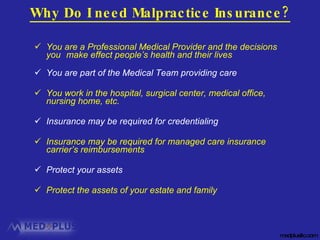

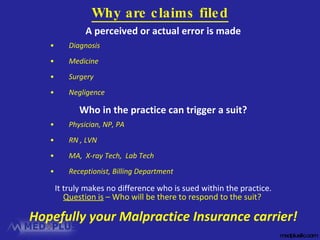

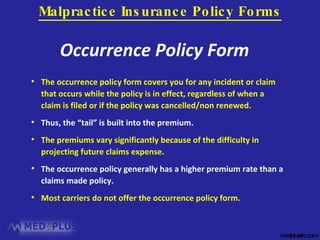

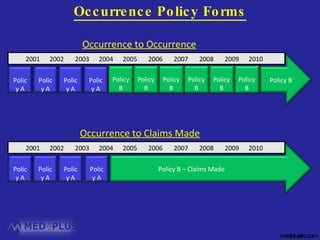

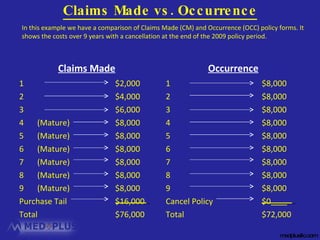

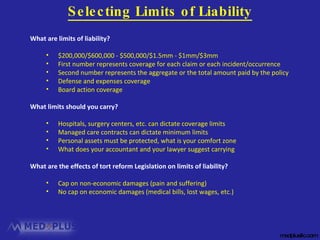

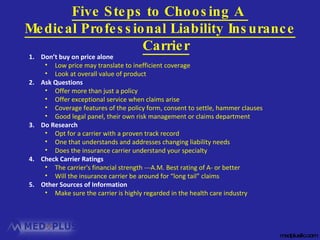

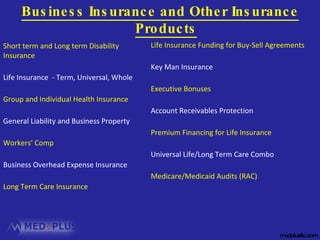

Malpractice insurance, also known as professional liability insurance, provides defense, expenses, and indemnity coverage for acts or errors of omission or negligence by healthcare providers. It protects licensed medical professionals, facilities, and some non-licensed staff from costs associated with lawsuits. The document discusses the different types of malpractice insurance policies including occurrence and claims-made policies, and factors to consider when selecting a malpractice insurance carrier.

![INTRODUCTION TO MALPRACTICE INSURANCE 9555 W. Sam Houston Pkwy Ste. 475 Houston, Texas 77099 www.medplusllc.com [email_address] t:713 995 1842 f:713 995 0692](https://image.slidesharecdn.com/introductiontomedmalprinted92910-12868342938172-phpapp02/75/Introduction-To-Med-Mal-Insurance-1-2048.jpg)