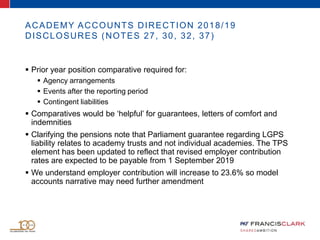

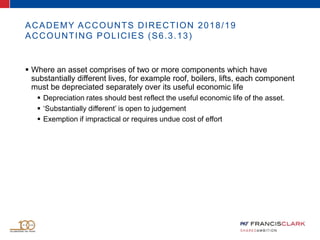

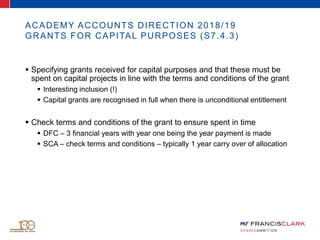

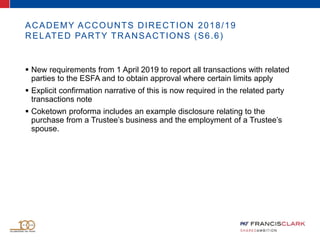

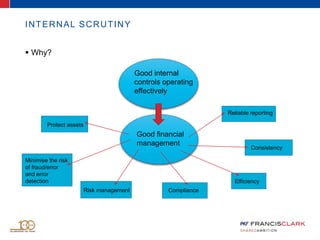

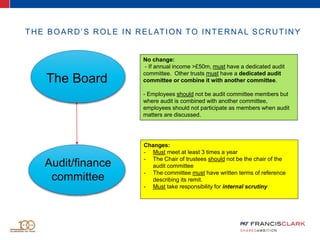

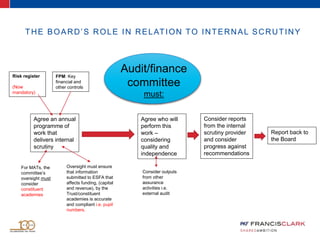

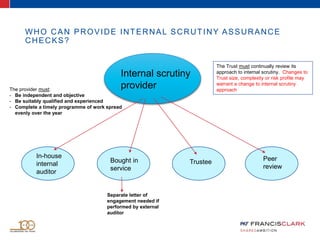

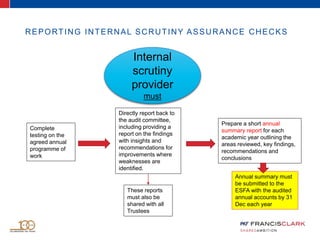

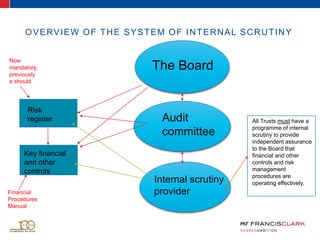

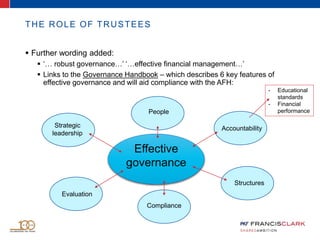

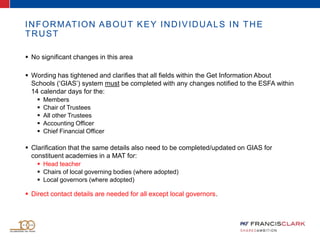

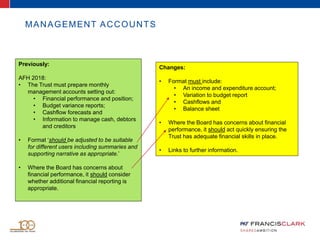

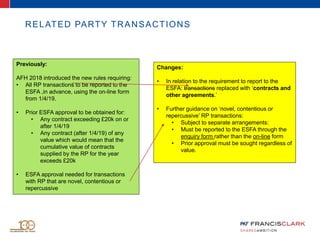

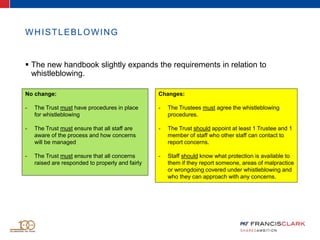

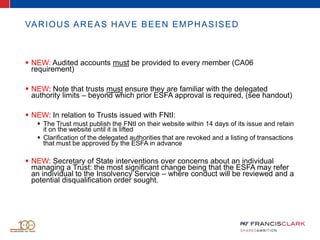

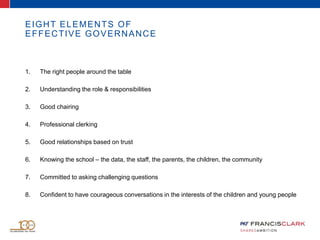

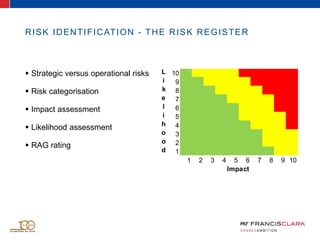

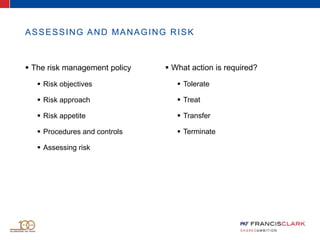

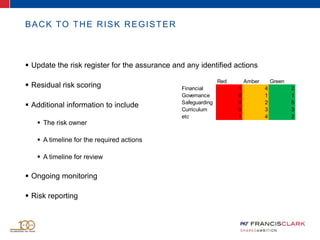

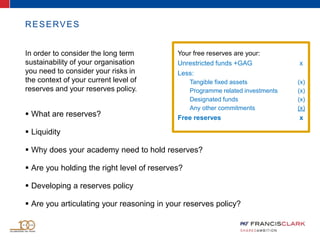

The document provides an update on the changes to the Academy Accounts Direction for 2019, highlighting clarifications in financial reporting requirements and governance practices. Key points include the removal of specific disclosures, enhanced governance expectations, and the introduction of mandatory risk registers. Additionally, it outlines updates to the Academies Financial Handbook concerning internal scrutiny, related party transactions, and whistleblowing procedures.