This document provides an overview of various types of commercial insurance policies and concepts, including:

- Commercial Package Policies that bundle various coverage parts like general liability, property, and business income.

- The distinction between first-party insurance that pays the policyholder, and third-party insurance that pays others.

- The importance of reading the policy (RTFP) to understand what is and isn't covered, including any sub-limits or exclusions.

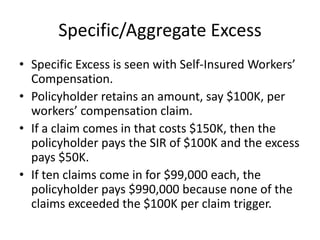

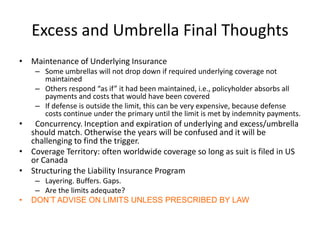

- Differences between excess policies, umbrellas, towers of coverage, and how policies may follow-form or have standalone terms.

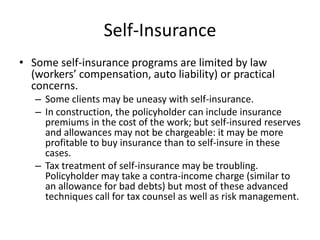

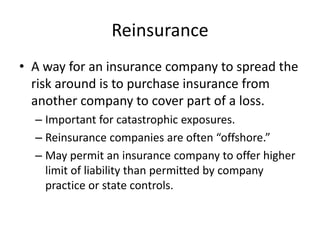

- Concepts of self-insurance, large deductible plans, captives, reinsurance, fronting