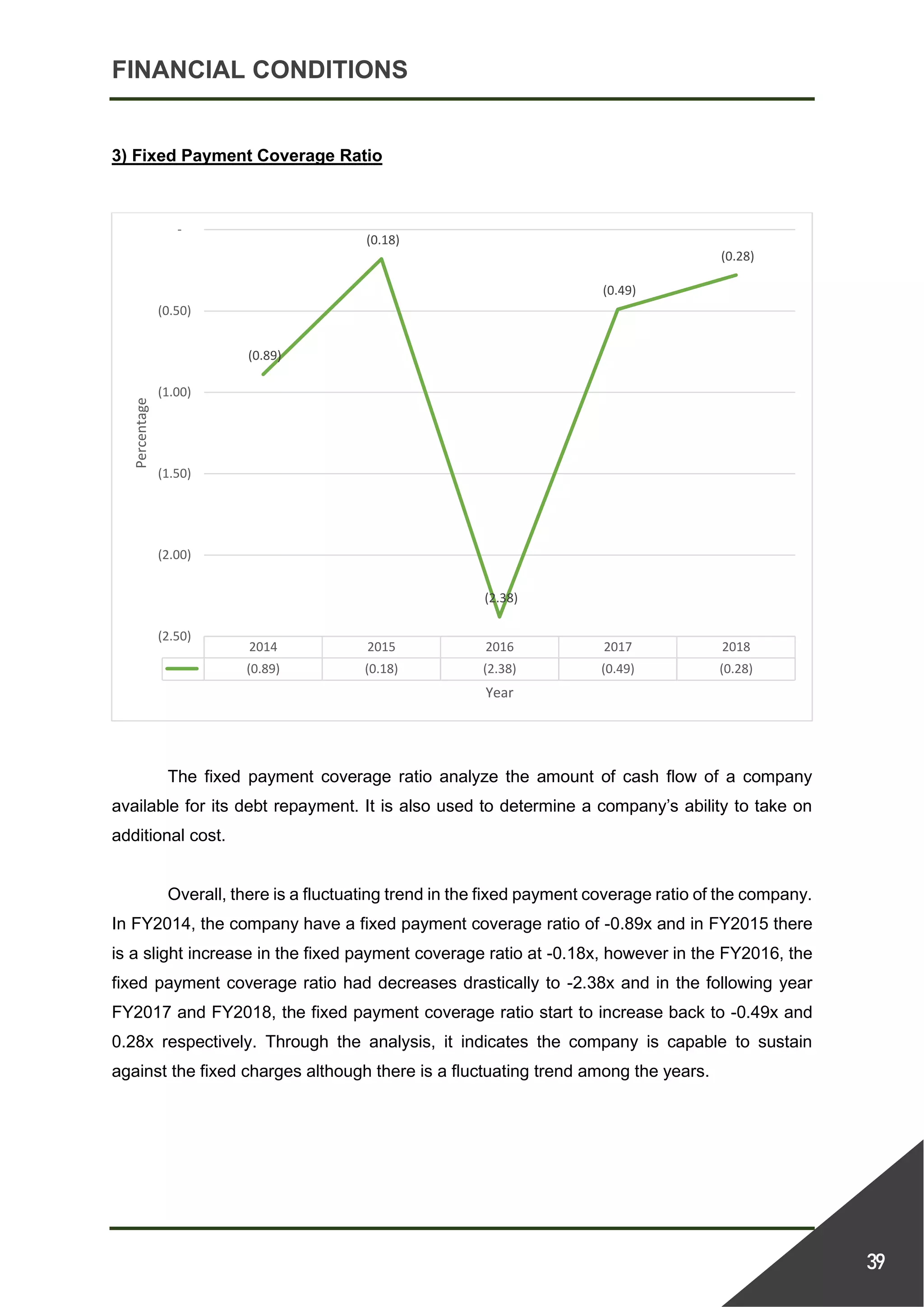

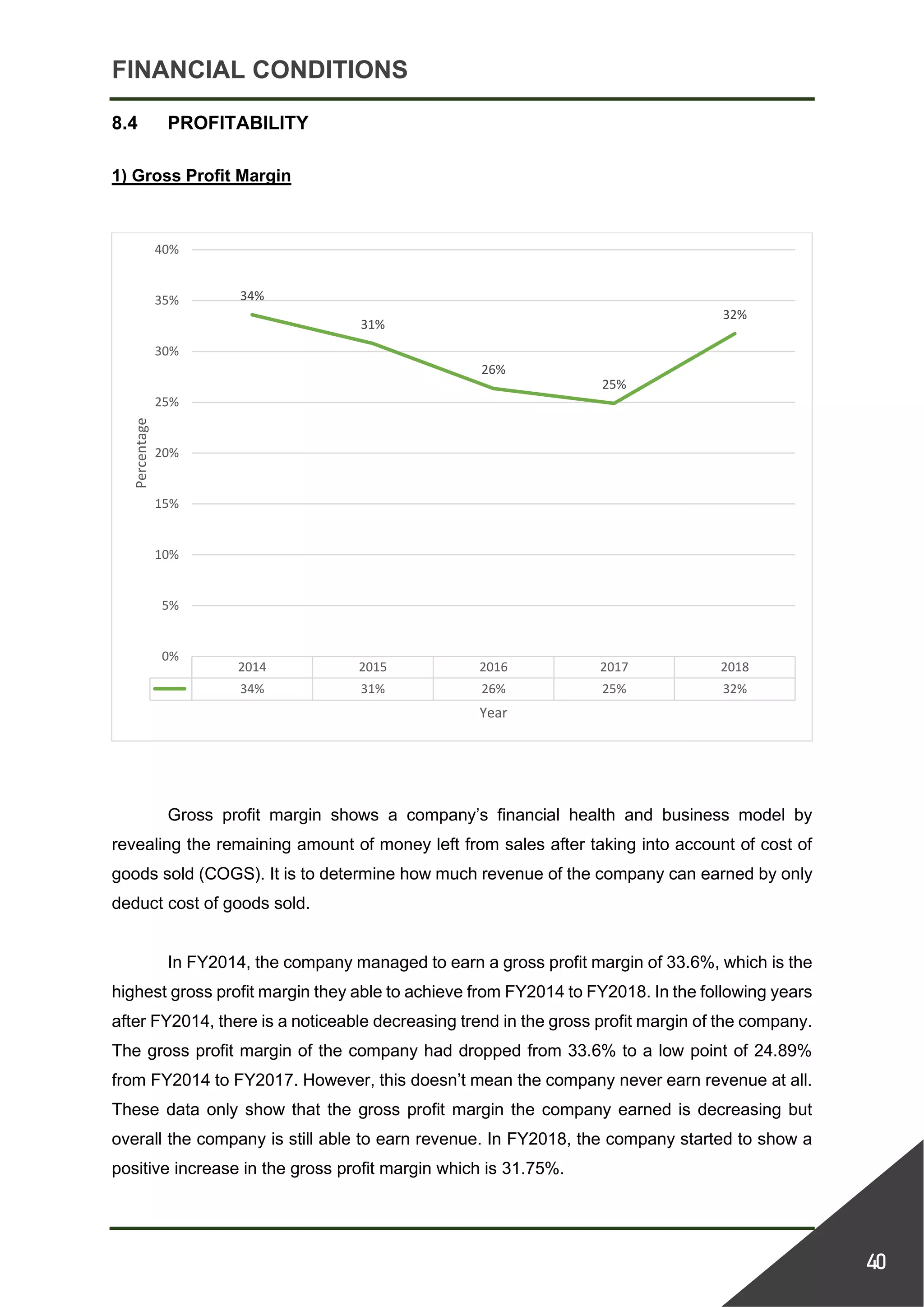

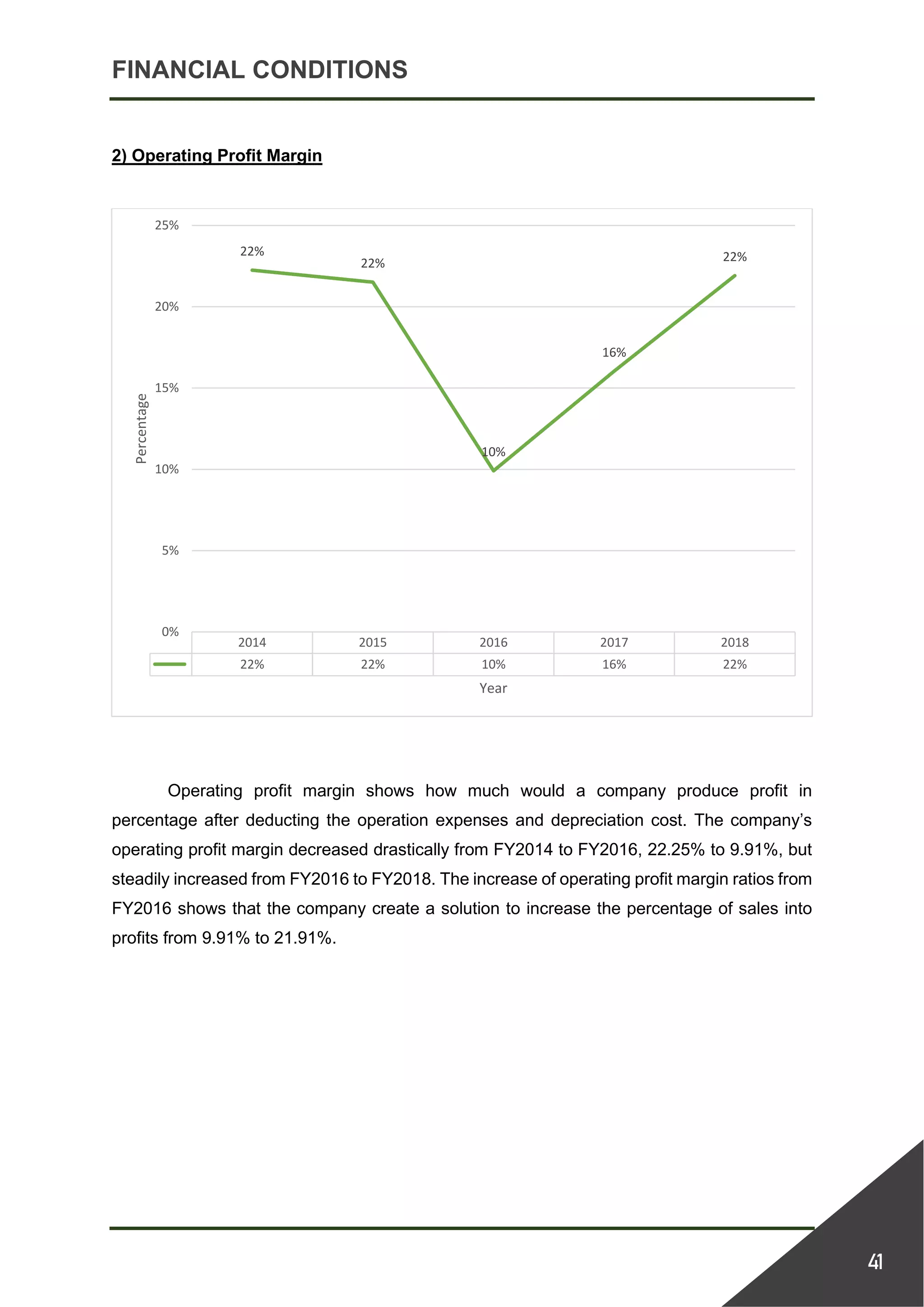

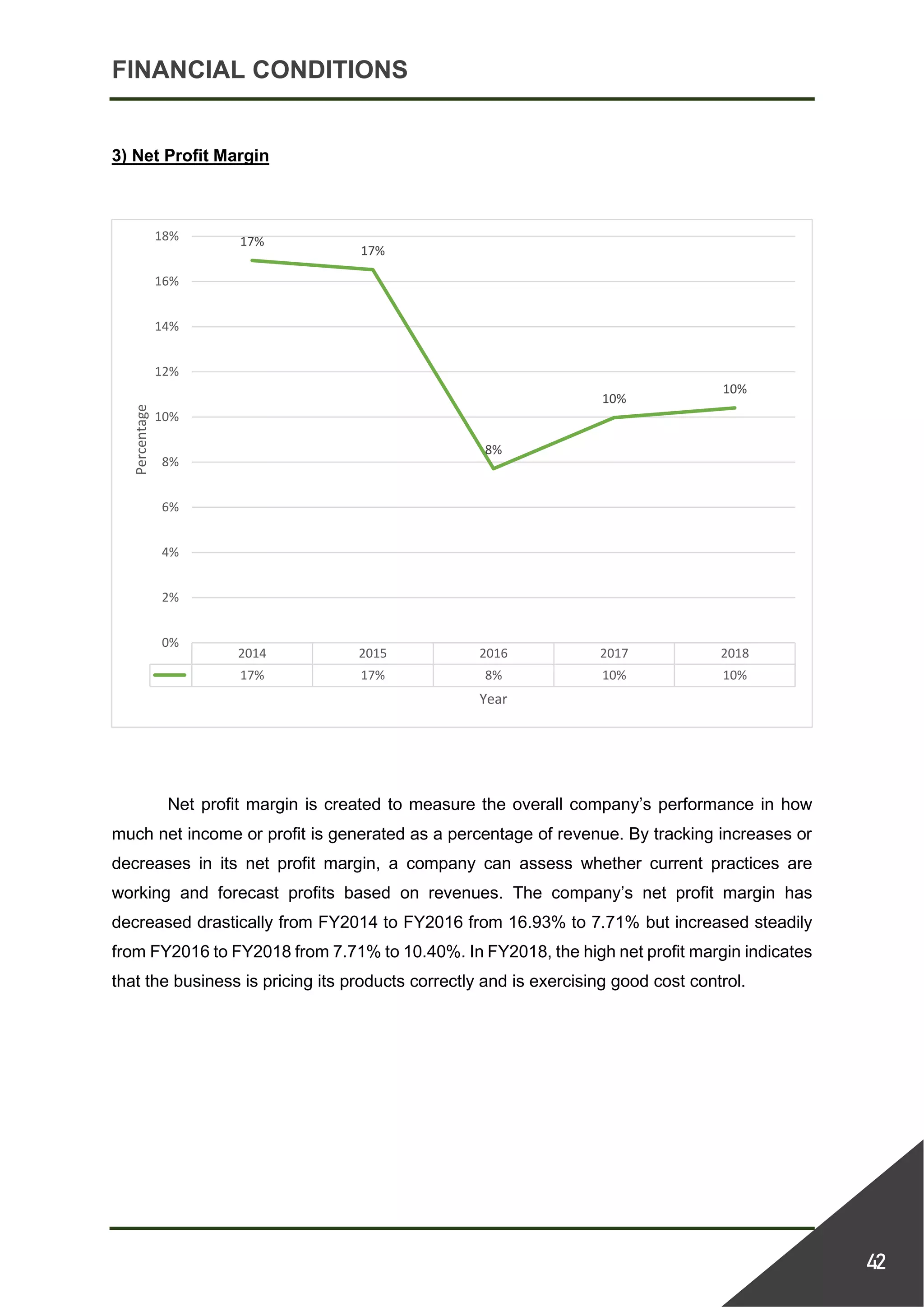

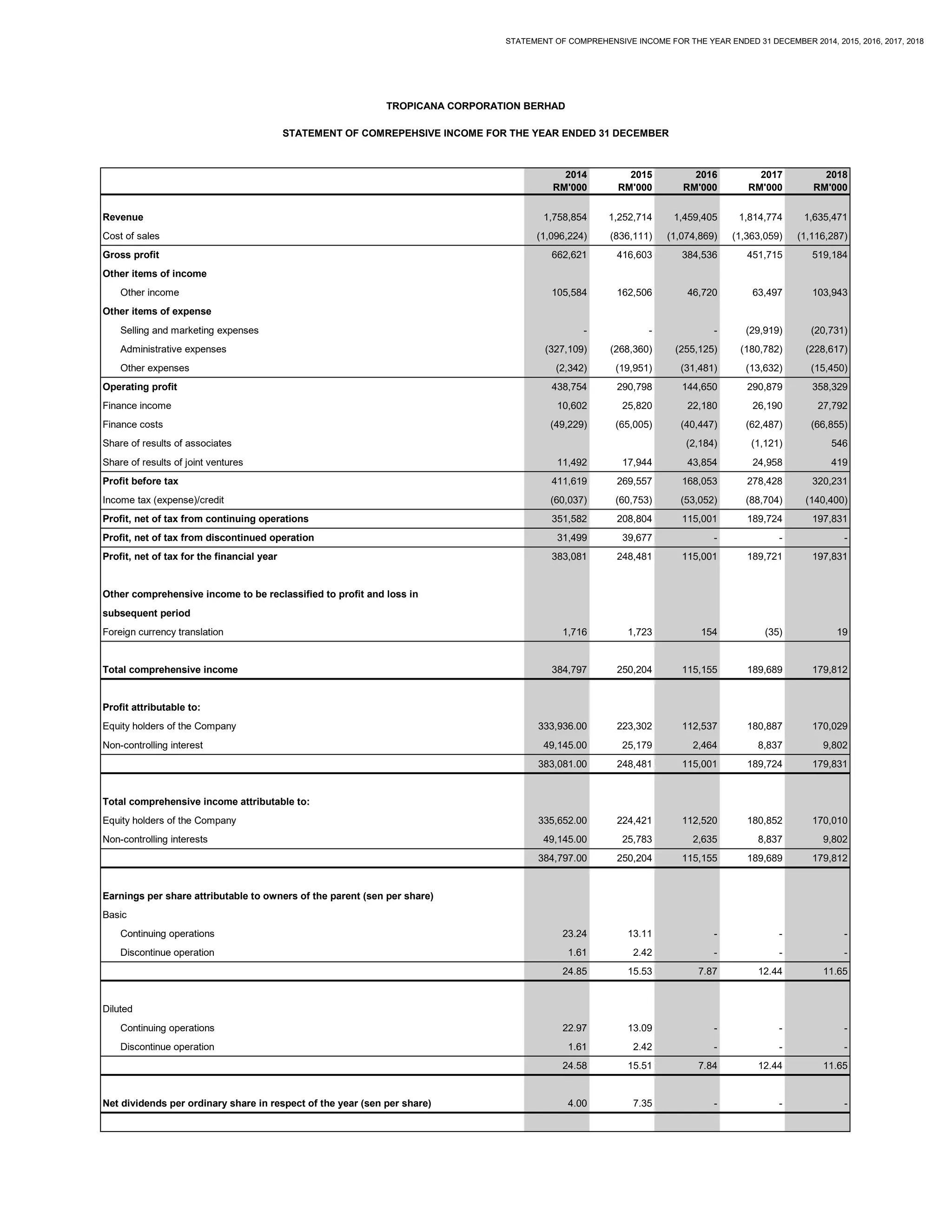

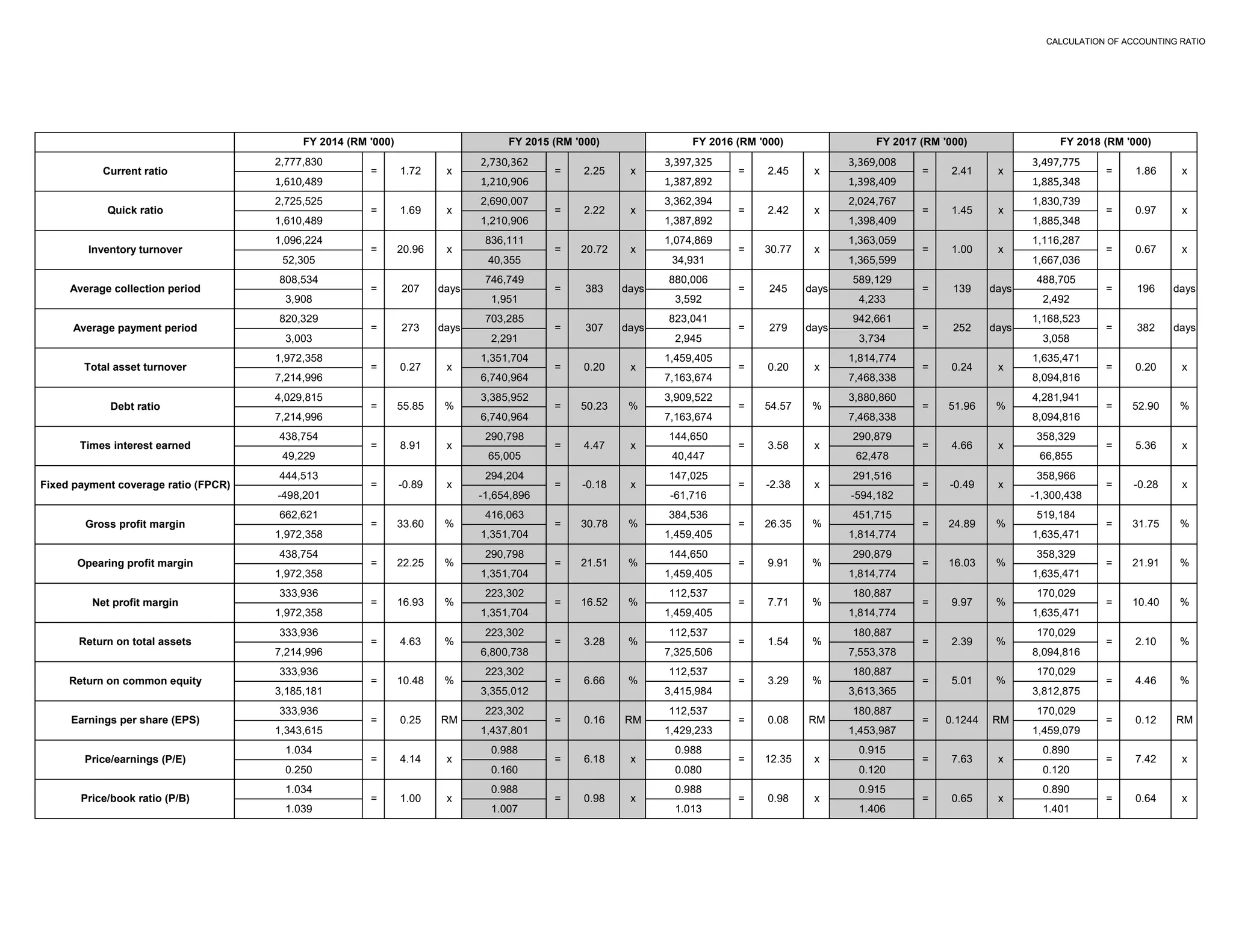

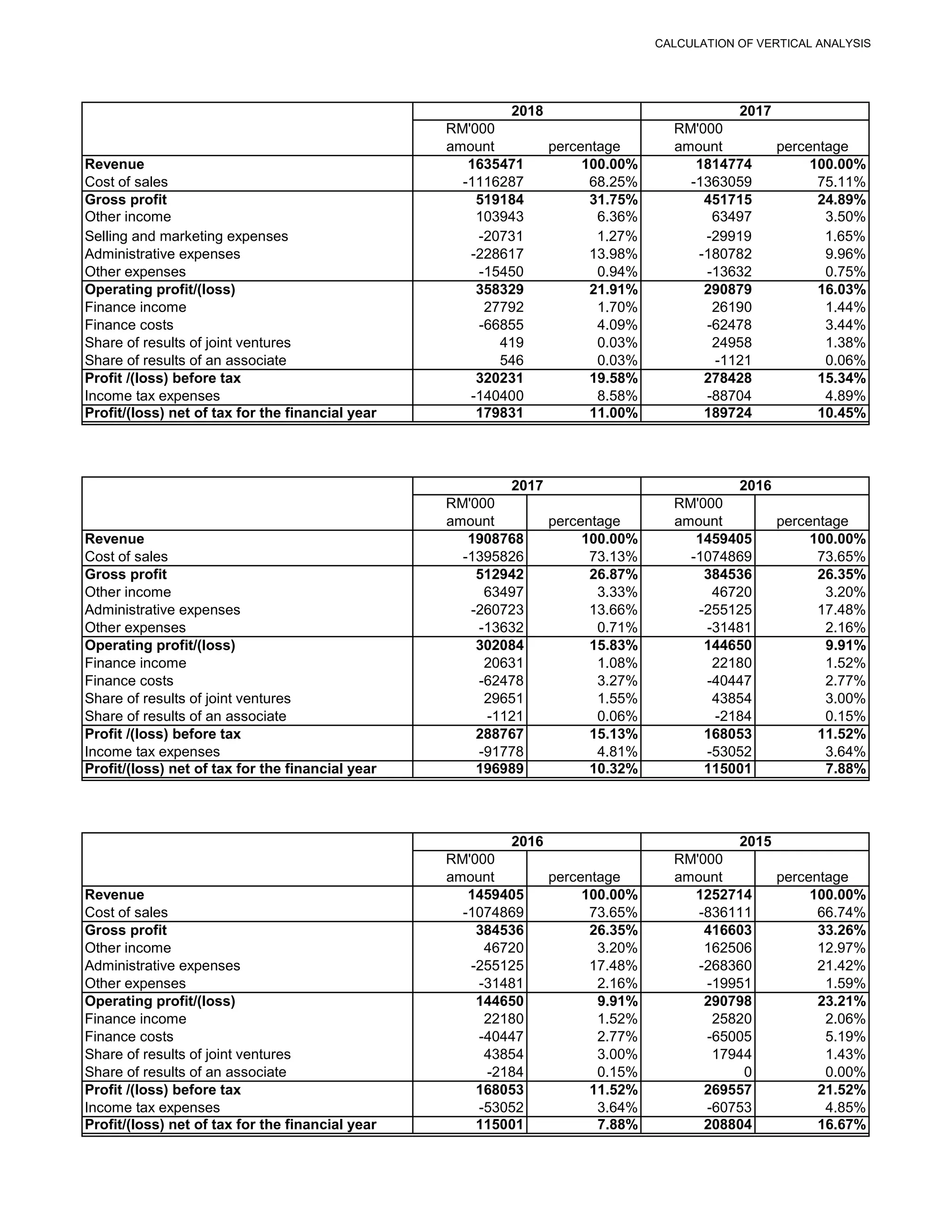

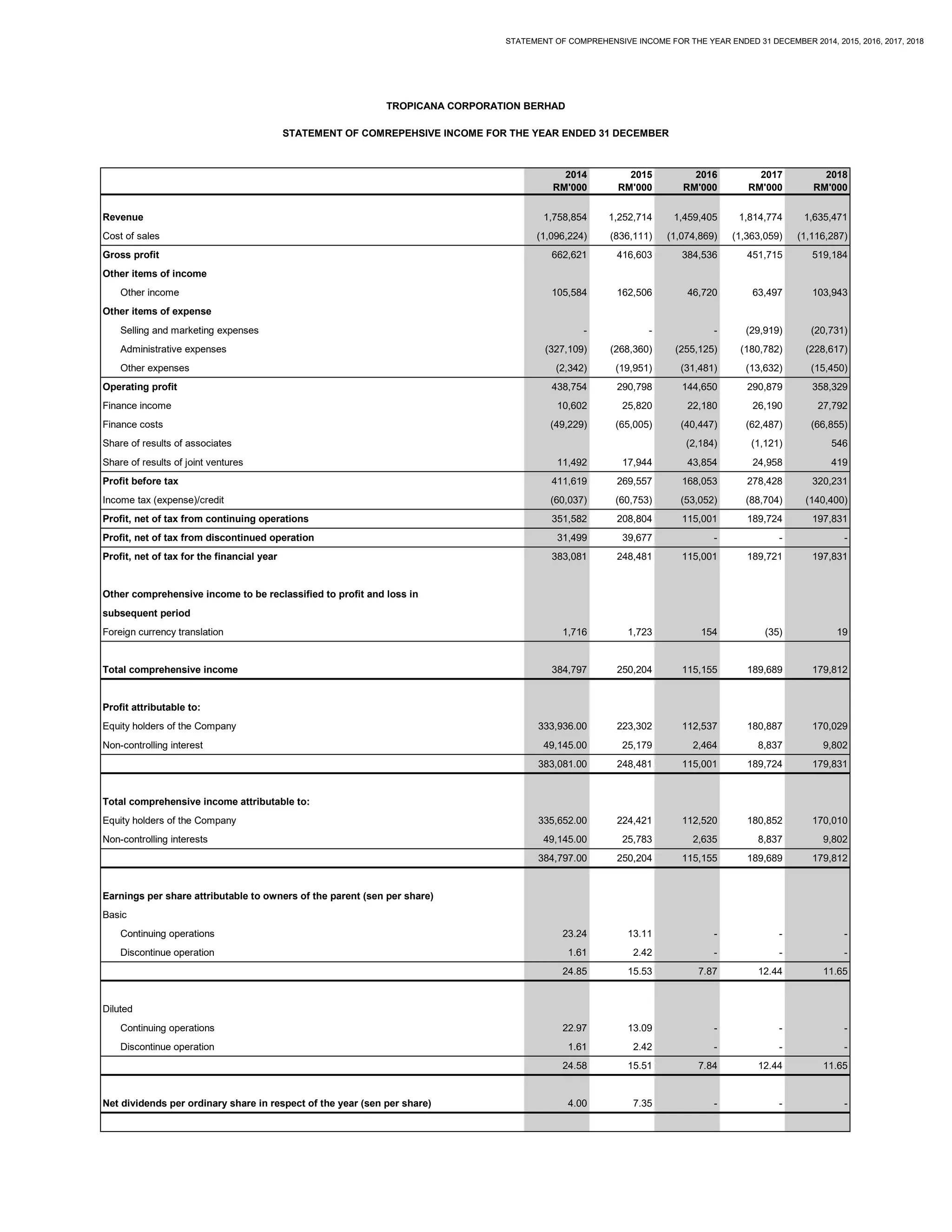

Tropicana Corporation's revenue declined 9.9% to RM1.64 billion in 2018 due to lower progress billings and sales across projects. However, pre-tax profit increased 15% to RM320.2 million due to higher profit recognition and cost savings. The company has been selling non-core assets and land since 2014 to reduce debt levels. Property development remains the core business and driver of financial performance, with over RM827 million in unbilled sales providing earnings visibility. Investment holding revenue grew slightly through investment income and private school operations.

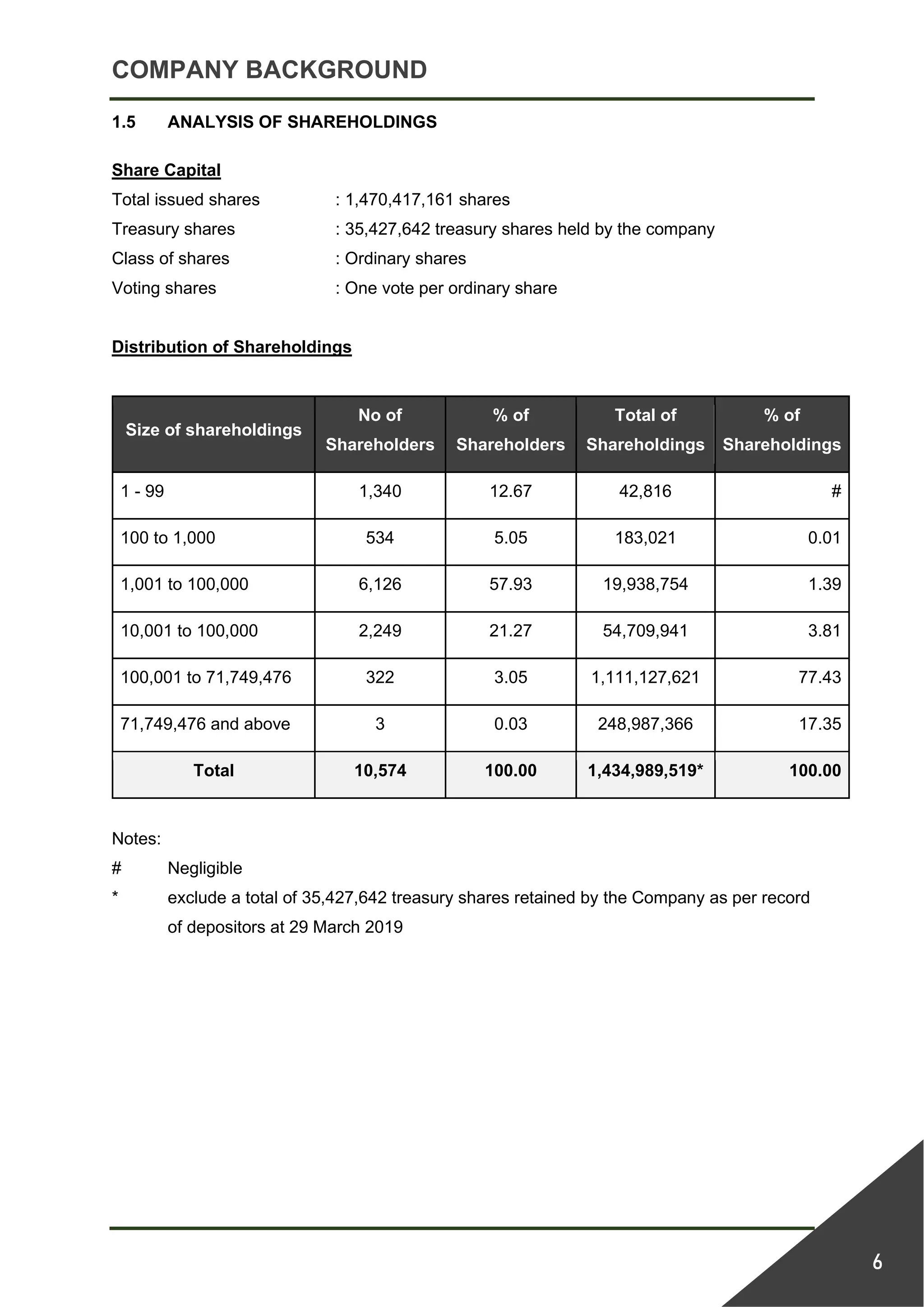

![SUMMARY OF RATIOS FORMULA

Financial Ratio

Current Assets

Current Liabilities

Current Assets - Inventories

Current Liabilities

Costs of goods sold

Inventories

Accounts receivables

Daily credit sales

Accounts payables

Average purchase per day

Sales

Total assets

Total debt

Total assets

Operating profit

Interest expense

EBIT + Lease payments

Interest + Lease payment + [(Principal payment + Preferred stock dividents)/(1-T)]

Gross profit

Sales

Operating profit

Sales

Net profit

Sales

Net profit

Total assets

Net profit

Total common equity

Net profit

No. of shares of common stock outstanding

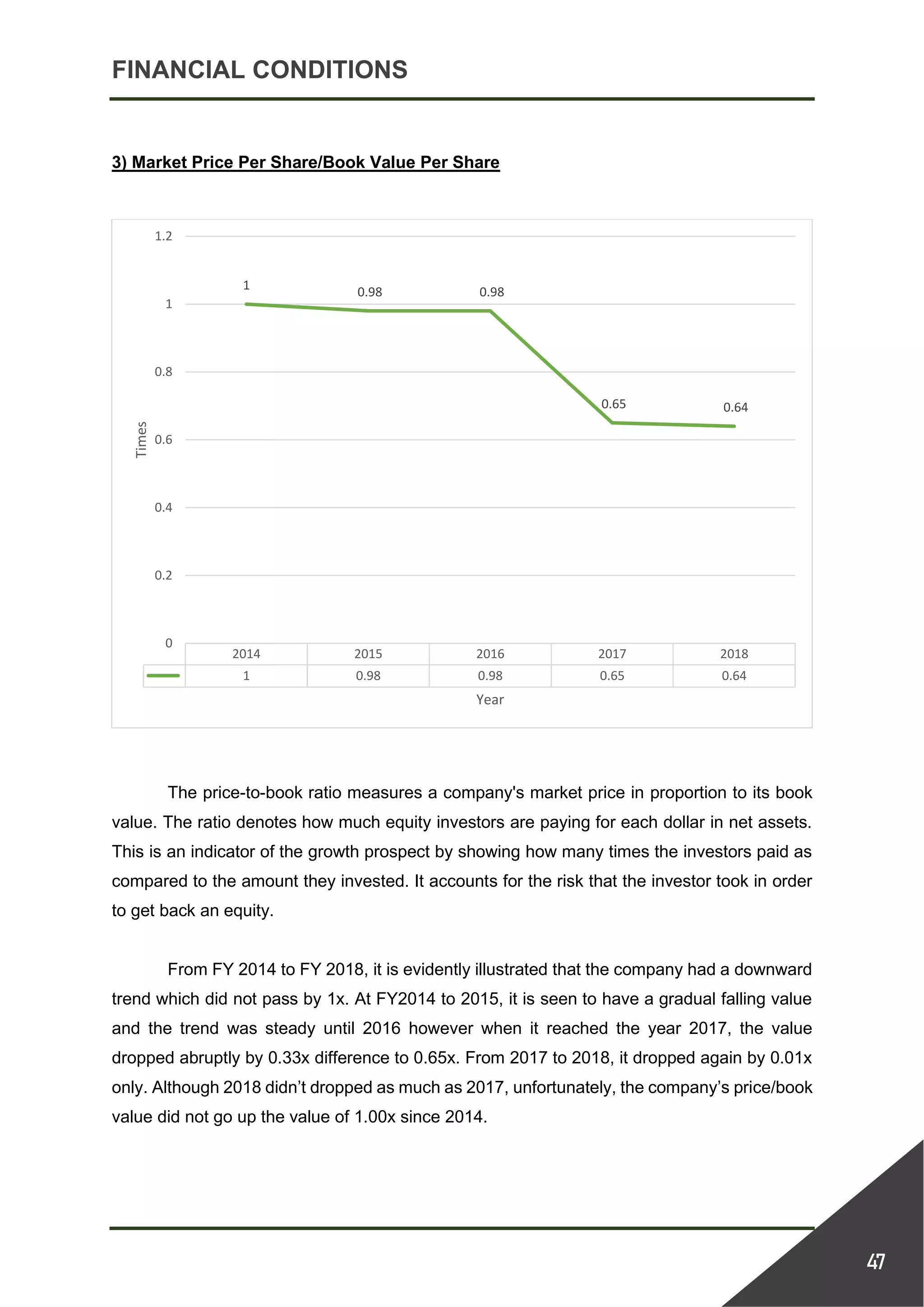

Market price per share

Earnings per share

Market price per share

Equity book value per share

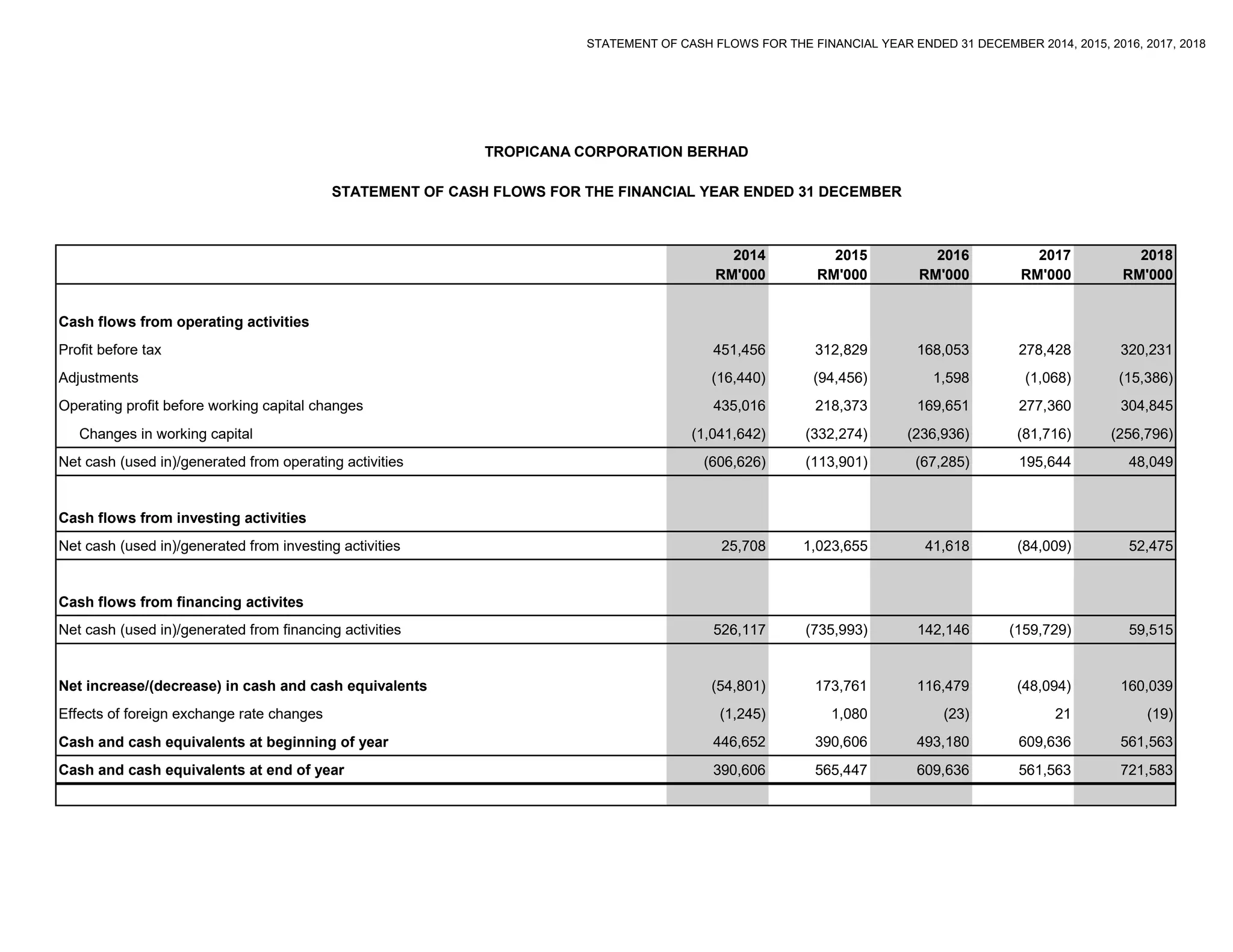

Net profit margin

Operating profit margin

Gross profit margin

Fixed payment coverage ratio (FPCR)

Price/Book ratio (P/B)

Price/Earnings (P/E)

Earnings per share (EPS)

Return on common equity (ROE)

Return on total assets

Quick ratio

Current ratio

RATIOS FORMULA

Times interest earned

Debt ratio

Total asset turnover

Average payment period (Days)

Average collection period (Days)

Inventory turnover

Formula](https://image.slidesharecdn.com/ilovepdfmerged1-200619055822/75/Financial-Management-Group-Assignment-Financial-Analysis-67-2048.jpg)

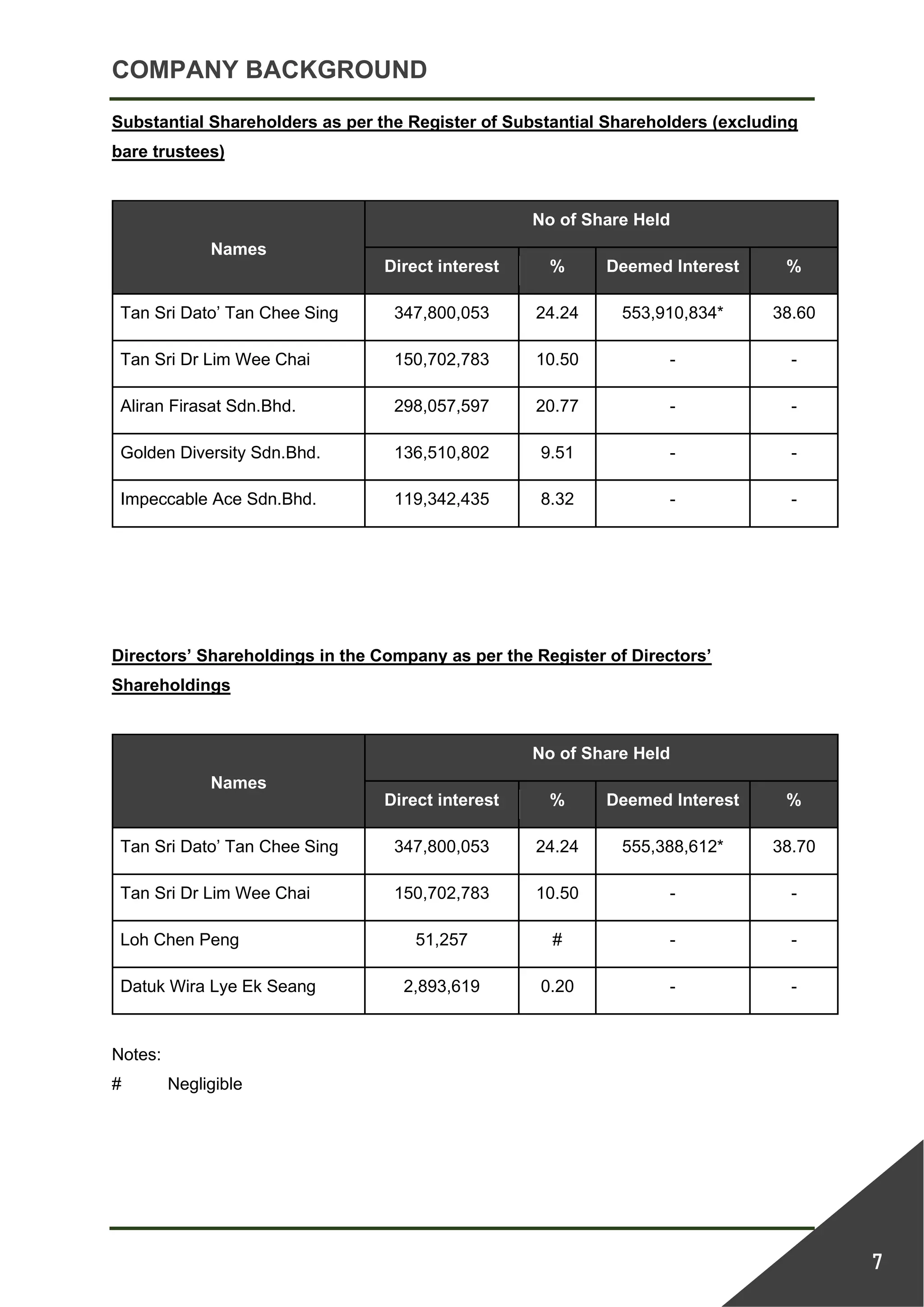

![SUMMARY OF RATIOS FORMULA

Financial Ratio

Current Assets

Current Liabilities

Current Assets - Inventories

Current Liabilities

Costs of goods sold

Inventories

Accounts receivables

Daily credit sales

Accounts payables

Average purchase per day

Sales

Total assets

Total debt

Total assets

Operating profit

Interest expense

EBIT + Lease payments

Interest + Lease payment + [(Principal payment + Preferred stock dividents)/(1-T)]

Gross profit

Sales

Operating profit

Sales

Net profit

Sales

Net profit

Total assets

Net profit

Total common equity

Net profit

No. of shares of common stock outstanding

Market price per share

Earnings per share

Market price per share

Equity book value per share

Quick ratio

Current ratio

RATIOS FORMULA

Times interest earned

Debt ratio

Total asset turnover

Average payment period (Days)

Average collection period (Days)

Inventory turnover

Formula

Net profit margin

Operating profit margin

Gross profit margin

Fixed payment coverage ratio (FPCR)

Price/Book ratio (P/B)

Price/Earnings (P/E)

Earnings per share (EPS)

Return on common equity (ROE)

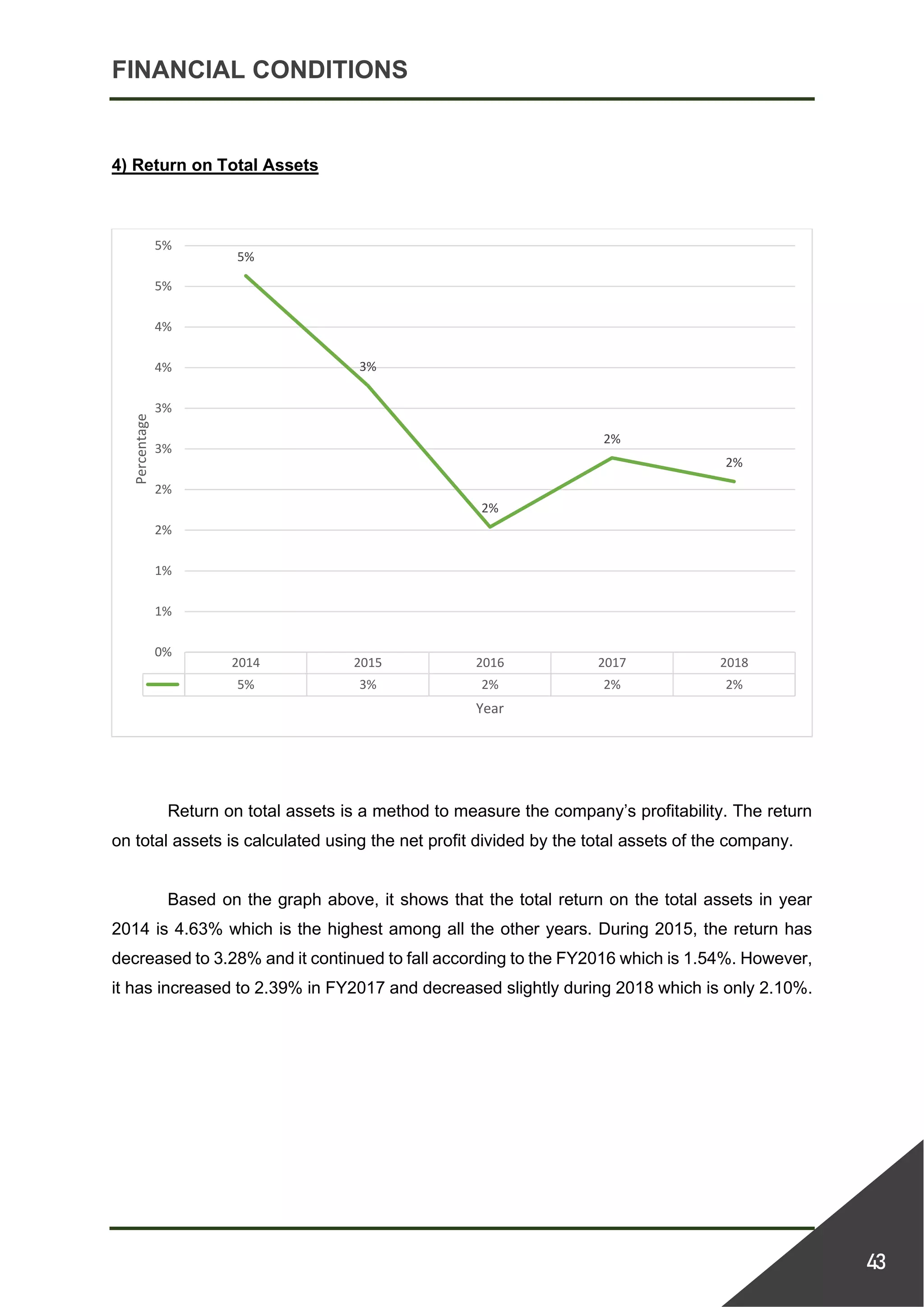

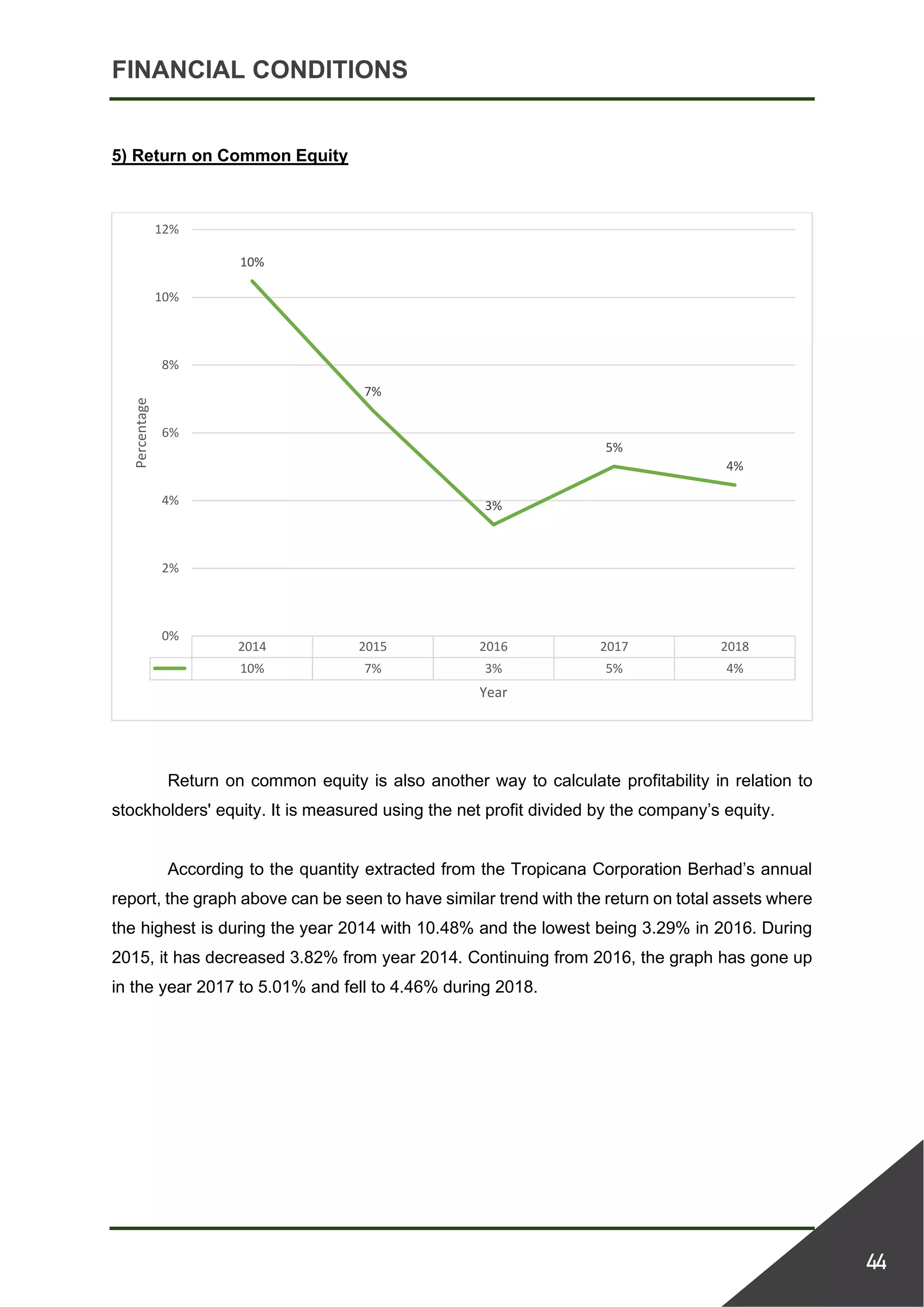

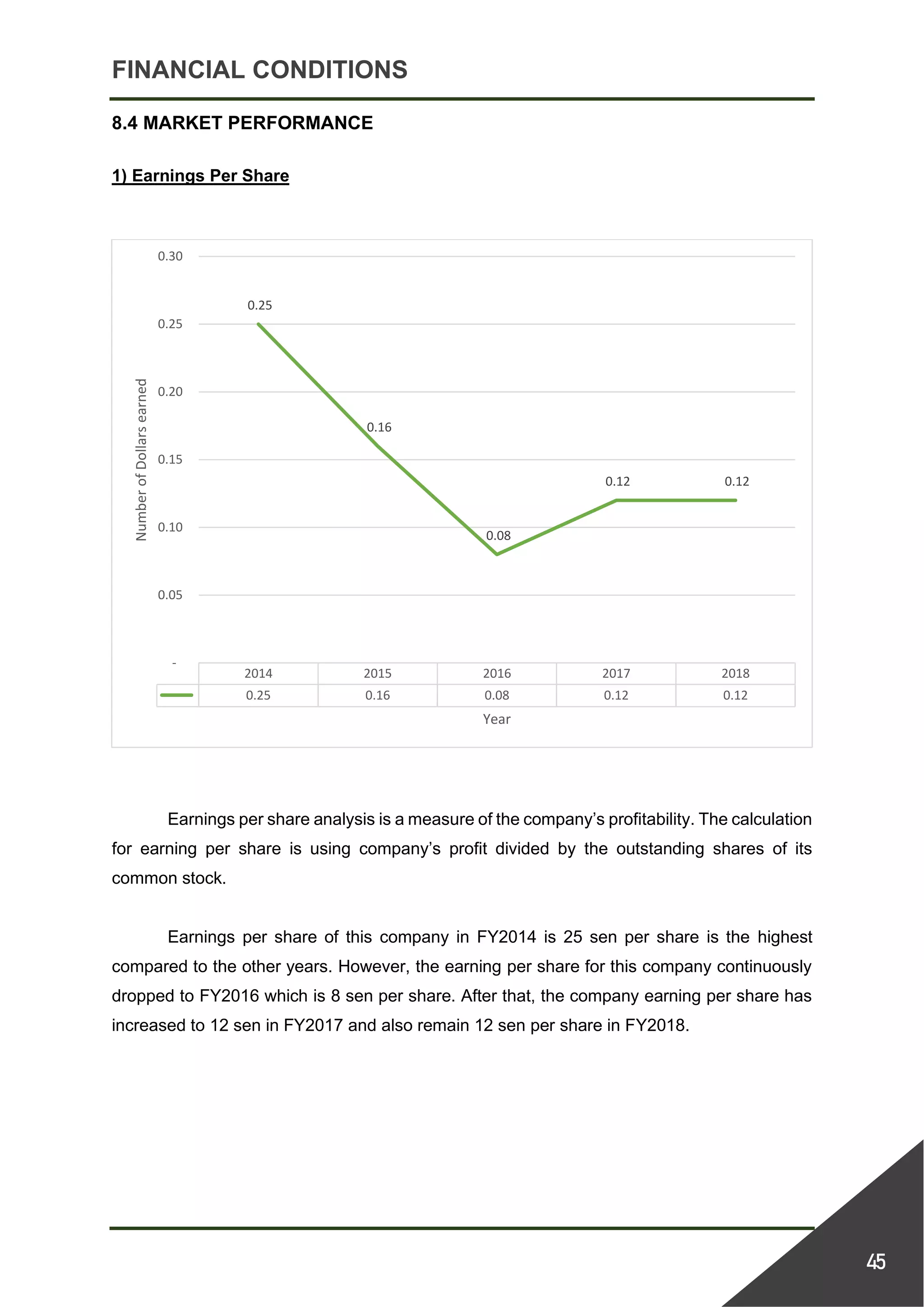

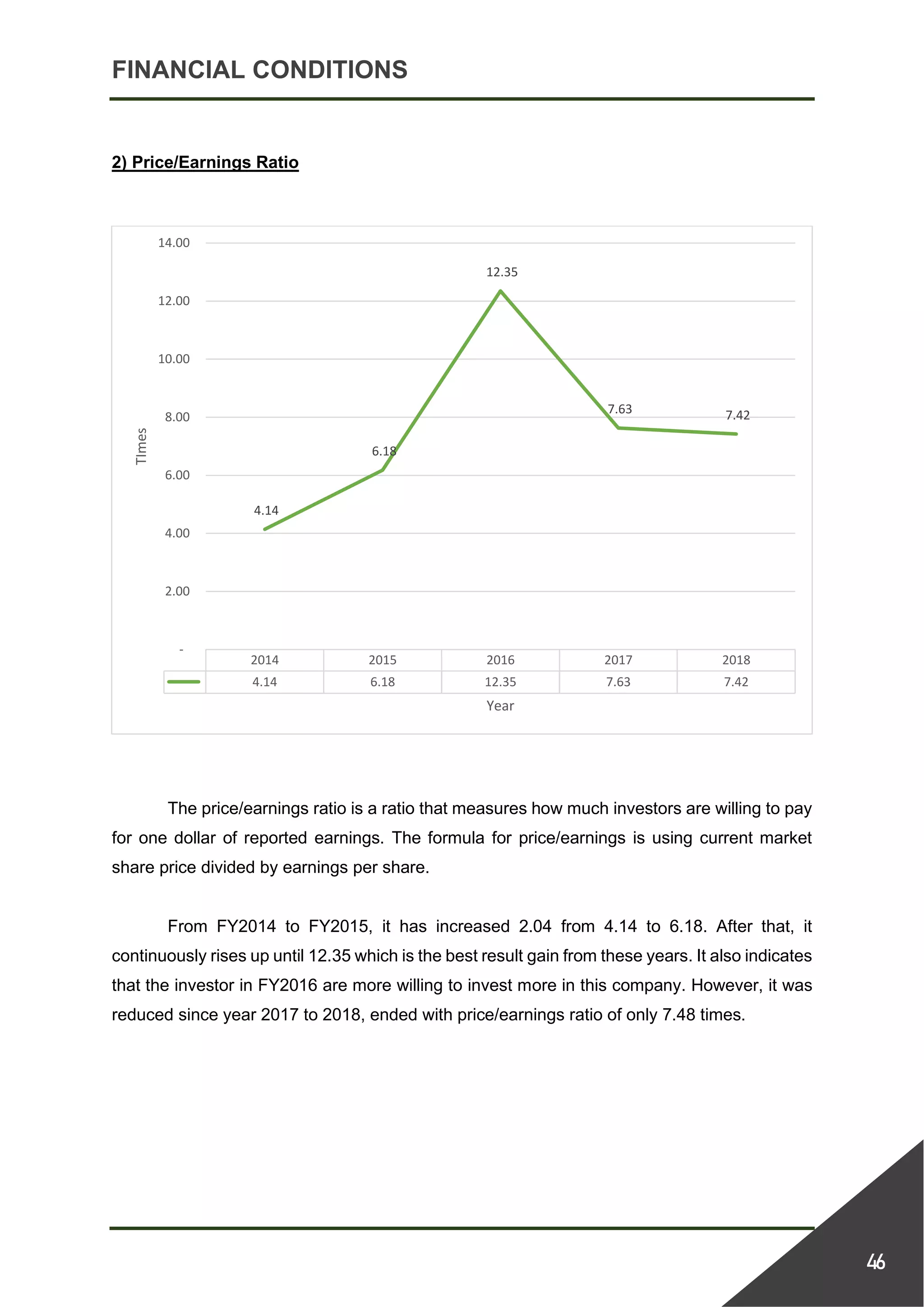

Return on total assets](https://image.slidesharecdn.com/ilovepdfmerged1-200619055822/75/Financial-Management-Group-Assignment-Financial-Analysis-77-2048.jpg)