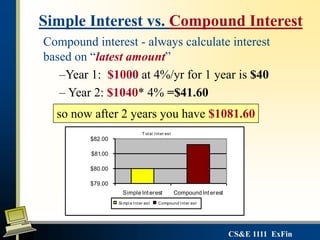

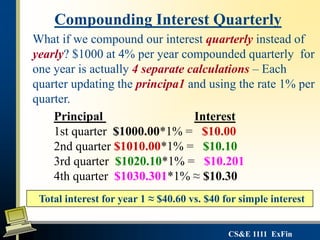

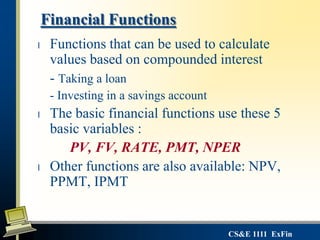

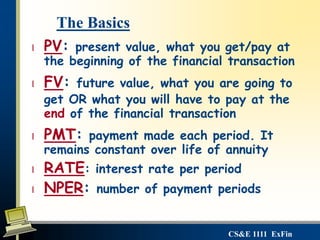

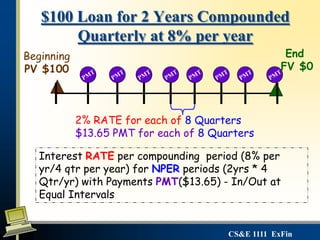

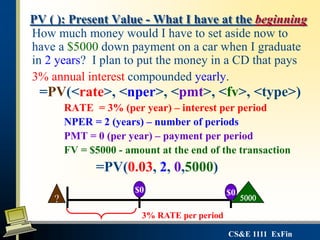

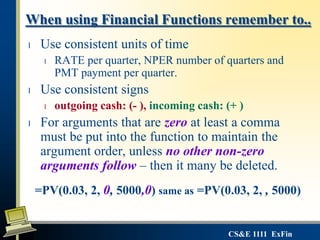

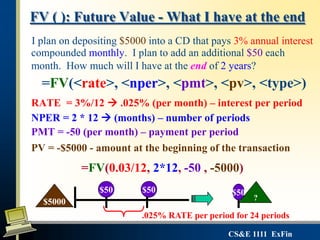

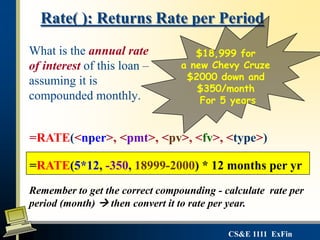

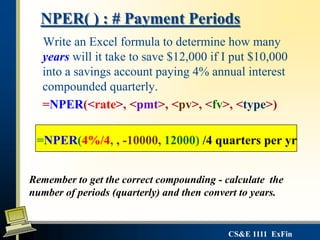

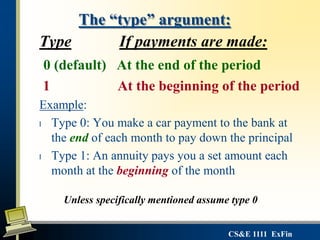

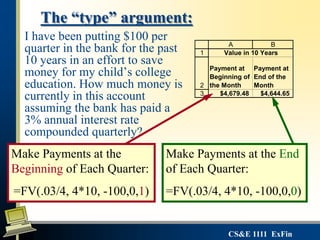

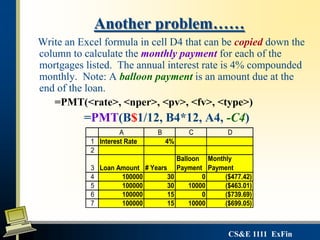

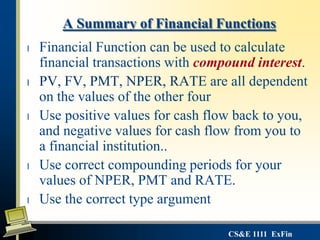

The document discusses financial functions in Excel for calculating values related to loans, savings, and investments with compound interest. It defines the key functions - PV, FV, PMT, RATE, and NPER - which use the variables of present value, future value, payment, interest rate, and number of periods. The functions allow calculation of loan payments, savings growth, and other financial transactions over time. The document also explains the importance of specifying the correct compounding periods and using the "type" argument appropriately in the functions.