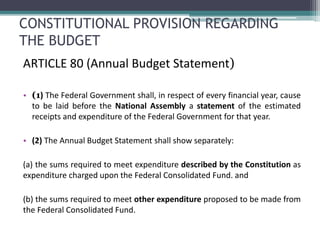

The document discusses the constitutional provisions regarding the budget in Pakistan. Article 80 requires the federal government to present an annual budget statement to the National Assembly showing estimated receipts and expenditures. Article 81 defines expenditures that are automatically approved and "charged" to the consolidated fund. Article 82 establishes that other expenditures must be approved as "demands for grants" by the assembly. The budget serves as an important control tool for public sector organizations in Pakistan by providing standards for financial planning and performance evaluation.

![ARTICLE 81 (Expenditure Charged Upon Federal

Consolidate Fund)

• The following expenditure shall be expenditure charged upon the Federal

Consolidated Fund:

• (a) the remuneration payable to the President and other expenditure

relating to his office, and the remuneration payable to

(i) the Judges of the Supreme Court [and the Islamabad High Court]

(ii) the Chief Election Commissioner;

(iii) the Chairman and the Deputy Chairman of the senate;

(iv) the Speaker and the Deputy Speaker of the National Assembly;

(v) the Auditor-General of Pakistan;](https://image.slidesharecdn.com/rabia-141210114924-conversion-gate02/85/R-abia-4-320.jpg)