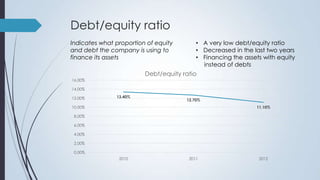

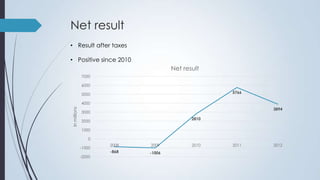

ING Group has seen positive financial results in recent years. The dividend has increased from 0.08 euros in 2012 to 0.3 euros. The debt to equity ratio has decreased from 13.4% in 2010 to 11.1% in 2012, showing they are financing more assets with equity than debt. The net result has been positive since 2010, rising from 2.81 billion euros in 2010 to 5.766 billion euros in 2012. The share value increased over 80% in one year due to investments. Analysts recommend buying ING Group shares due to their investments in sustainability and increasing financial performance.