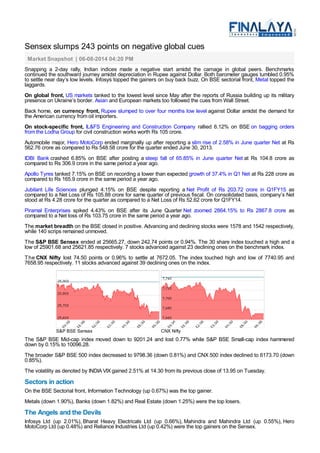

Indian stock indices experienced a decline, with the Sensex dropping 243 points amid negative global cues and a weakening rupee. Key sectors such as metal and banking faced losses, while Infosys gained on buyback news. The market breadth closed slightly positive, with 1578 advancing and 1542 declining stocks on the BSE.