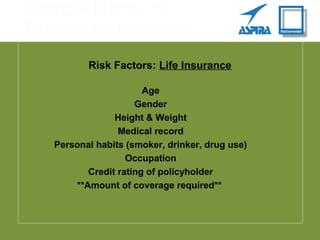

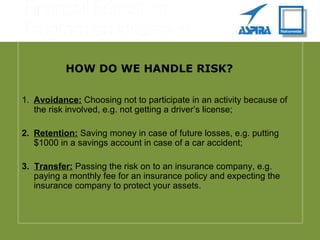

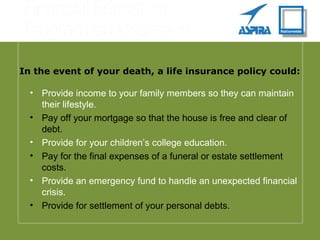

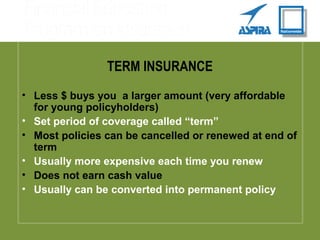

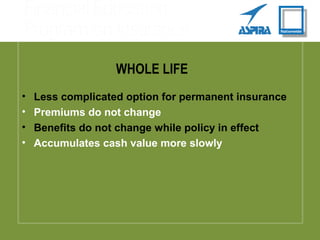

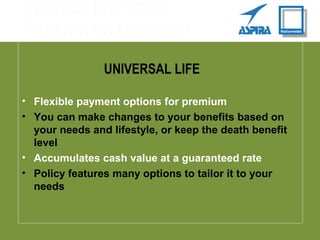

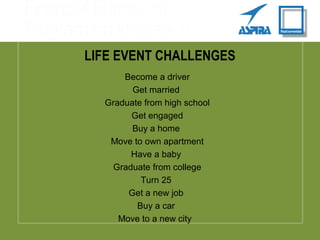

The document provides an introduction to insurance, explaining that insurance transfers risk from an individual to an insurance company in exchange for regular premium payments and that risk factors such as age, health, occupation, and amount of coverage determine the cost of a policy. It also outlines the different types of life insurance policies including term, whole, and universal life and factors to consider when choosing the best policy.