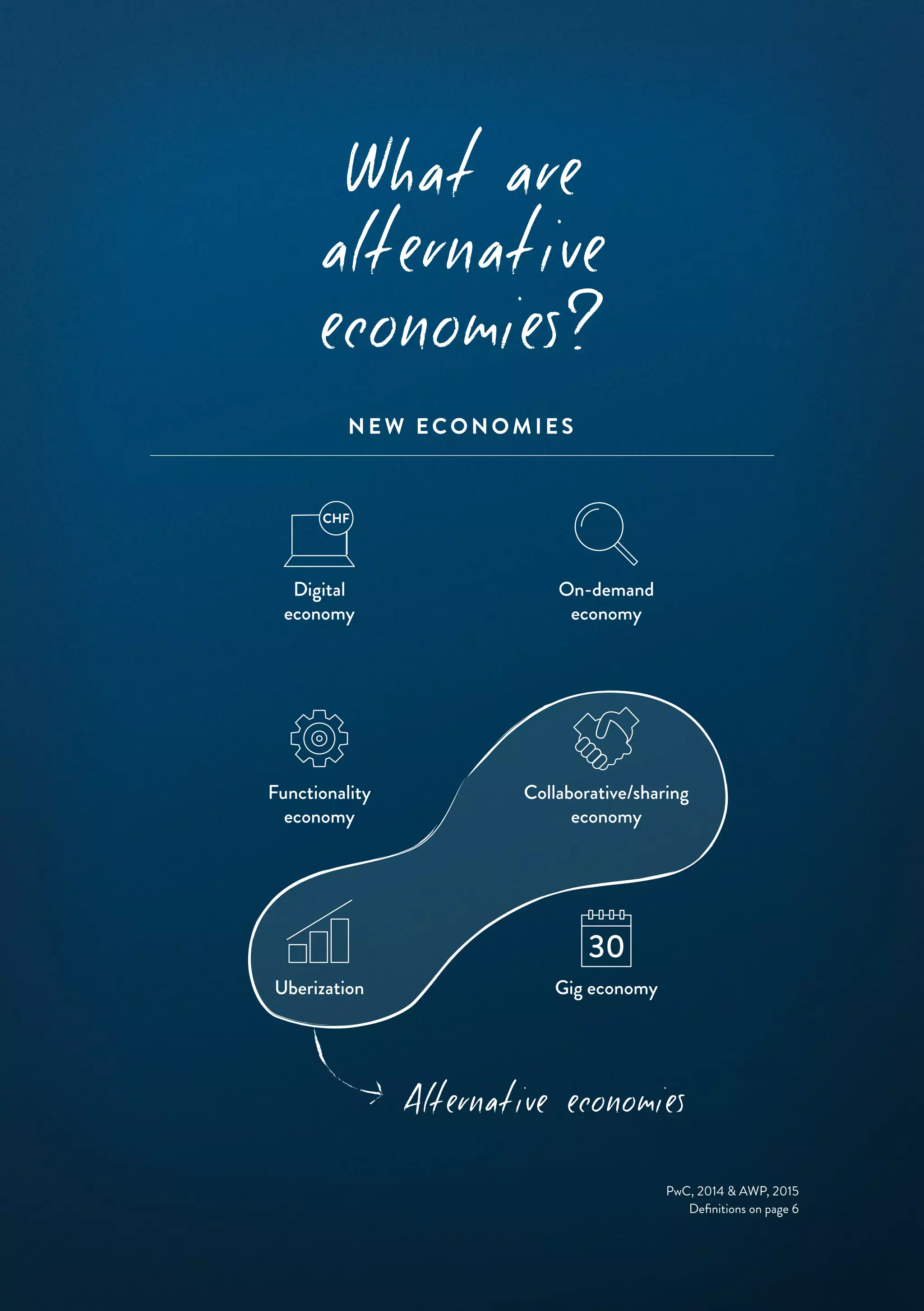

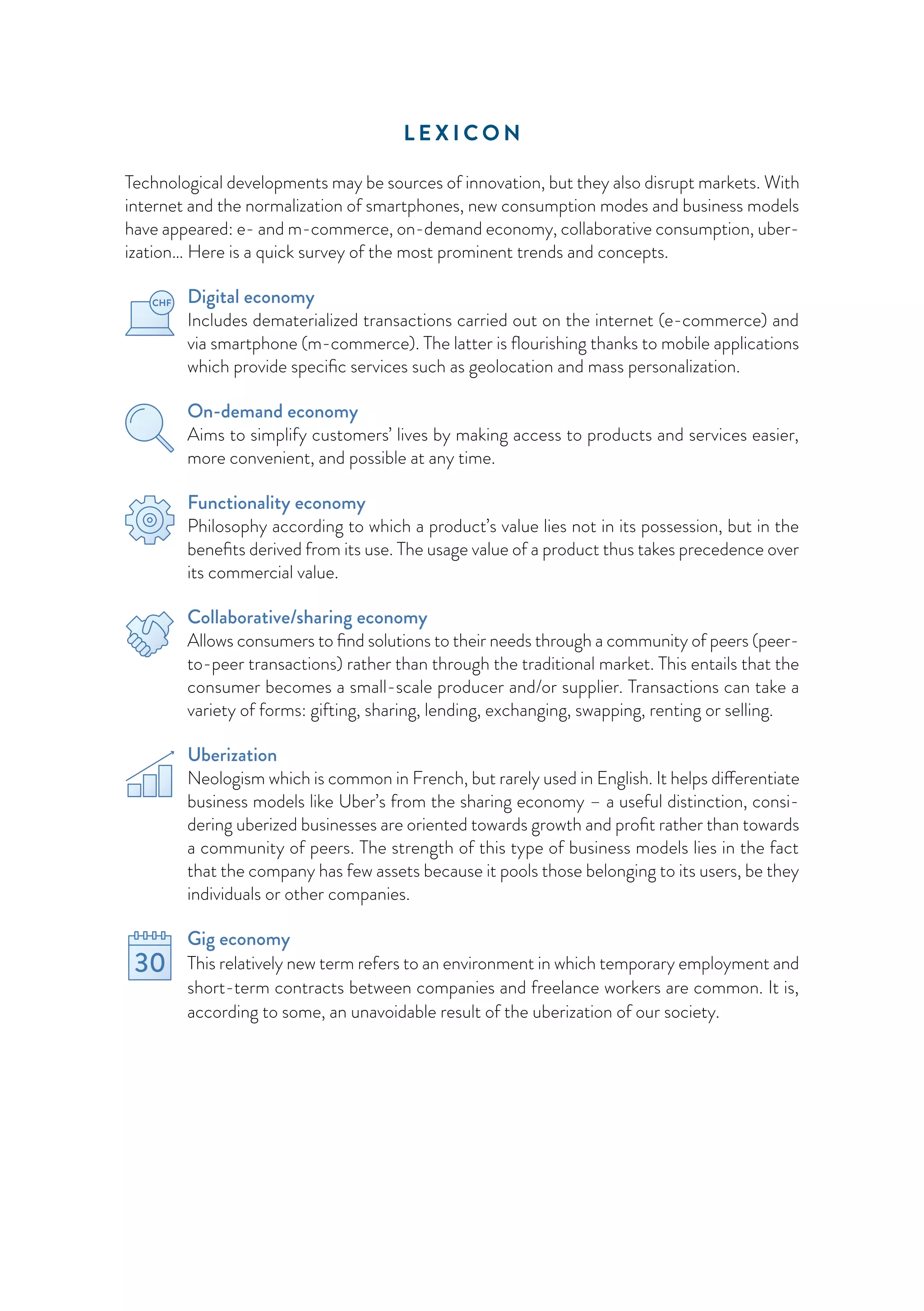

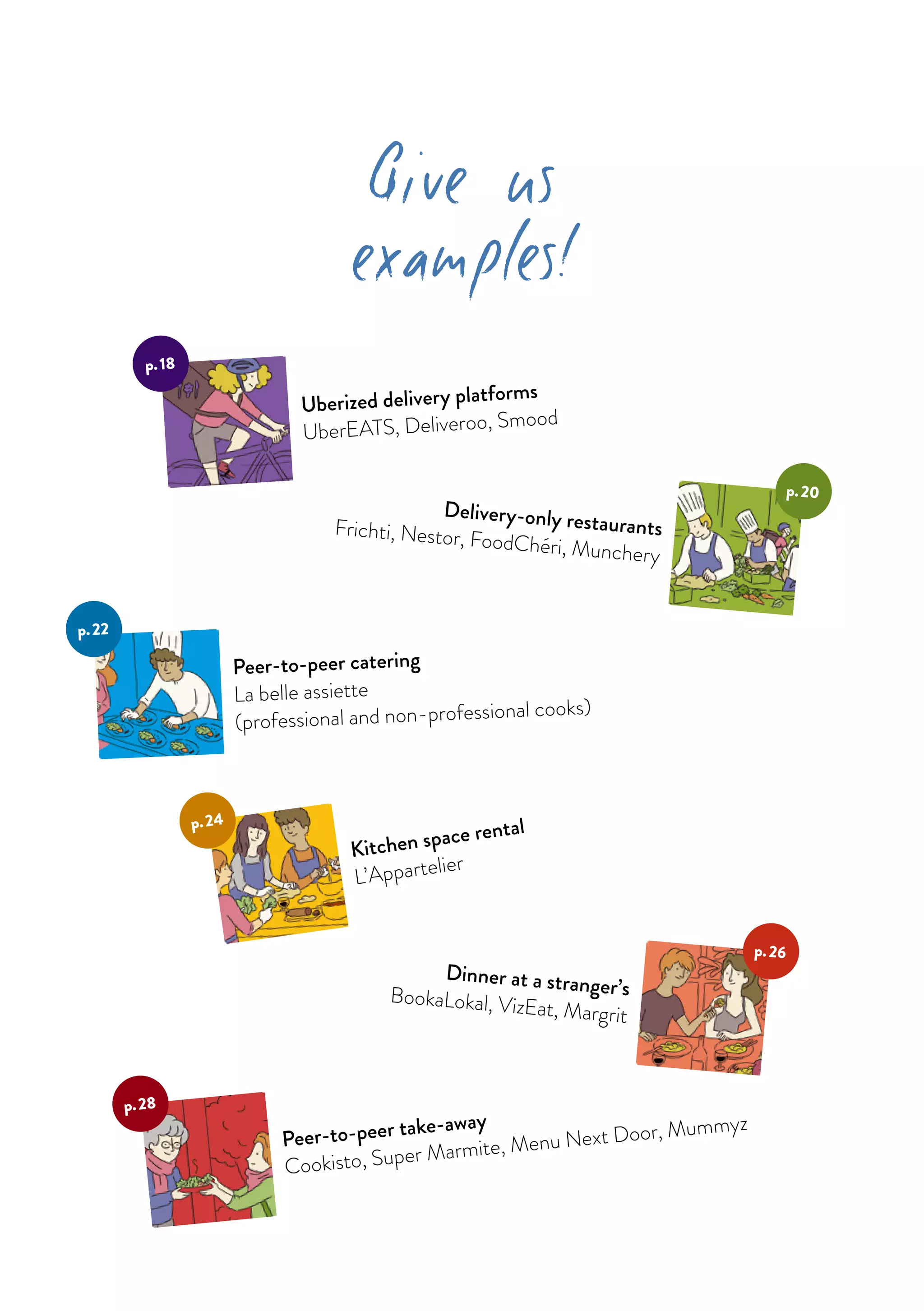

The document discusses emerging alternative foodservice concepts and their potential impact on traditional restaurants. It analyzed survey responses from nearly 500 people on their perceptions of concepts like peer-to-peer catering, kitchen space rentals, and Uber-like delivery platforms. The survey found consumers are open to alternative economies if it means better quality, affordability and service. However, challenges include regulation, taxes, and effects on job markets and social protection. Traditional restaurants need to adapt their offers and services to changing customer expectations or potentially collaborate with innovative companies.