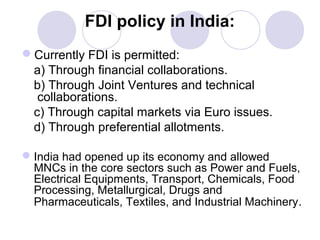

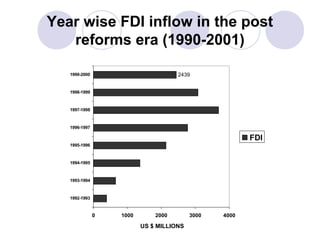

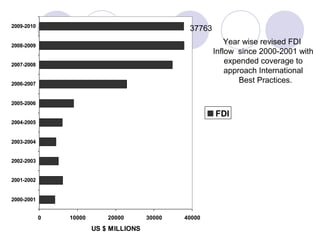

FDI in India has increased steadily since economic liberalization in the 1990s. Major sectors that have benefited from FDI include telecommunications. While FDI can increase productivity and competitiveness, there are also drawbacks such as local firms losing business. There is debate around allowing FDI in multi-brand retail, as it could displace many small retailers but improve consumer access to goods. Studies on FDI in India have found mixed impacts on growth, employment, and exports. Policy measures are needed to ensure FDI's benefits are shared widely and its costs managed.