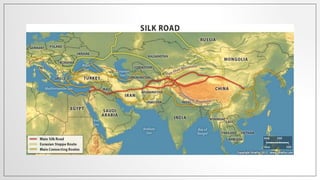

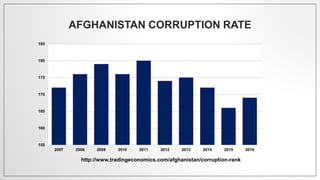

Afghanistan's strategic location along the New Silk Road connecting China to Europe provides opportunities to develop its infrastructure through increased trade and investment. While Afghanistan faces major obstacles like insecurity, corruption and poverty, developing infrastructure could make Afghanistan economically stronger by providing access to new markets. International organizations like the World Bank and private sector investment play important roles in decreasing risks and mobilizing the financing needed for infrastructure projects in Afghanistan.