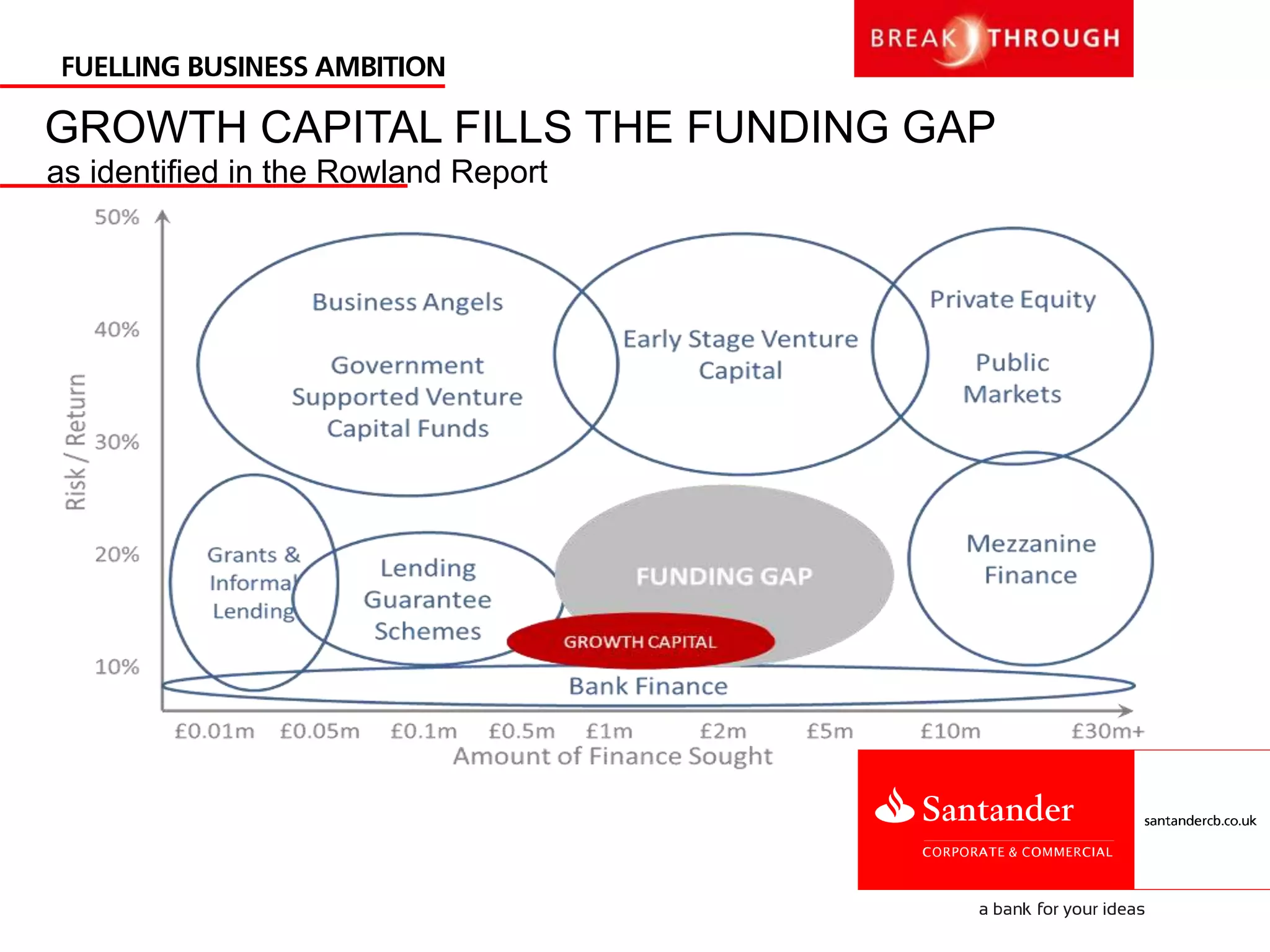

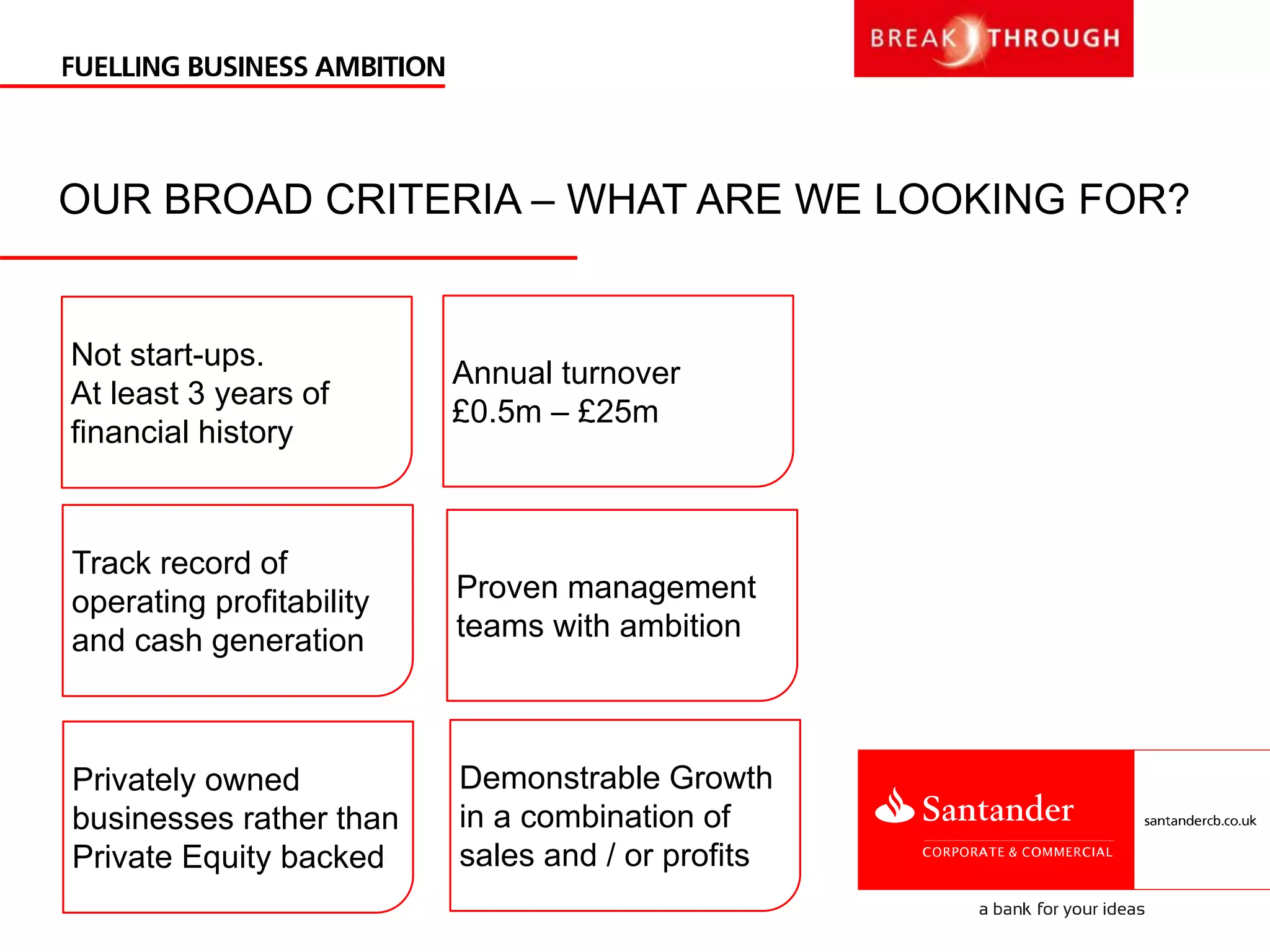

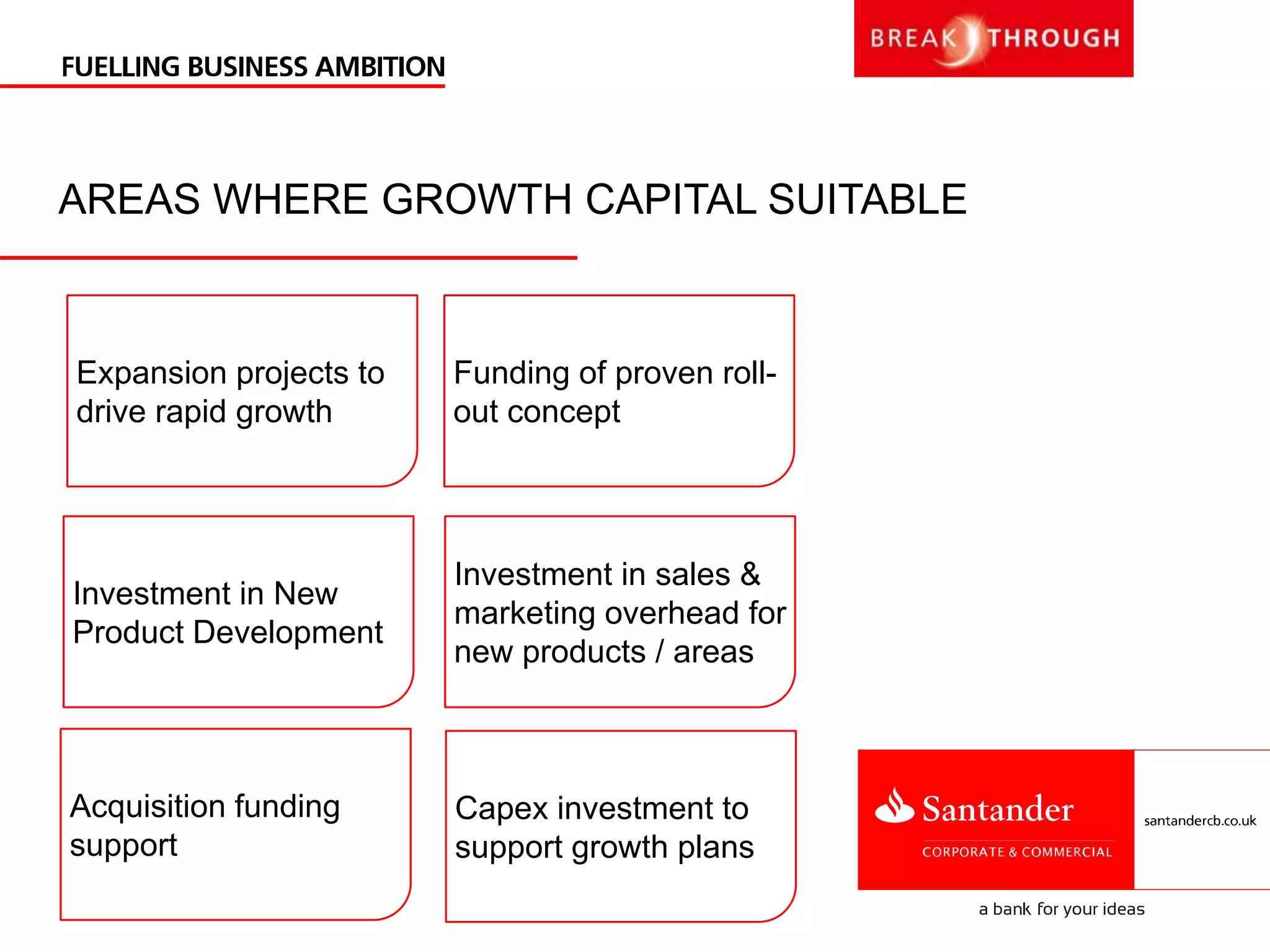

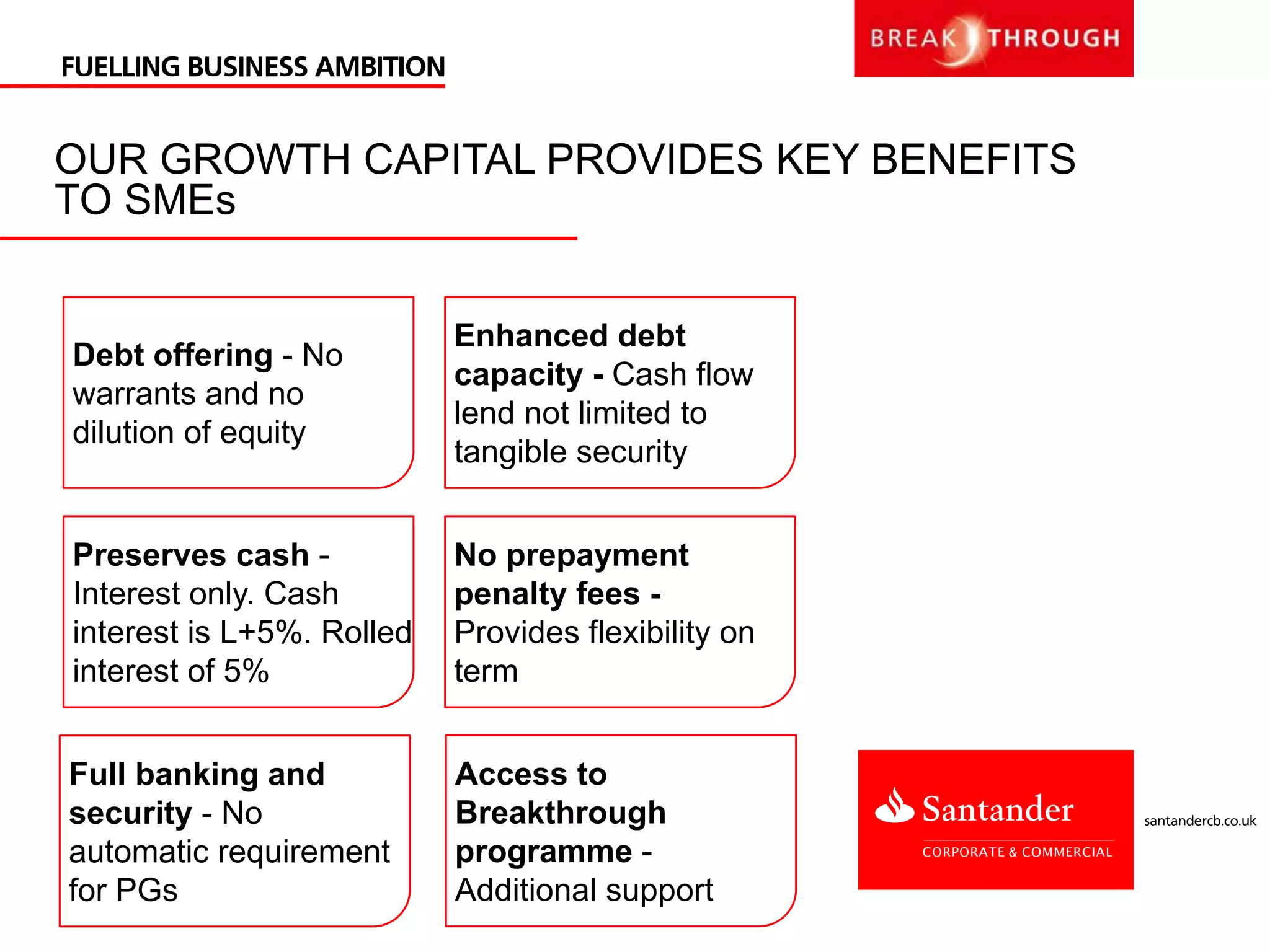

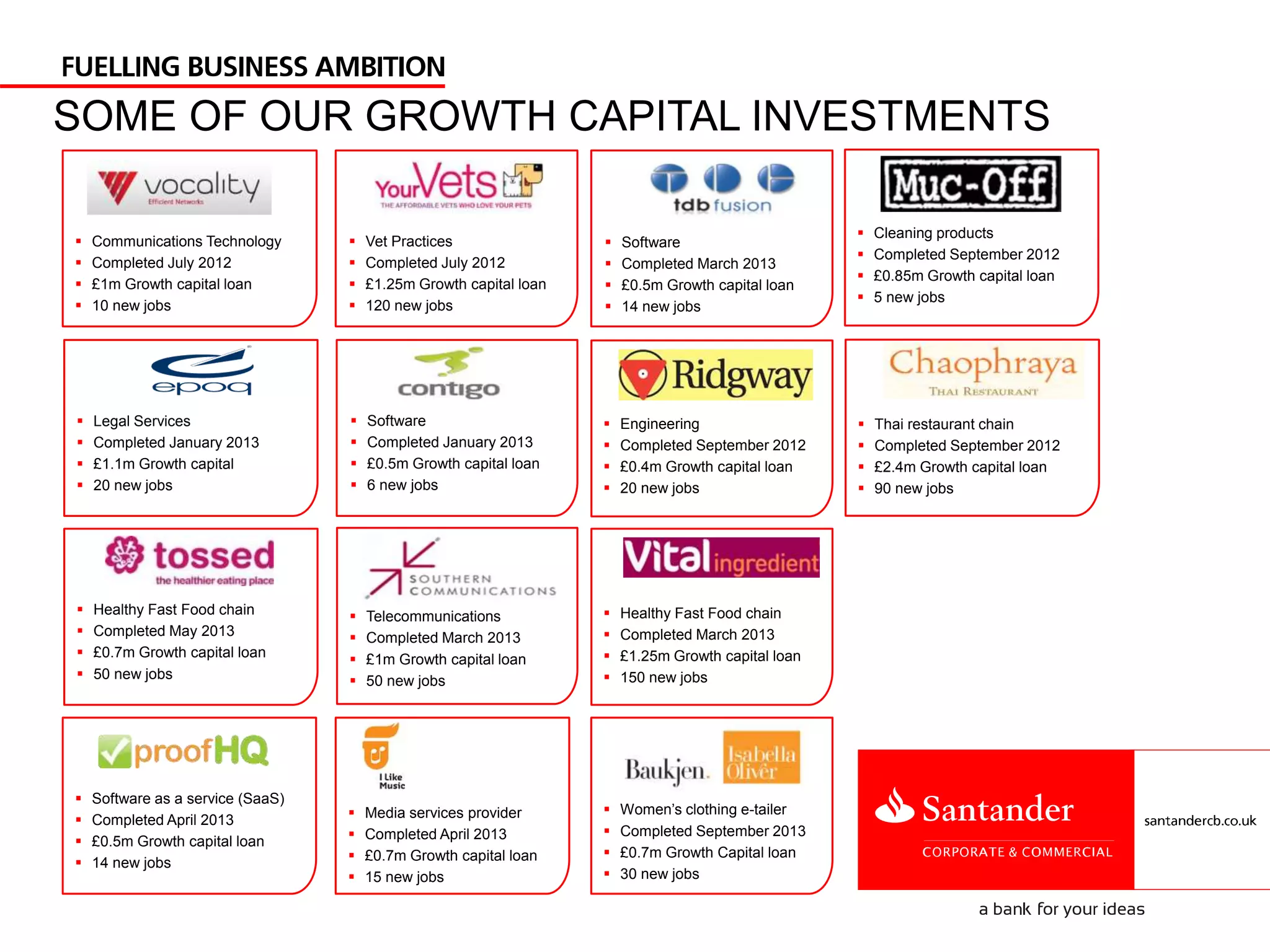

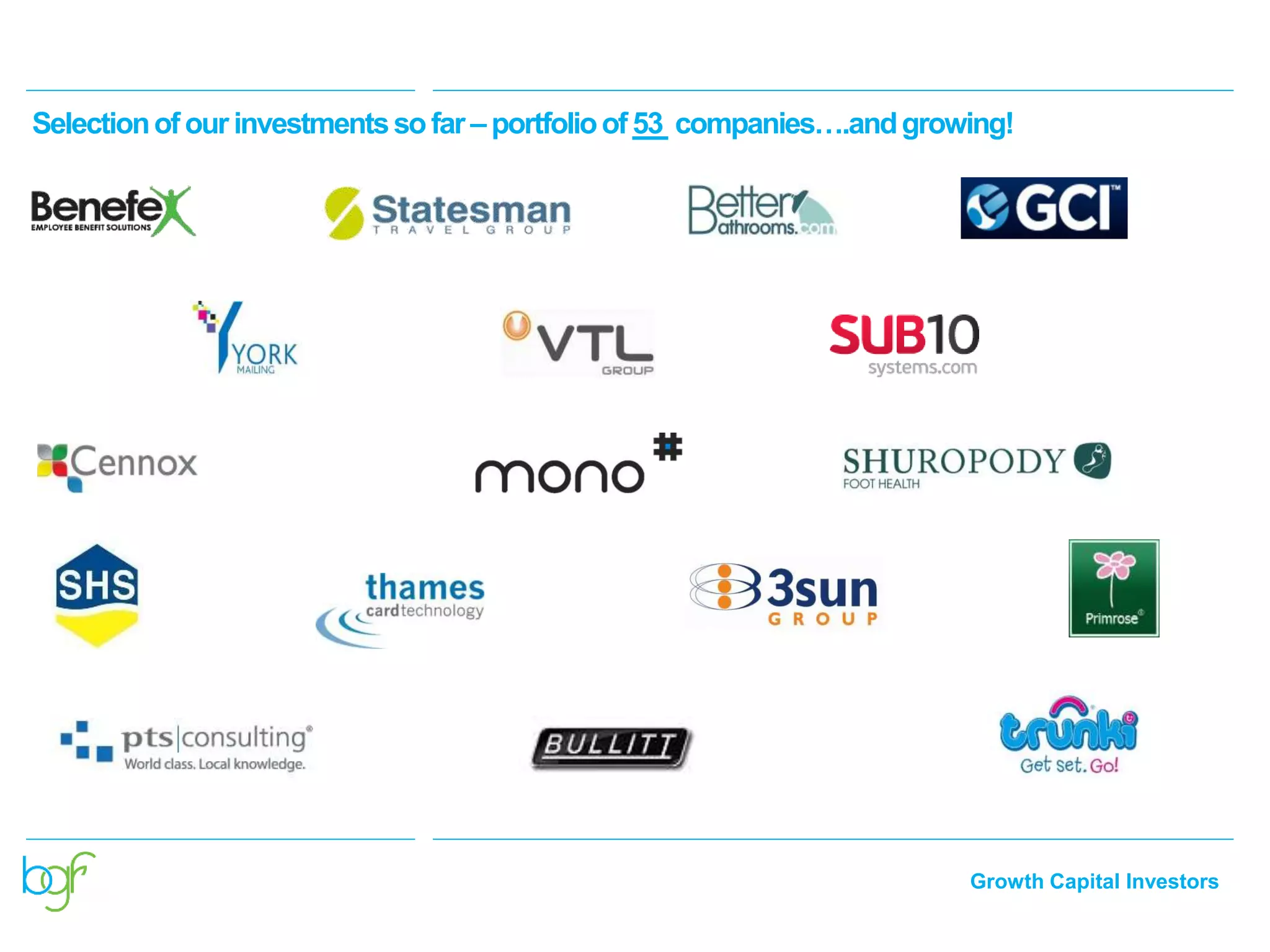

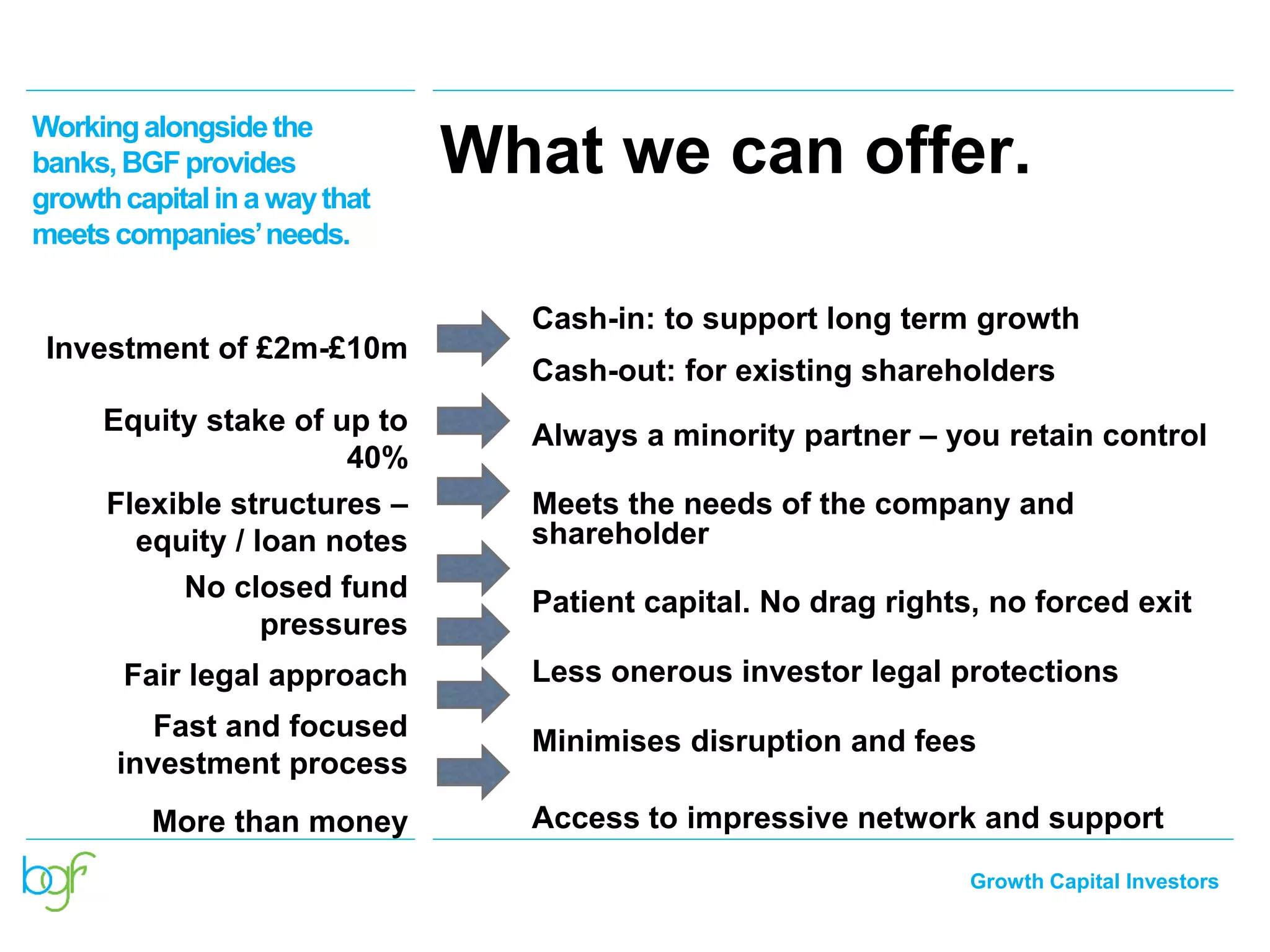

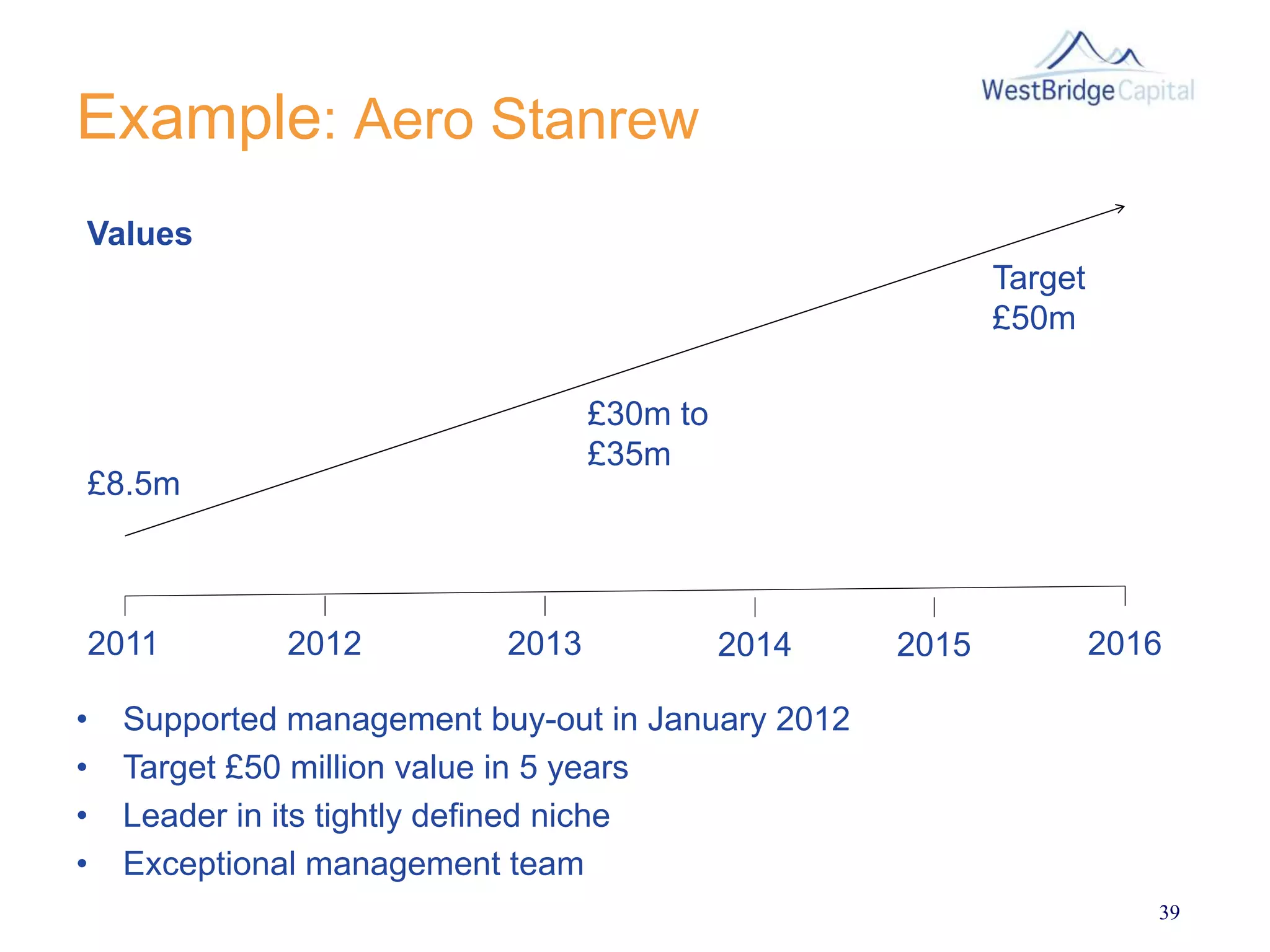

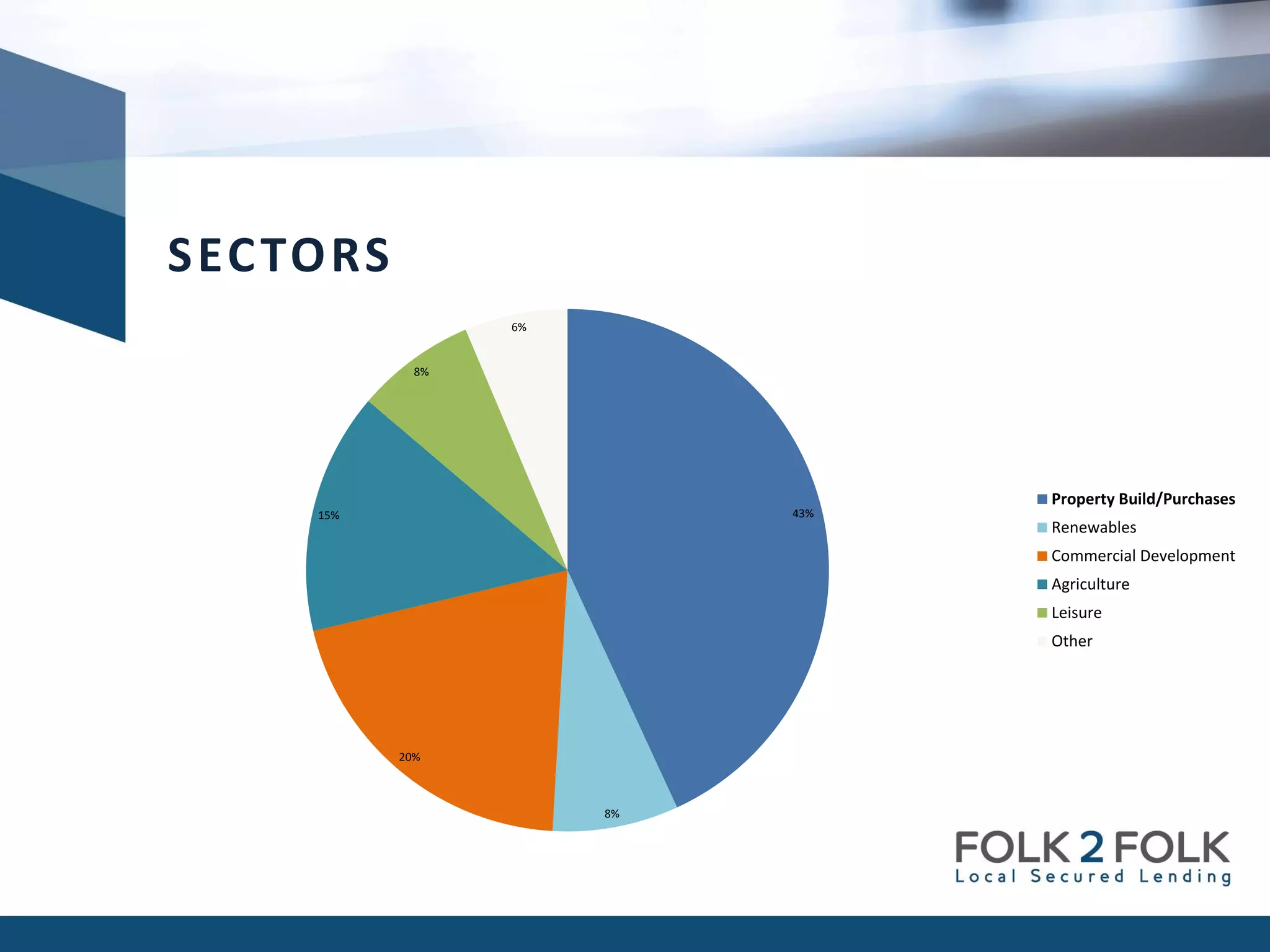

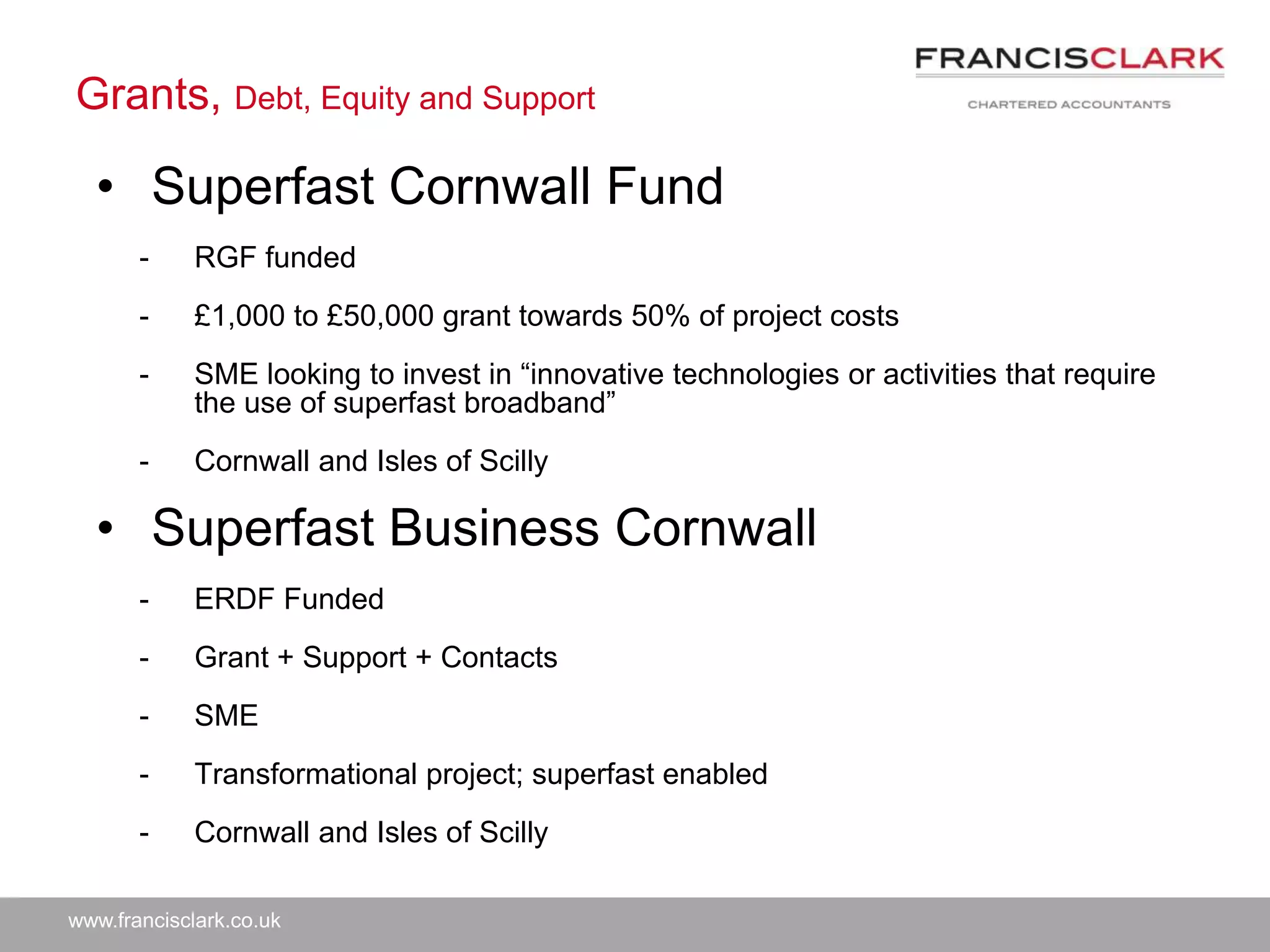

This document provides an agenda and overview for a funding and support event for SMEs. The morning session includes introductions to grants and an overview of funding schemes. Breakout sessions in the afternoon focus on specific funding options for SMEs, including assisted asset purchase grants, loans from the South West Loans Fund, mezzanine funding from Santander, equity funding from the Business Growth Fund and WestBridge Capital, and peer-to-peer lending through Folk 2 Folk. Presenters provide details on eligibility and examples of previous funding. The event aims to help SMEs access various sources of financing to support growth.