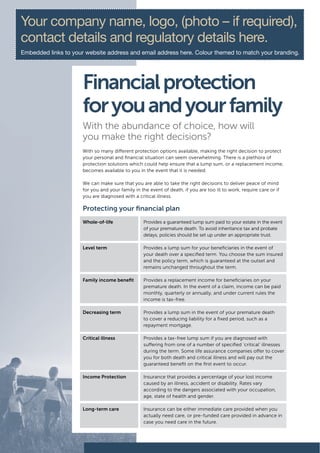

This document provides information about various types of financial protection options, including whole-of-life insurance, term life insurance, family income benefit, decreasing term insurance, critical illness insurance, income protection, and long-term care insurance. It explains what each option provides, such as a lump sum payment or replacement income. The document also states that the company can help clients understand their unique needs and circumstances to provide the most suitable and cost-effective protection solutions.