Embed presentation

Download to read offline

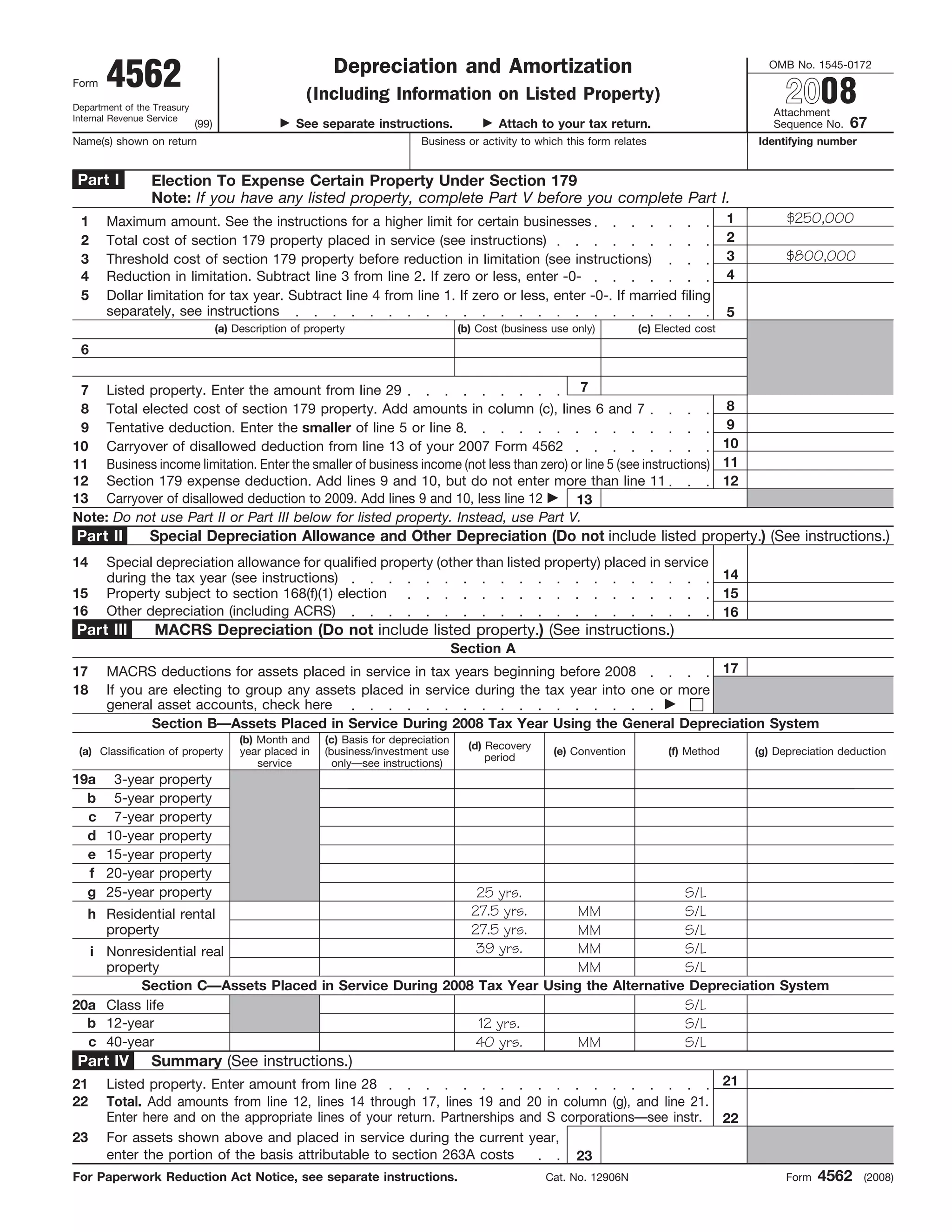

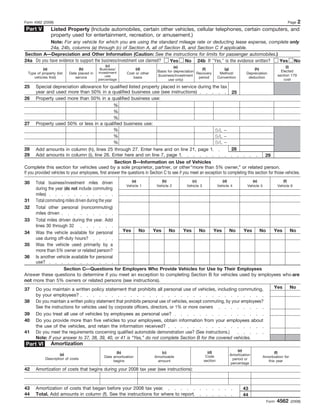

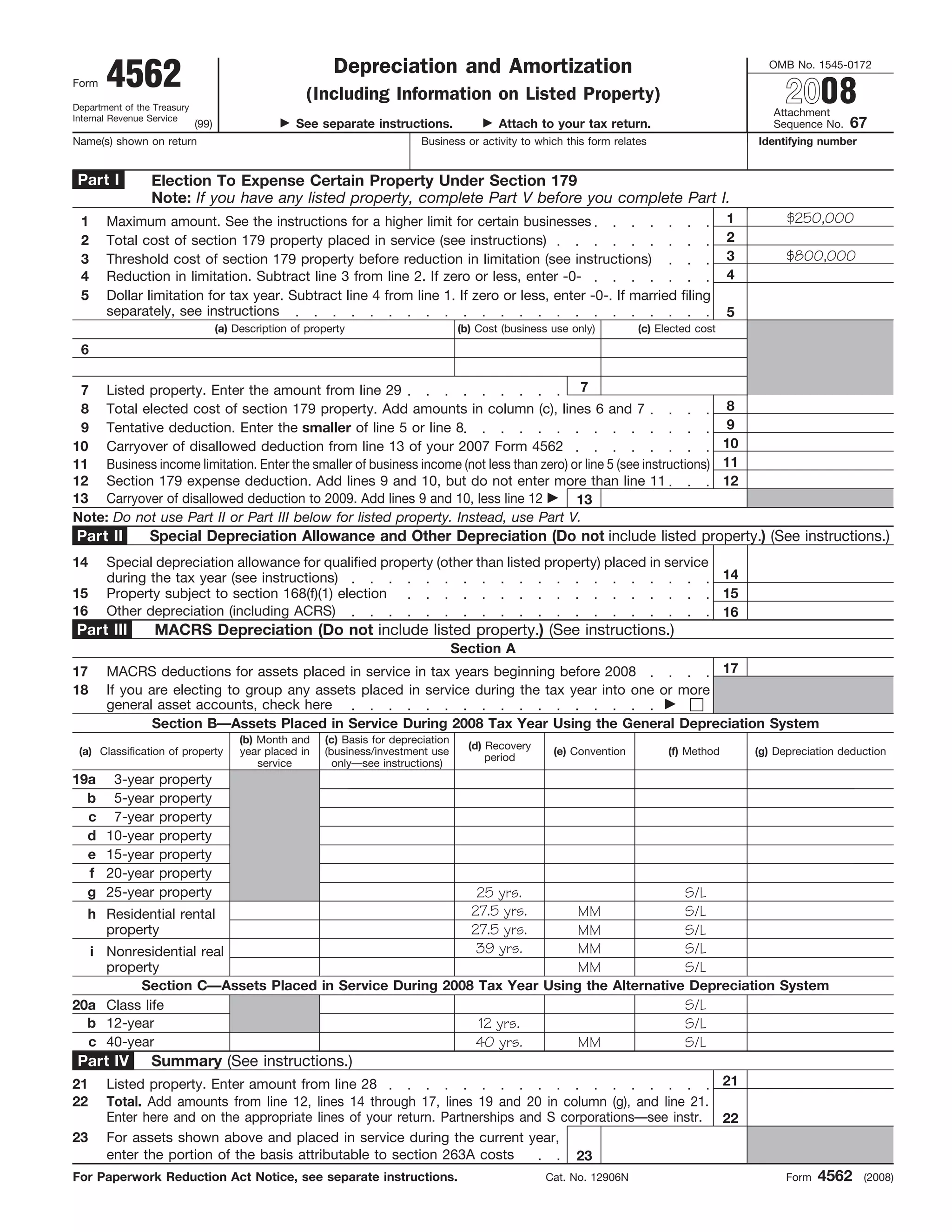

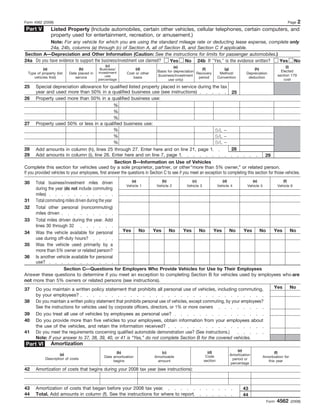

This document summarizes depreciation and amortization rules for tax reporting purposes. It includes: 1) Elections to expense certain property under Section 179, including maximum expense amounts and requirements. 2) Special depreciation allowance and other depreciation deductions for assets placed in service, excluding listed property. 3) MACRS depreciation deductions using general and alternative deprecation systems for assets placed in service in 2008.