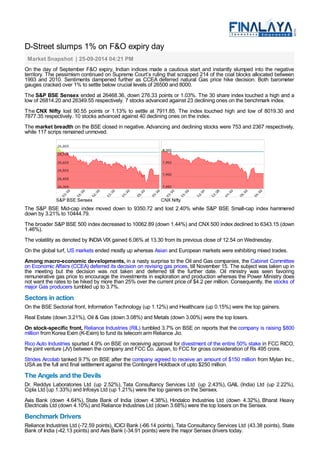

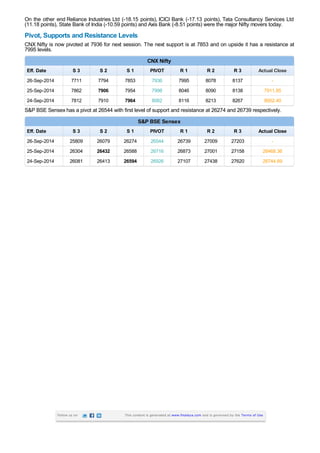

The Indian stock market indices declined over 1% on the day of September futures and options contract expiry due to negative global cues and the Supreme Court scrapping 214 coal blocks. The Sensex closed down 276 points at 26468 and the Nifty fell 91 points to settle at 7912. Key sectors like real estate, oil & gas and metals witnessed a decline while IT and healthcare ended higher. Reliance Industries stock dropped 3.7% due to a fundraise by its telecom unit while Dr. Reddy's was among the top Sensex gainers.