- Indian equity indices opened higher but turned negative for the seventh straight session, despite gains in global markets.

- Key factors dampening domestic sentiment included the crashes of MCX and Financial Technologies stocks after NSEL suspended most contracts, and disappointing manufacturing PMI data.

- Several banks such as Bank of Baroda reported rising NPAs in their quarterly results, though some like Union Bank of India posted profit growth.

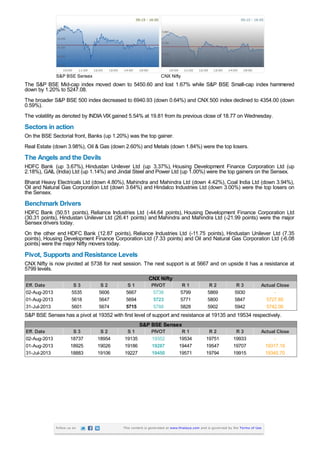

- The BSE Sensex ended down 0.15% while the Nifty fell 0.25%, with real estate and oil & gas among the top losing sectors.