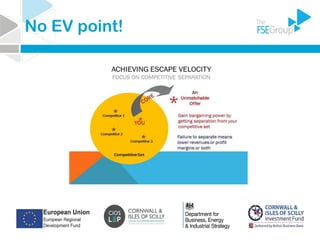

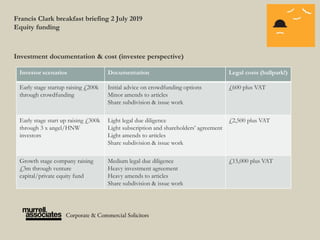

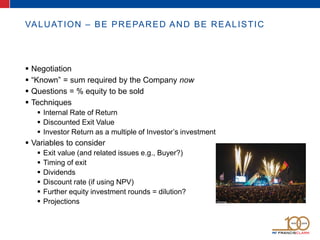

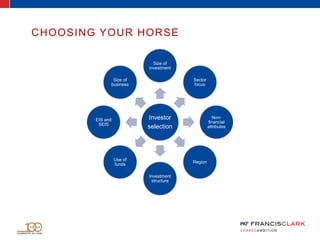

The document outlines a series of presentations and discussions focused on raising equity finance for SMEs in Cornwall, covering essential topics like investment readiness, legal considerations, and tax incentives such as EIS and SEIS. It emphasizes the importance of understanding market dynamics, differentiating offerings, and having a viable business model for attracting investors. Additionally, it provides insights into the documentation and legal costs associated with various fundraising scenarios and highlights the key criteria investors look for in potential investments.