Embed presentation

Download to read offline

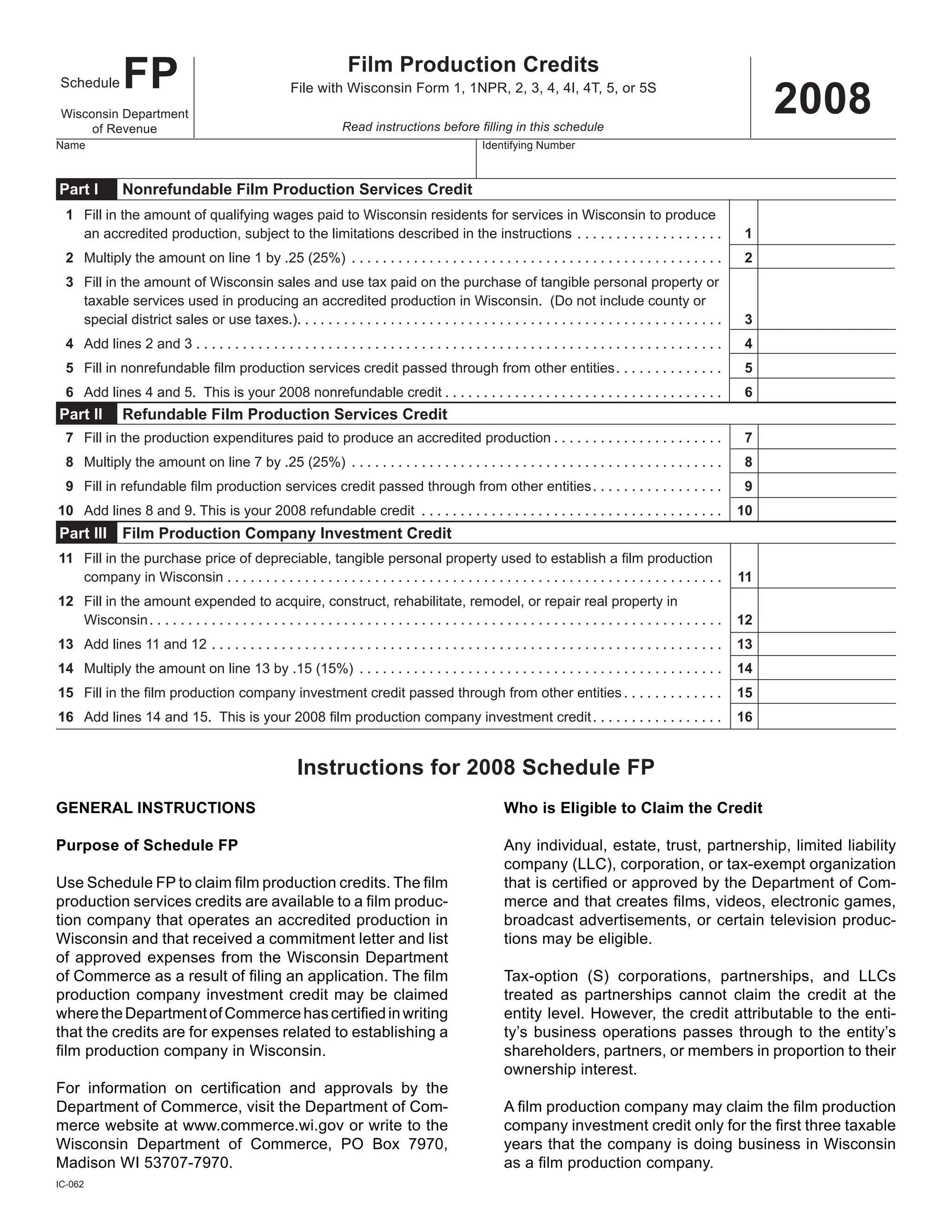

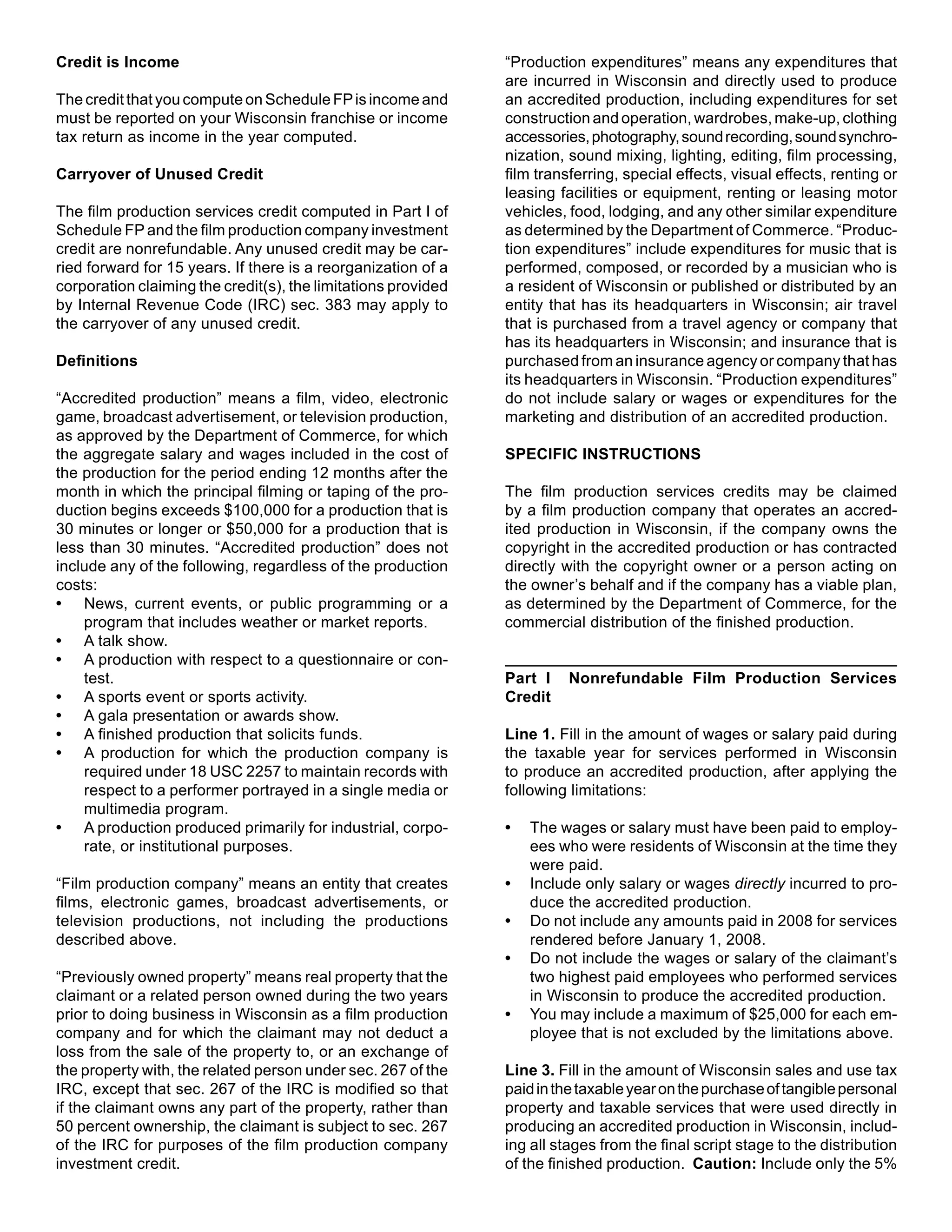

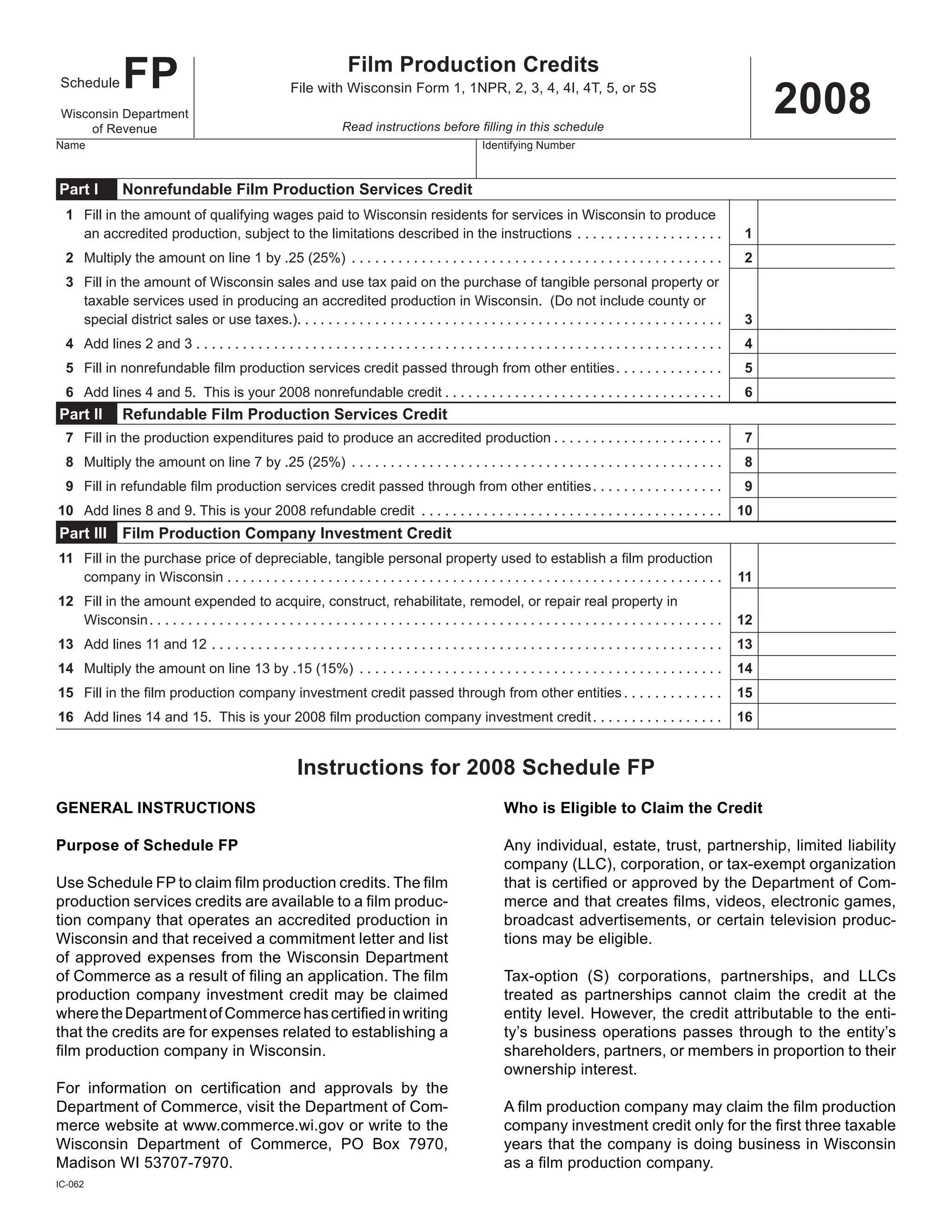

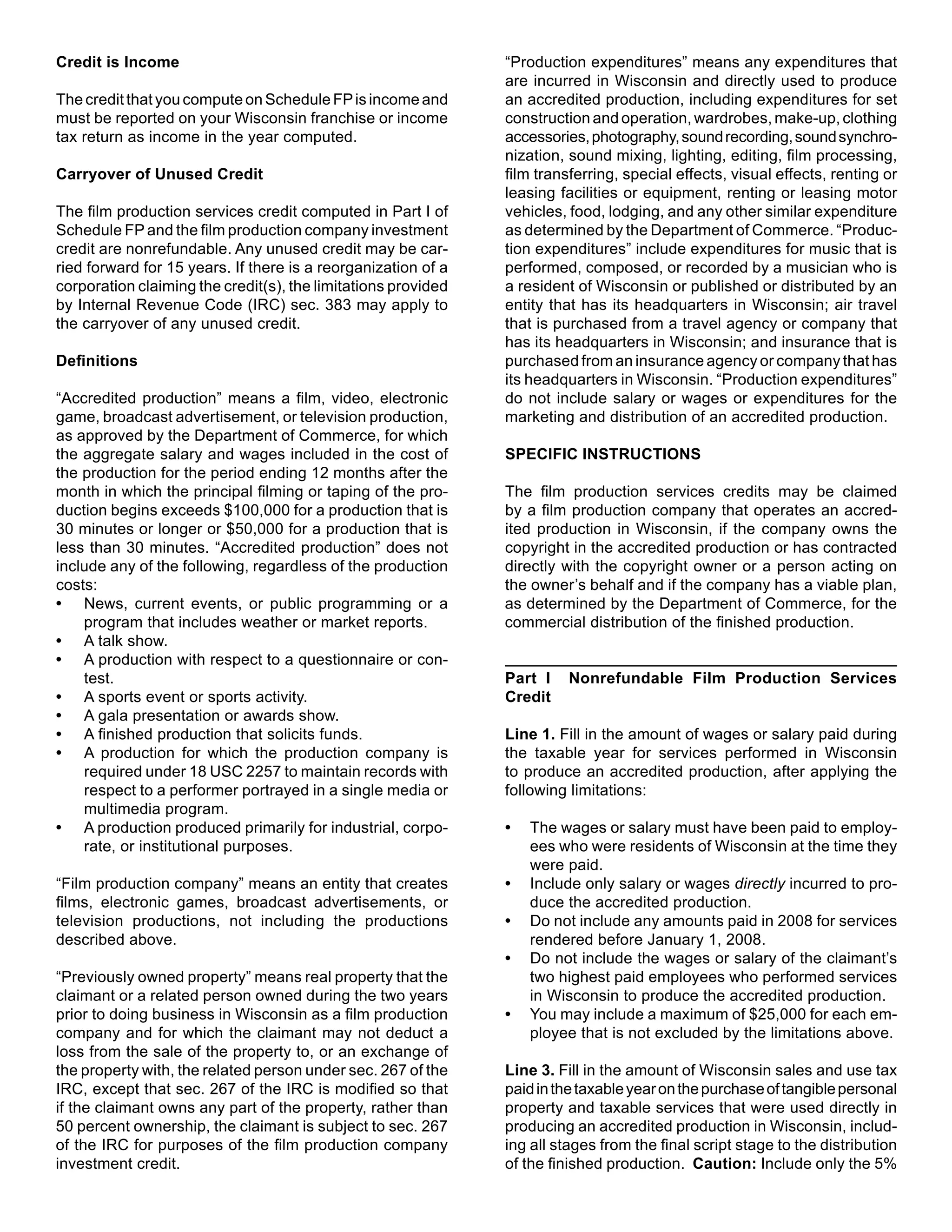

This document provides instructions for claiming film production tax credits on the Wisconsin Schedule FP tax form. It outlines three types of nonrefundable and refundable credits available to film production companies for qualifying wages paid to Wisconsin residents, sales and use taxes paid on production purchases, and investments made to establish a film production company in Wisconsin. The instructions specify who is eligible to claim the credits and provide details on certification requirements and limitations.