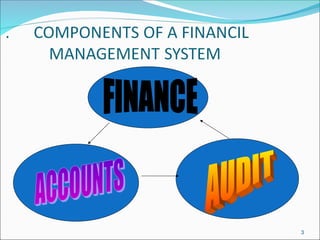

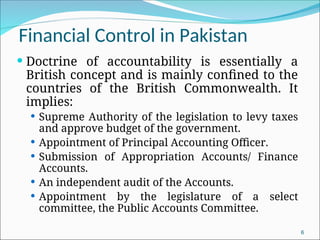

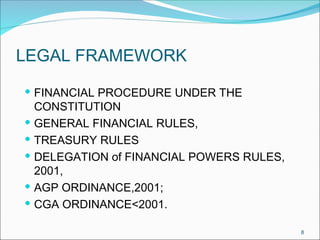

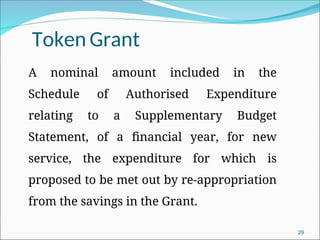

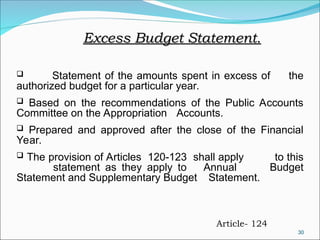

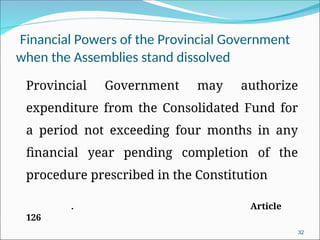

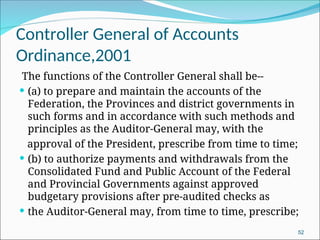

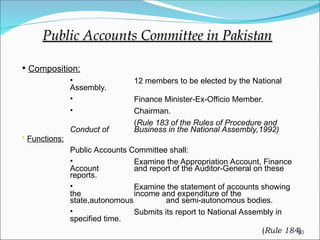

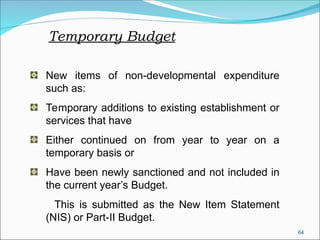

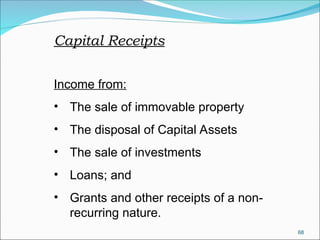

The document outlines the framework and processes for public sector financial management in Pakistan, including the responsibilities of key financial officers and the accountability mechanisms defined by legislation. It covers the budget cycle, roles of the legislature and executive, and details specific financial procedures, including the classification of funds and types of expenditure. Additionally, it describes the auditing function carried out by the auditor-general and the legislative process for budget approval and oversight.