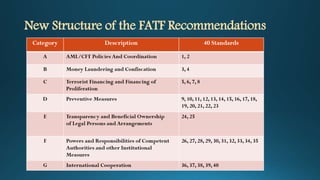

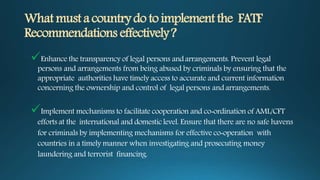

The FATF is an inter-governmental body that establishes standards for combating money laundering and terrorist financing. It comprises over 200 member countries that have committed to implementing the FATF Recommendations. The Recommendations establish global standards for anti-money laundering and counter-terrorist financing systems. Implementing the Recommendations effectively helps secure financial systems, build terrorism financing tracing capacity, and avoid sanctions.