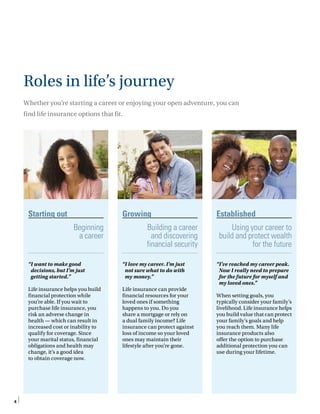

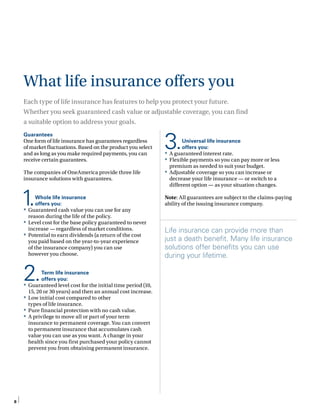

This document provides an overview of how life insurance can help people achieve financial security at different stages of life. It discusses the different types of life insurance products offered by OneAmerica companies, including whole life, term life, and universal life insurance. It explains the benefits these products provide, such as death benefits, cash value accumulation, and living benefits. The document aims to help readers understand how life insurance can help meet goals for estate planning, income replacement, education funding, and more.