The document provides information about an internship at TGB Banquets, including:

1) TGB Banquets is part of the Bhagwati group hotel chain founded in 1989, with a 4-star hotel in Ahmedabad and sales of Rs. 49.98 crore.

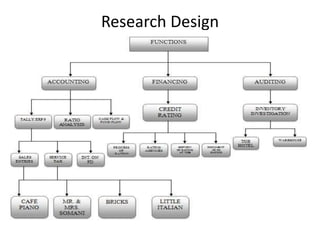

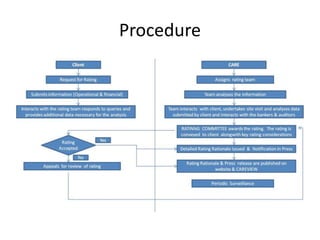

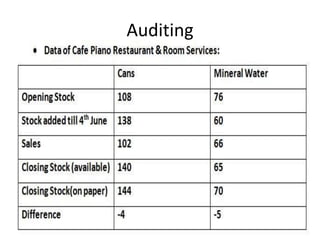

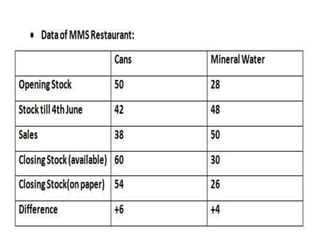

2) The internship objectives were to study the company's accounting practices, auditing methods, and finance activities such as credit ratings.

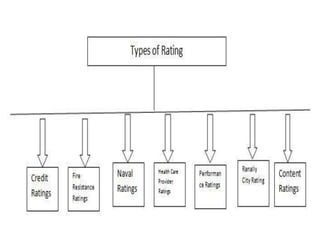

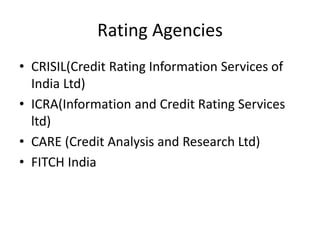

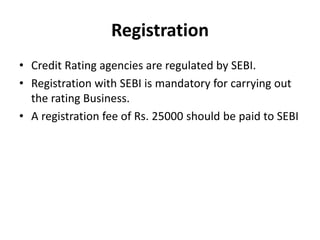

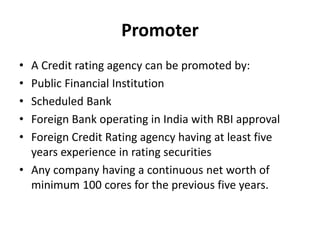

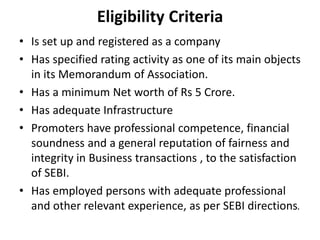

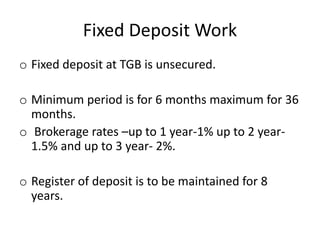

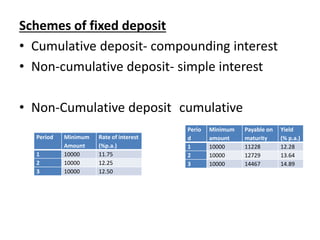

3) Key finance activities observed were fixed deposits, credit ratings through agencies like CRISIL and ICRA, and maintaining accounting records in Tally ERP 9.0.