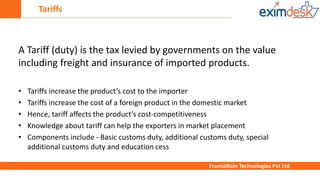

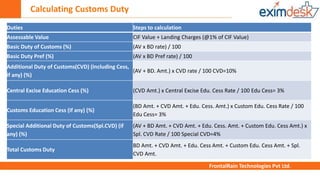

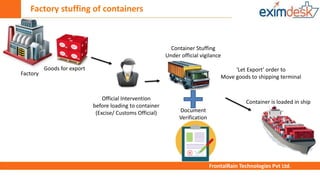

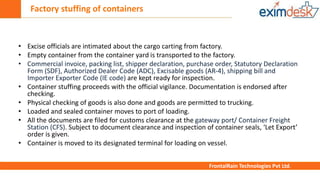

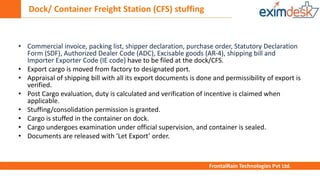

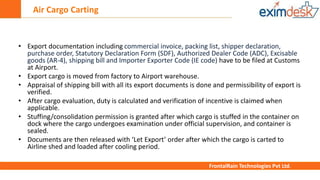

The document discusses export procedures from India, including tariffs, customs duty calculation, determining import duty, export shipment steps, factory stuffing of containers, dock/CFS stuffing, and air cargo carting. It provides details on documentation requirements, official procedures and interventions at various stages of export. It also addresses some frequently asked questions about invoicing currency, export proceeds realization timeline, accumulating proceeds in foreign accounts, and RBI permission for short realization.