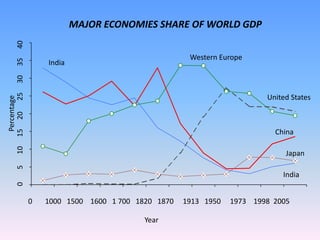

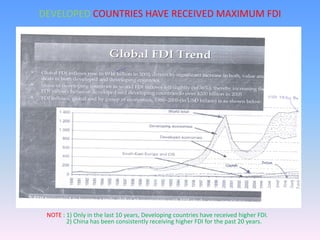

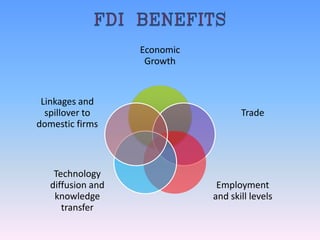

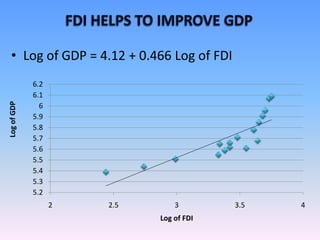

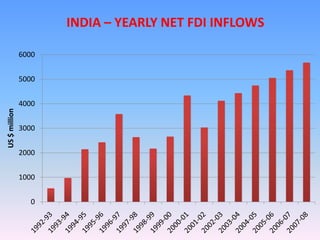

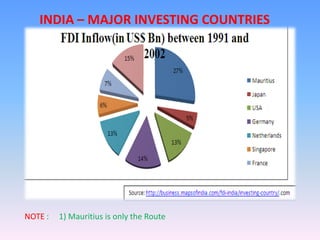

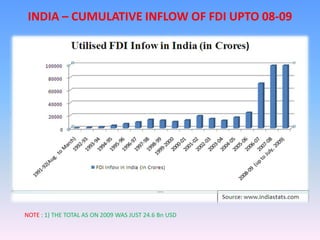

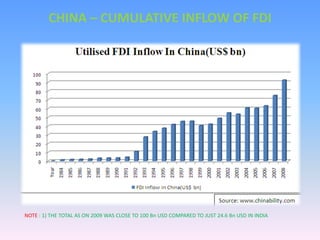

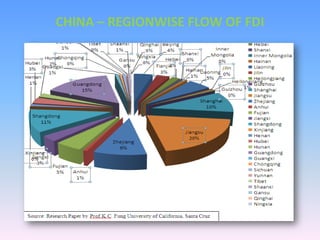

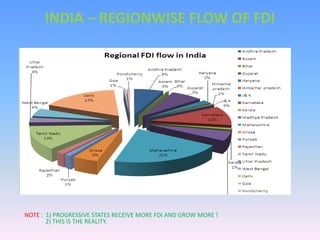

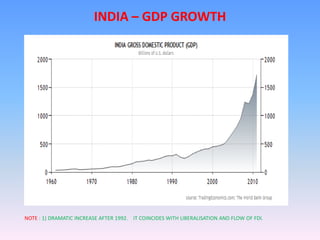

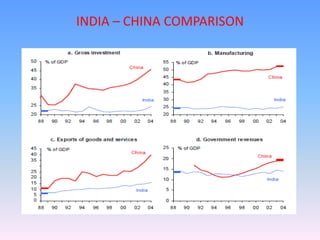

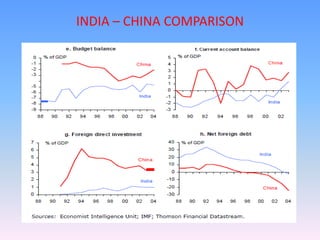

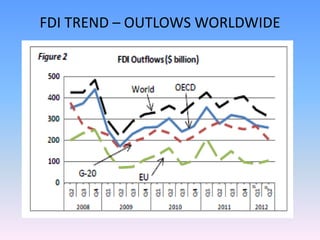

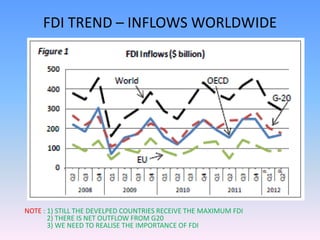

FDI in India has been increasing over the past few decades. [1] Developed countries received most FDI historically but developing countries like China and India have received higher amounts in recent years. [2] FDI provides benefits like economic growth, technology diffusion, employment opportunities and increases in domestic firm capabilities. [3] India's GDP growth increased dramatically after economic reforms in 1992 that coincided with rising FDI inflows.