- The Indian markets ended flat, shrugging off positive global cues, as sentiments remained mixed among investors who were looking for direction.

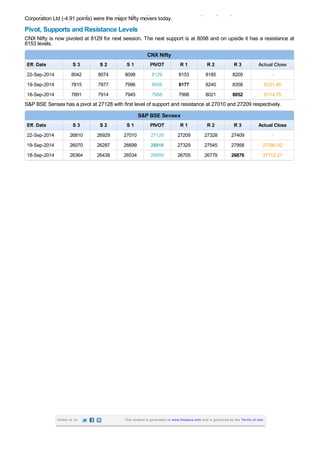

- The Sensex closed down 21.79 points at 27090.42 while the Nifty gained 6.70 points to close at 8121.45.

- Among sectoral indices, IT and healthcare gained while capital goods and oil & gas declined.