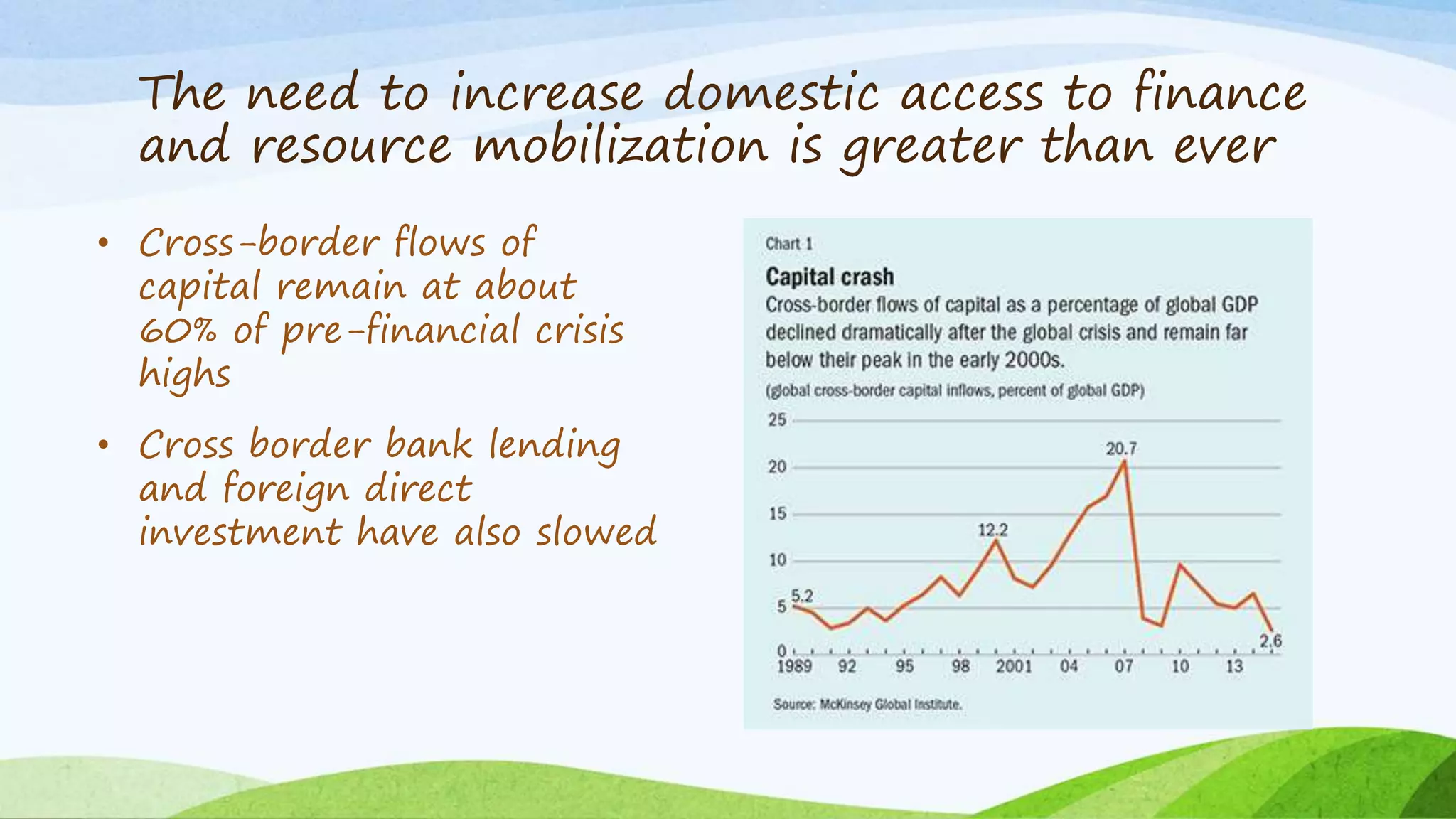

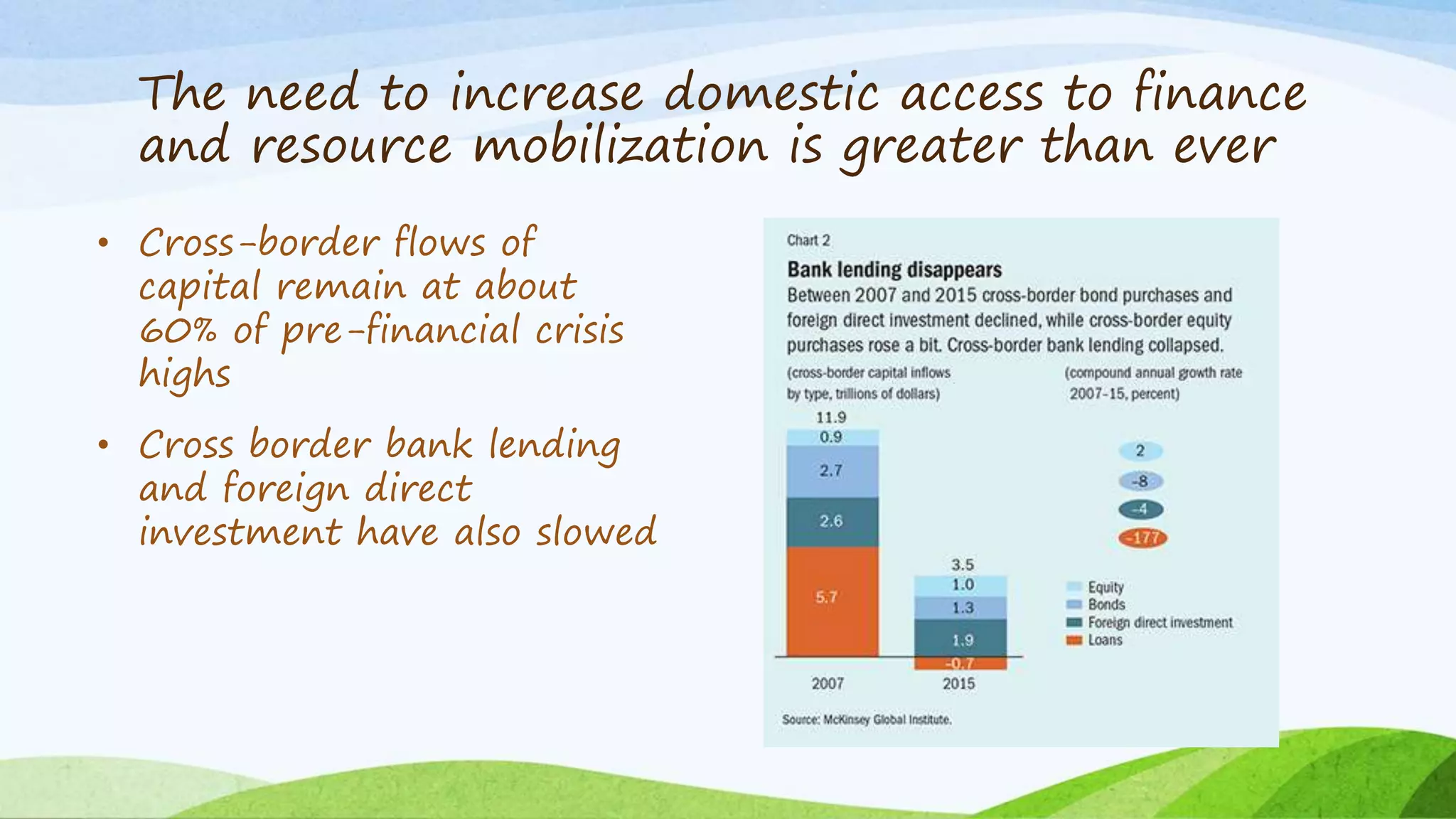

The document advocates for increased investment in financial inclusion and microfinance to facilitate access to finance for micro, small, and medium enterprises (MSMEs) in Nicaragua and beyond. It highlights the significant challenges faced by these enterprises due to limited access to credit and financial services, emphasizing the importance of innovative financial products, technology, and regulatory frameworks to enhance efficiency and outcomes. The text concludes that concessional financing is essential to launch domestic financial service sectors and attract private investment, ultimately supporting economic growth and poverty reduction.