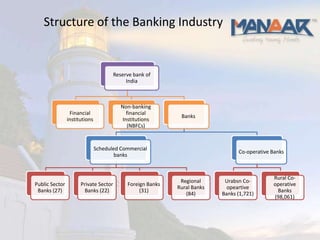

The document discusses trends in India's financial sector, including banking, insurance, and capital markets. It notes that banking is dominated by public sector banks, holding 65% of credit. The insurance sector is growing rapidly at 30-35% annually and has potential for further expansion in rural areas. Overall, the financial sector is critical to India's economy but still has opportunities to deepen penetration in rural and underserved areas to further support growth.