- The Indian stock market plunged on November 20, with the Sensex falling 255 points and Nifty dropping 80 points, snapping a three-day rally. The decline was driven by cautious comments from US Fed Chairman Ben Bernanke about tapering bond purchases.

- Most global and domestic sectors traded in the red, with banking and consumer sectors among the top losers in India. However, some sugar and pharmaceutical stocks rallied on company-specific news.

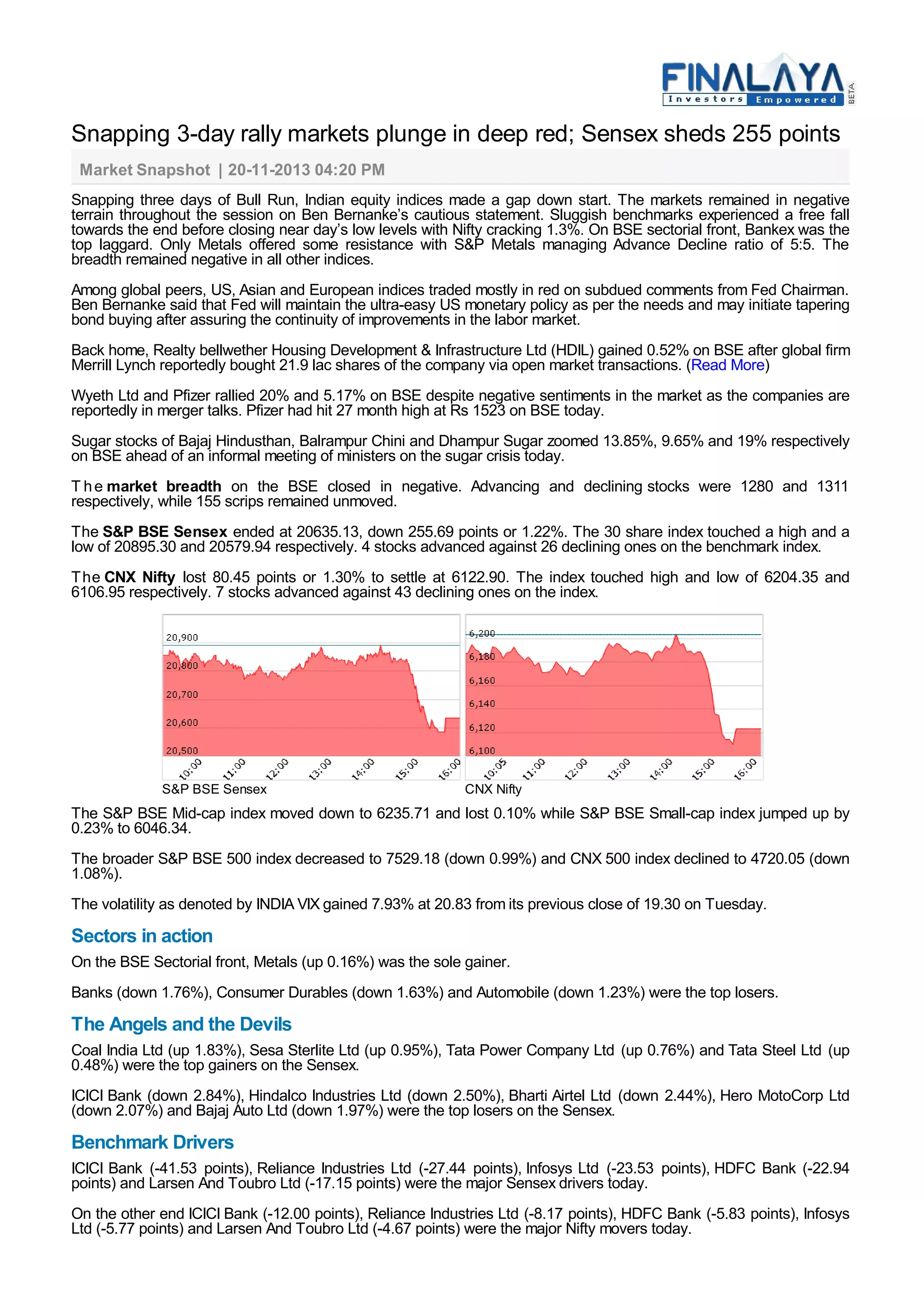

- The markets declined through the session and saw increased volatility. Most breadth indicators were negative as declining stocks outweighed advancing ones.