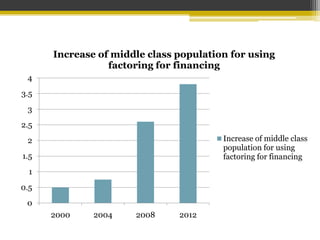

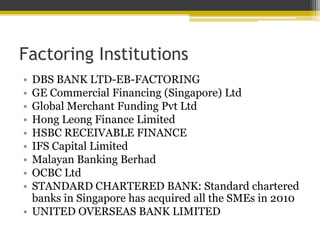

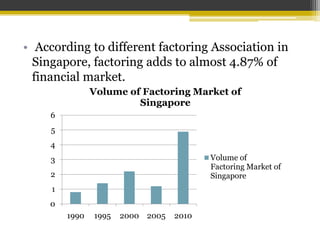

Factoring is an alternative form of financing where a business sells its accounts receivable to a third party called a factor. In Singapore, factoring has grown steadily due to a positive business environment and increasing acceptance. Factoring provides businesses liquidity and transfers the risk of default to the factor. The factoring market in Singapore services a variety of industries and provides different options to meet clients' needs. While factoring has grown in popularity, some businesses remain hesitant to use factoring due to concerns about losing control over receivables or not needing additional financing.