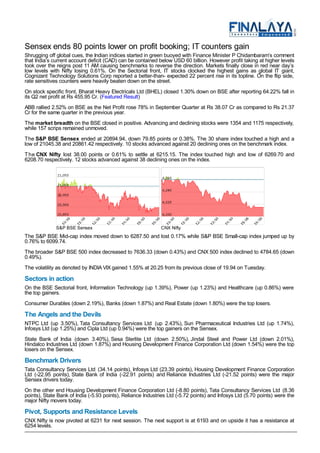

The Indian stock indices opened higher but later declined, closing lower due to profit booking. The Sensex ended 80 points lower while the Nifty lost 0.61%. IT stocks gained while rate sensitive stocks declined. TCS and Infosys were among the top Sensex gainers while SBI, Sesa Sterlite, and HDFC were among the top losers.