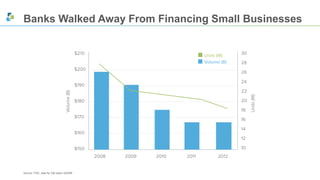

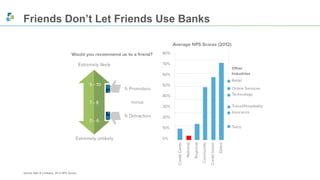

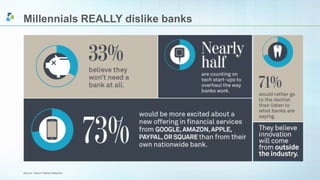

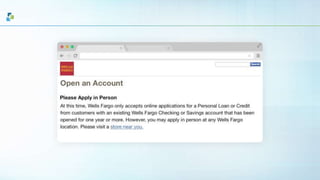

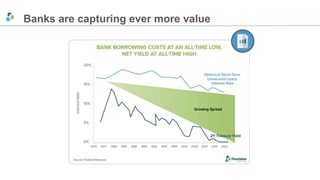

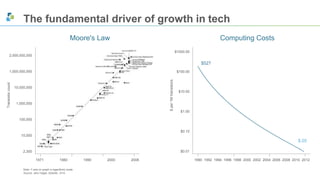

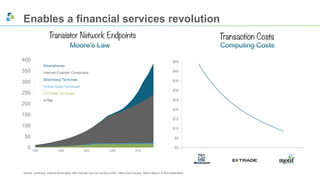

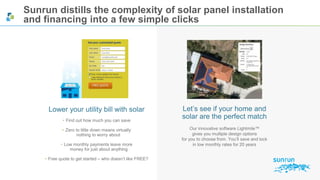

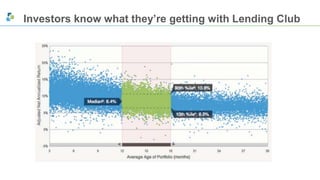

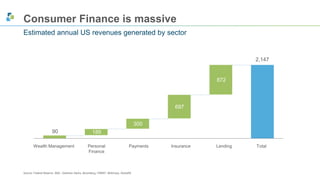

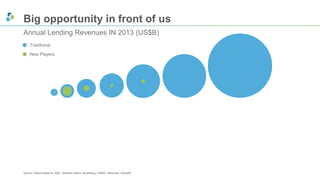

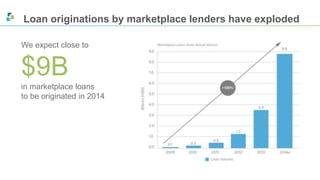

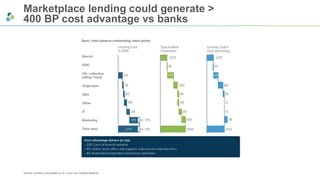

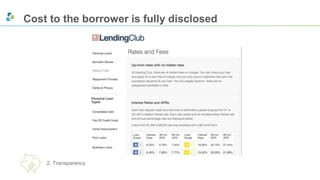

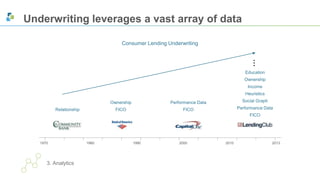

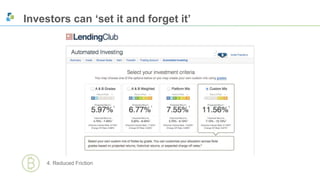

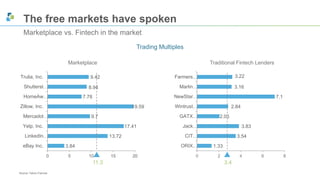

This document summarizes the growth of the financial technology (fintech) sector and marketplace lending. It notes that marketplace lending has grown exponentially in recent years, with Lending Club originating over $5 billion in loans in 2014. Marketplace lending offers consumers a simpler, more transparent process and uses alternative data and analytics to improve underwriting. This new model provides a better customer experience and potentially lower costs compared to traditional banks. The document argues this represents a major opportunity for continued growth and disruption of the large traditional banking industry.