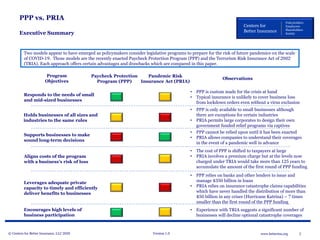

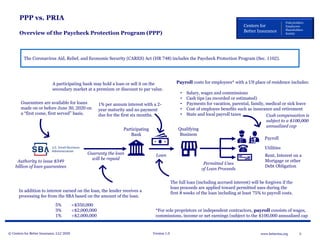

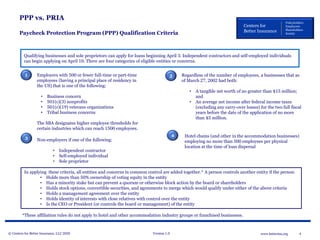

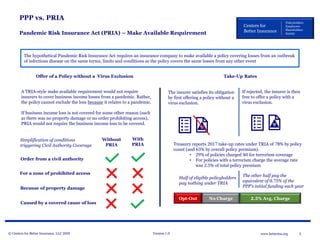

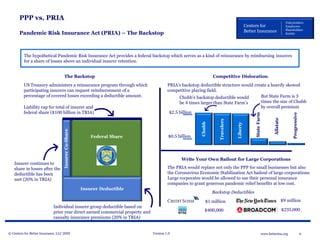

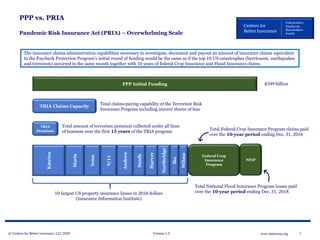

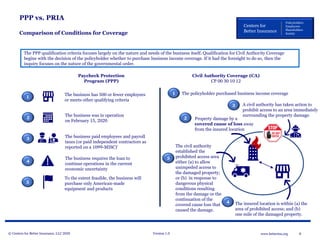

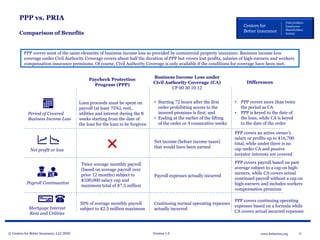

The document discusses the Centers for Better Insurance's analysis of two legislative models for managing pandemic-related economic risks: the Paycheck Protection Program (PPP) and the Pandemic Risk Insurance Act (PRIA). It highlights the advantages and disadvantages of each model, focusing on aspects such as eligibility, coverage scope, funding mechanisms, and potential impacts on businesses of varying sizes. The document emphasizes the importance of these models in preparing for future pandemic risks and their implications for policyholders and the insurance industry.