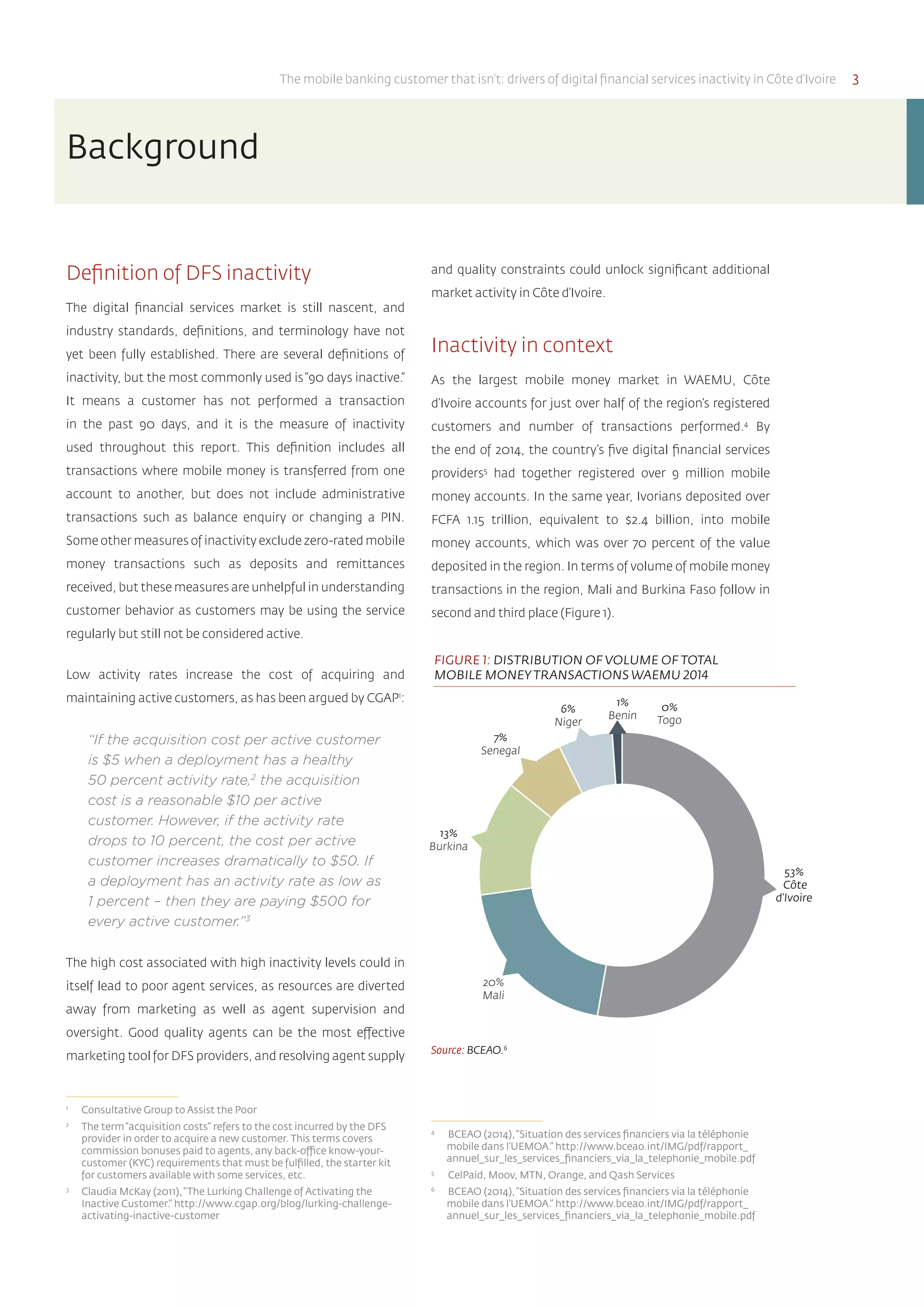

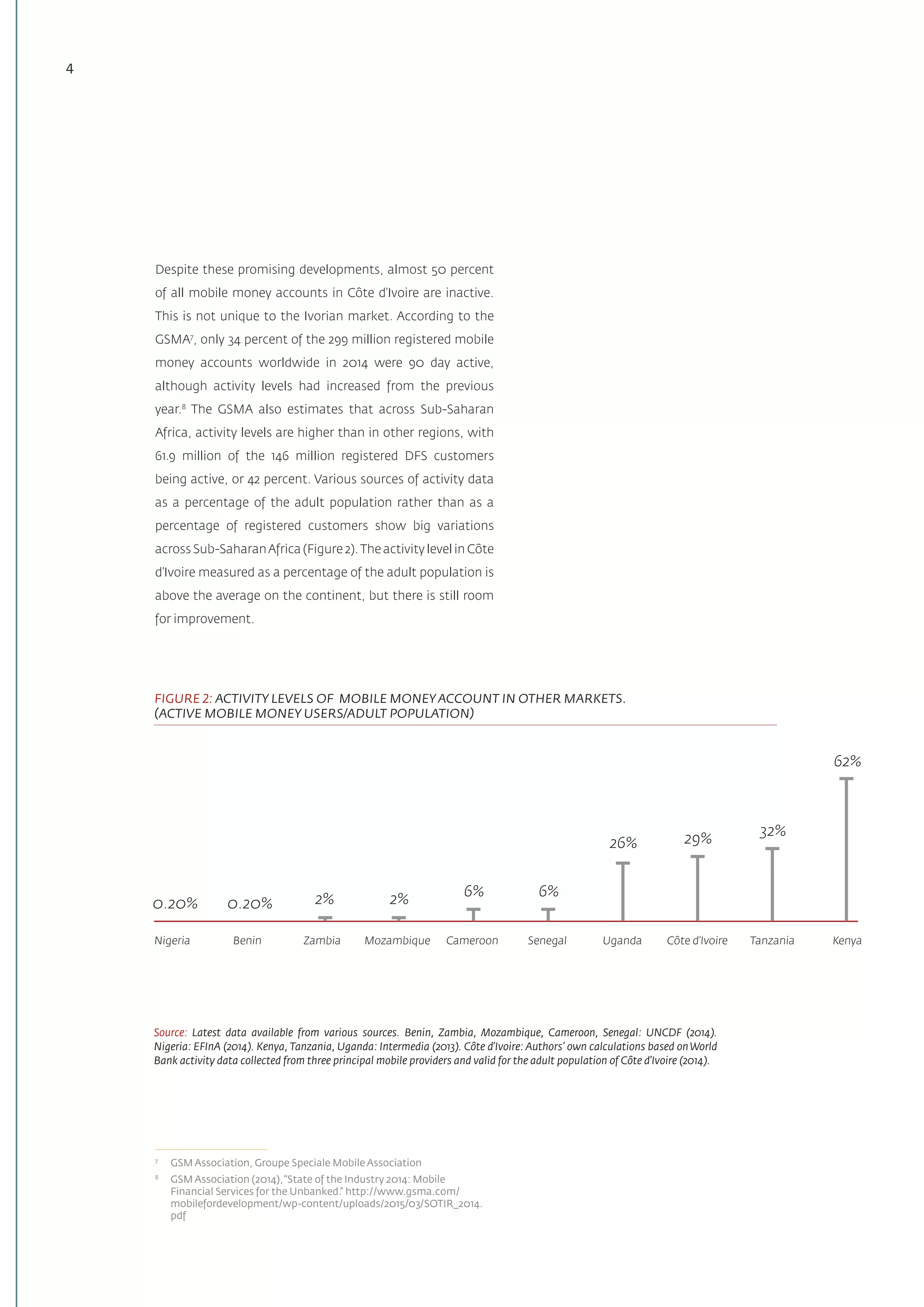

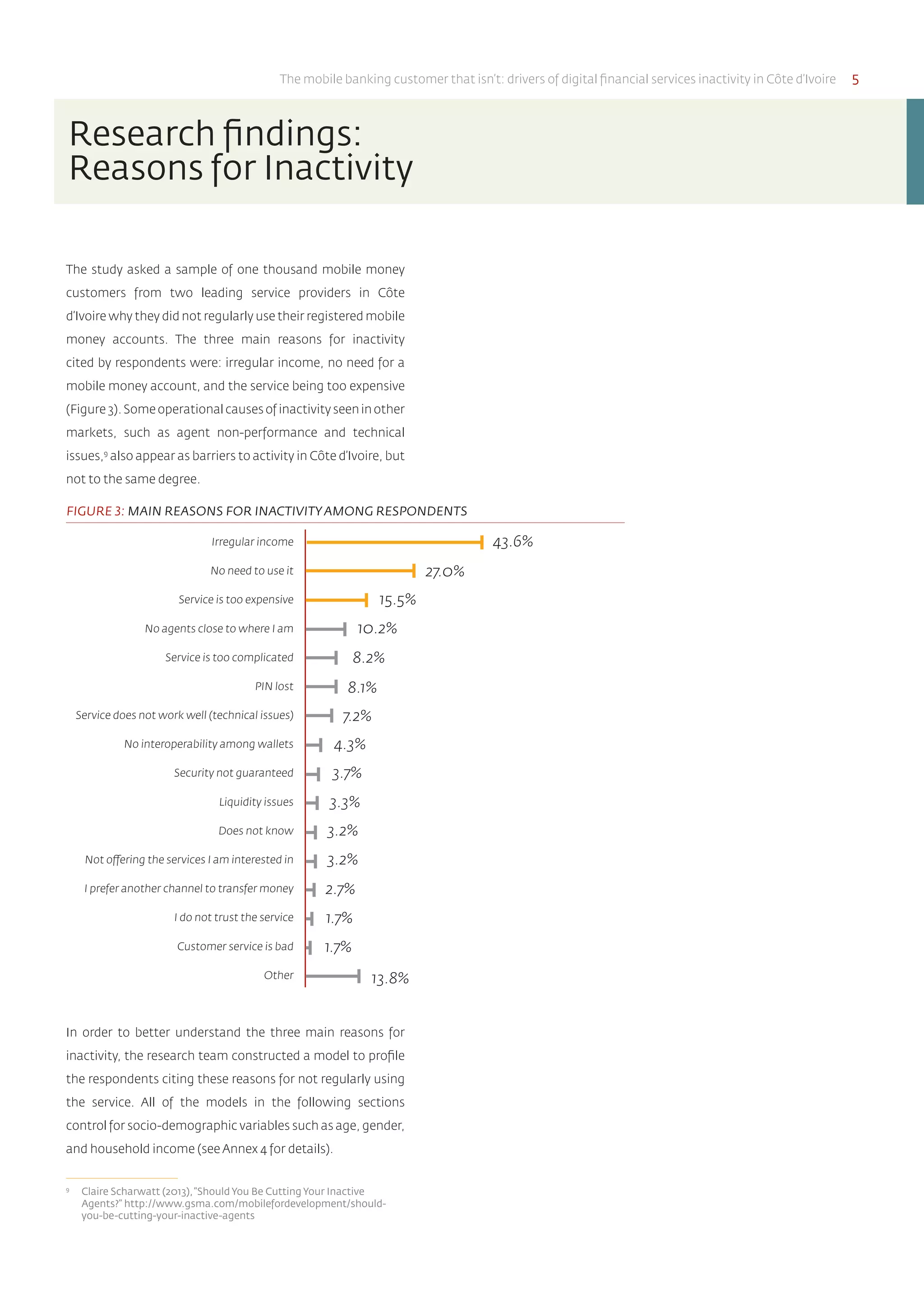

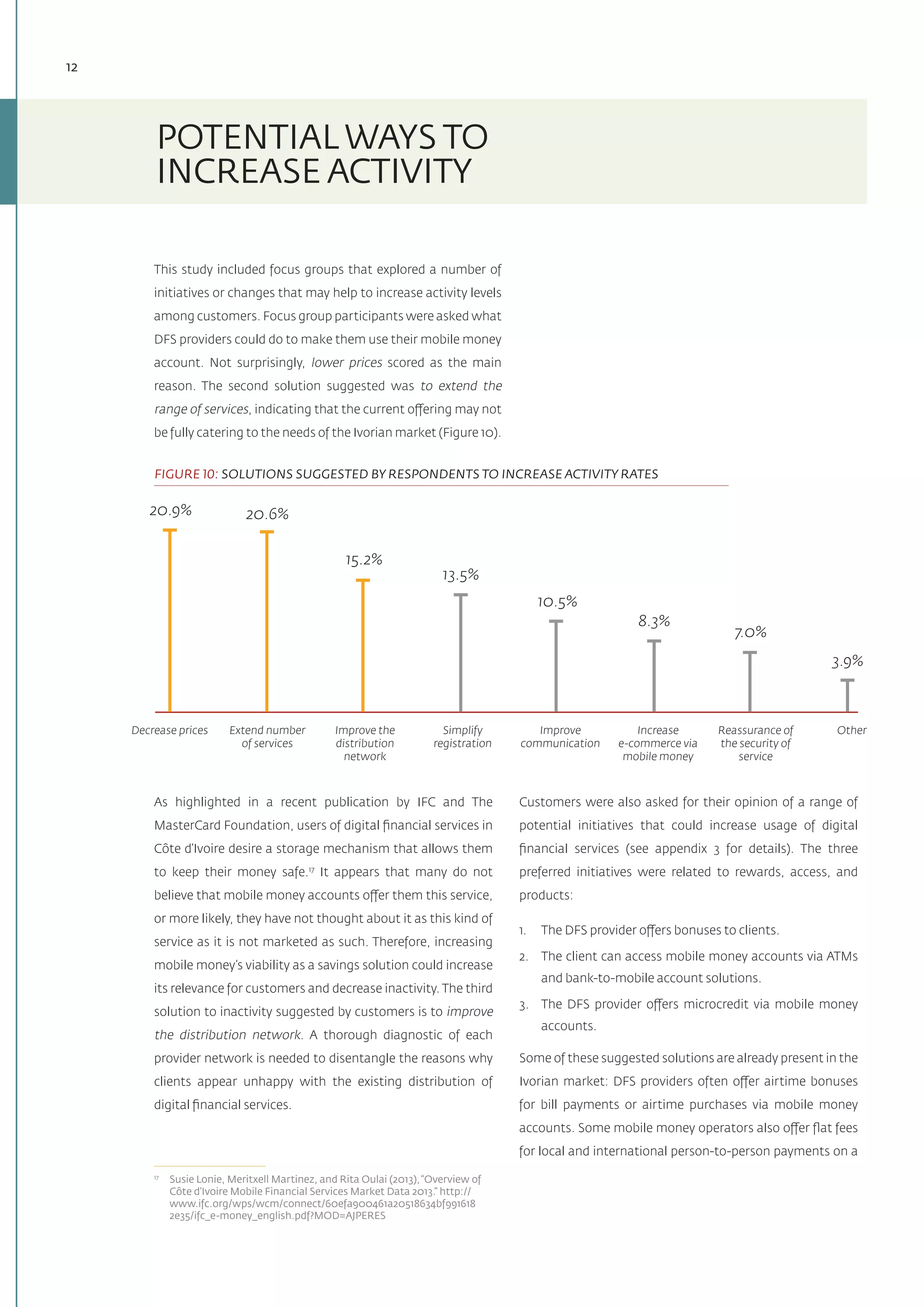

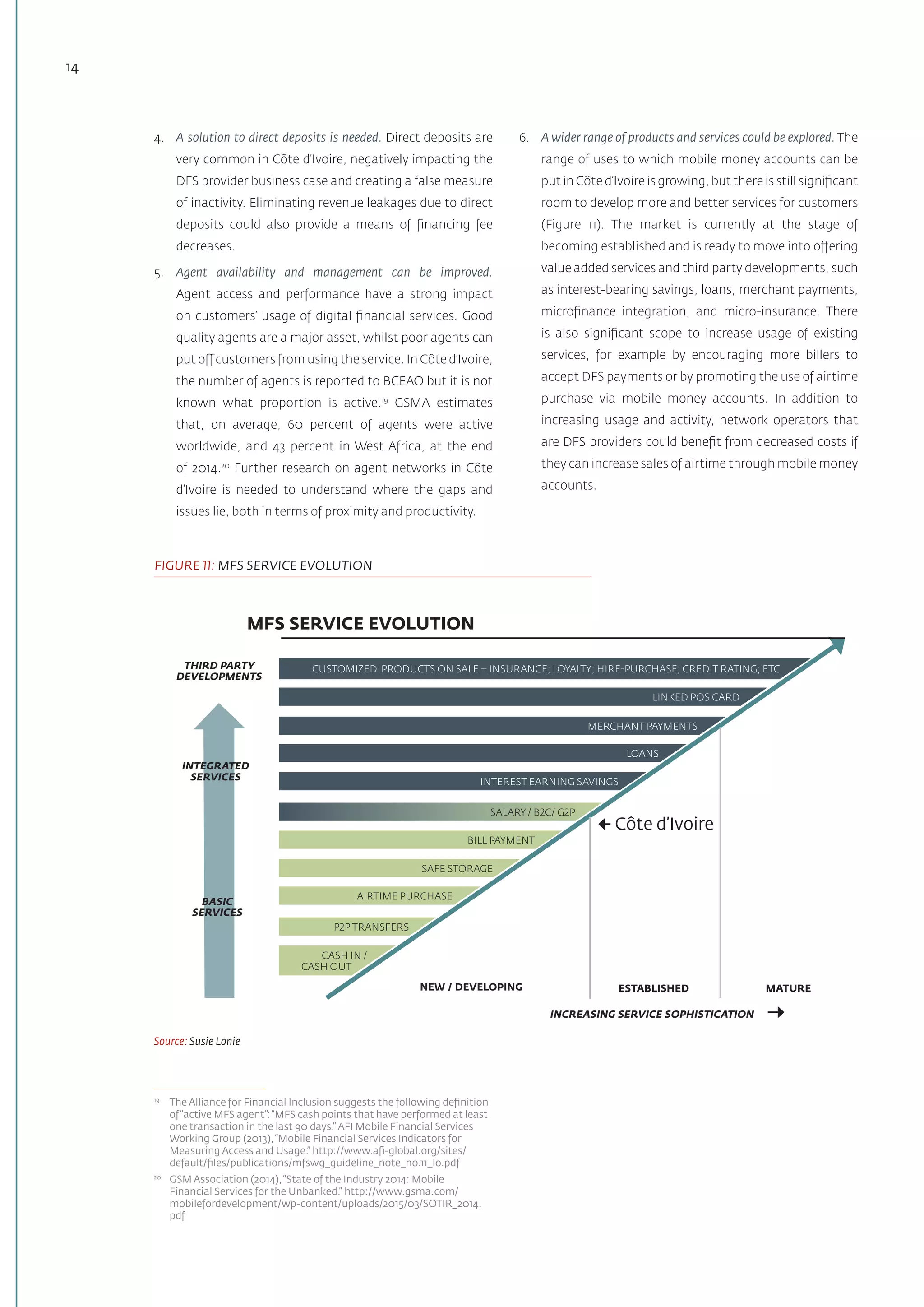

The document discusses drivers of inactivity in mobile banking and digital financial services in Côte d'Ivoire. It finds that nearly half of customers have irregular incomes and do not need to consistently use their accounts. Over a quarter are unaware of benefits compared to cash. Over 15% cite costs being too high as mobile money tariffs are higher in Côte d'Ivoire than other African countries. The document recommends reducing costs, making services more relevant with savings/loans, and improving agent distribution and education on benefits.