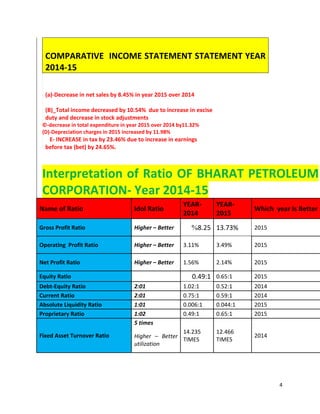

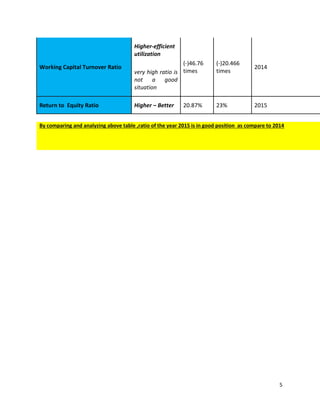

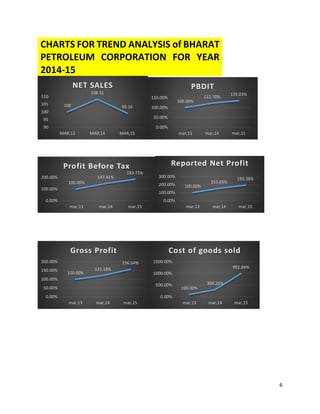

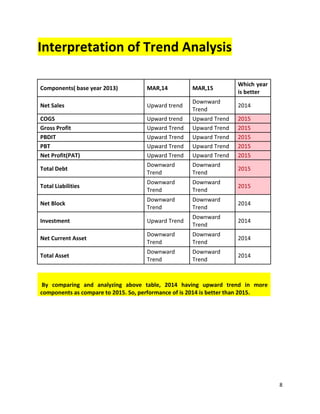

This document outlines the vision, mission, and organizational structure of Bharat Petroleum Corporation. The vision focuses on being the most admired global energy company and exploiting growth opportunities outside of energy. The mission echoes this vision. The document then provides an analysis of Bharat Petroleum's financial statements for 2014-2015, including common sized balance sheets, profit and loss statements, and ratio analyses. Trend analyses show most financial components had an upward trend in 2014 compared to 2015.