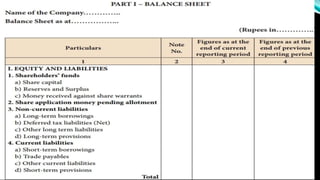

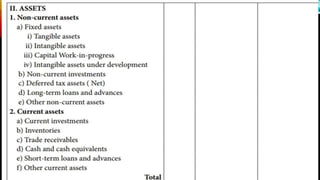

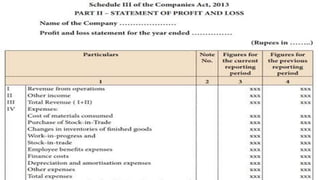

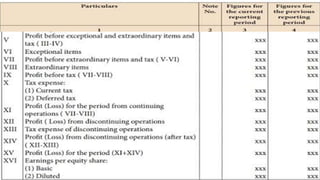

The document discusses the final accounts of a company which are prepared at the end of a fiscal year to provide a clear picture of the company's financial position to management and other stakeholders. The final accounts consist of a balance sheet according to Schedule III of the Companies Act 2013 and a statement of profit and loss. The balance sheet outlines the company's equity and liabilities including shareholders' funds, as well as its assets classified as current or non-current. The statement of profit and loss summarizes the company's revenues, costs, expenses, and earnings per share for a specified period. The objectives of preparing final accounts are to determine profit or loss, financial position, and act as a source of information for users.