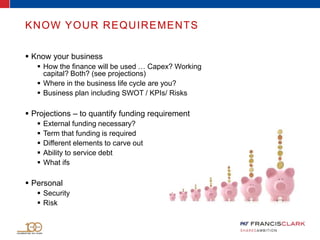

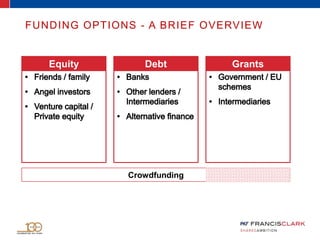

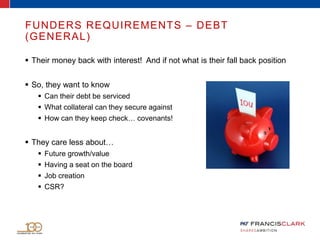

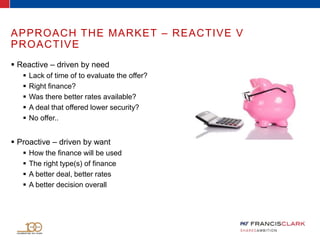

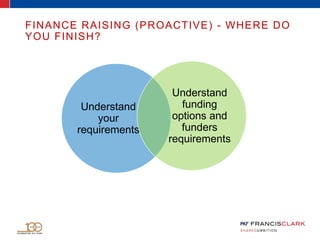

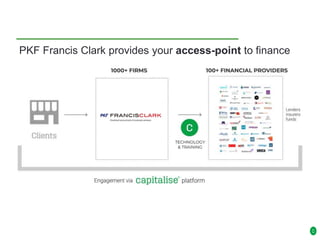

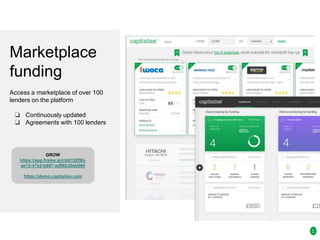

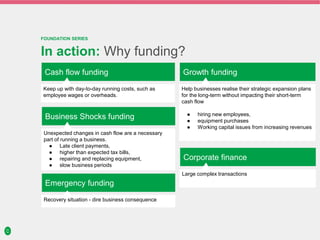

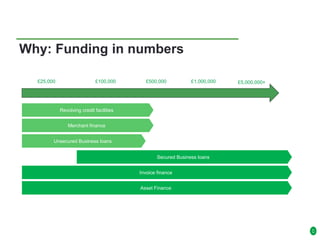

The document outlines a program on debt finance, featuring presentations from various speakers about the debt market, funding options, and the role of accountants in securing finance for SMEs. It emphasizes the importance of understanding financial requirements and options, the implications of personal guarantees, and market trends amidst uncertainties like Brexit. Additionally, it promotes a funding platform connecting advisors with numerous lenders to facilitate access to diverse financing sources for businesses.