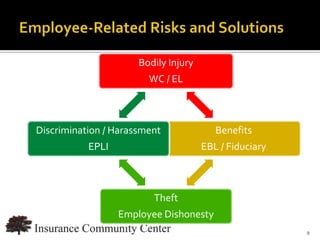

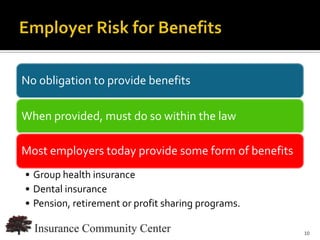

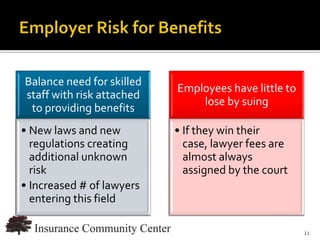

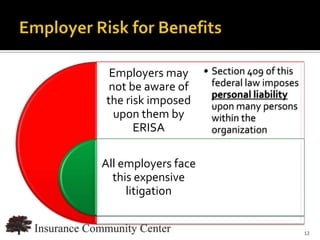

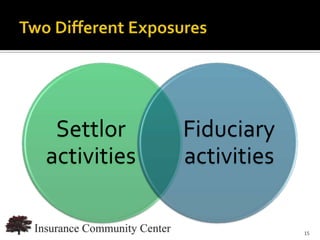

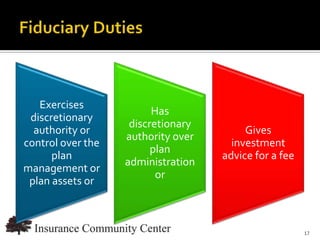

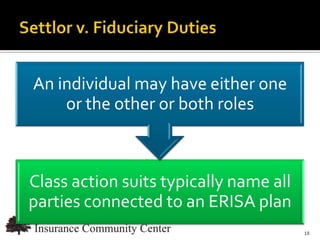

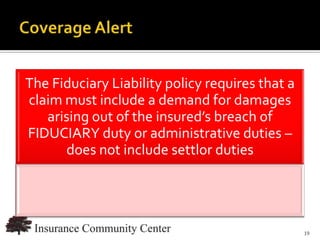

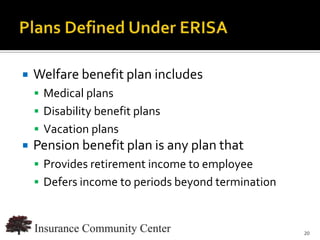

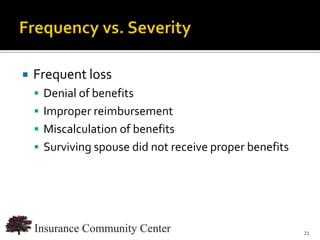

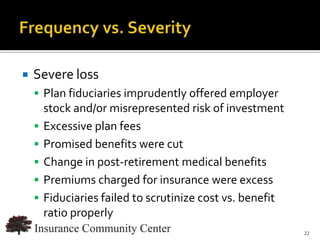

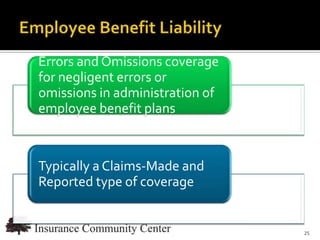

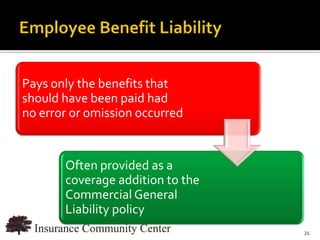

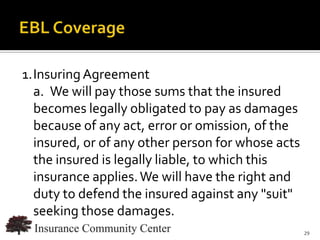

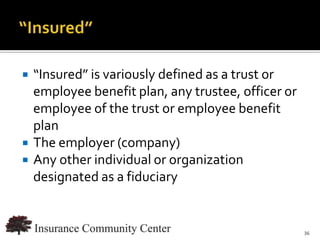

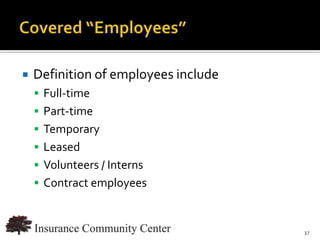

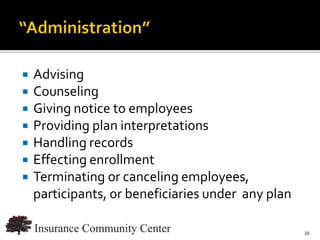

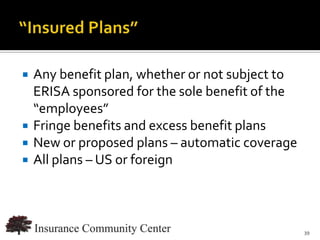

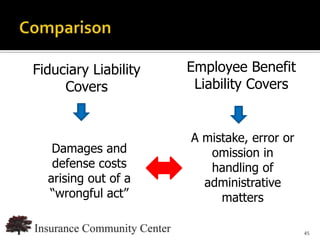

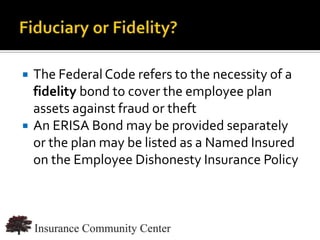

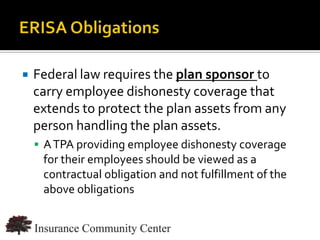

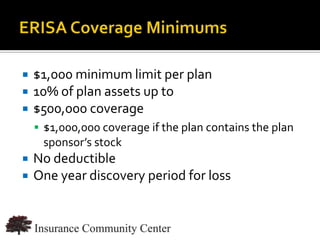

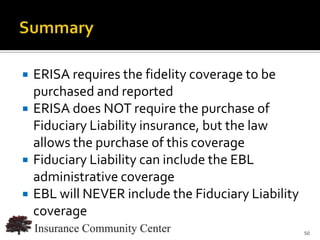

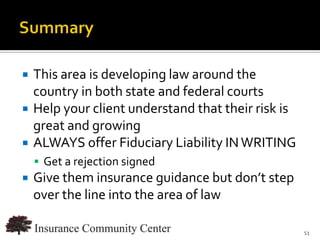

The document outlines key aspects of fiduciary liability and employee benefit liability (EBL) insurance relevant to employers, including types of coverage, responsibilities under ERISA, and potential risks associated with employee benefit plans. It highlights the importance of understanding and managing liabilities, the coverage limitations, and the necessity of fidelity bonds to protect plan assets. It also emphasizes the increasing complexity and legal challenges in this area, encouraging employers to consider fiduciary liability insurance.