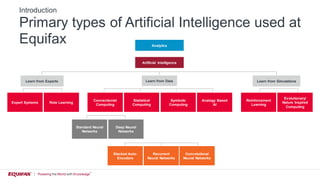

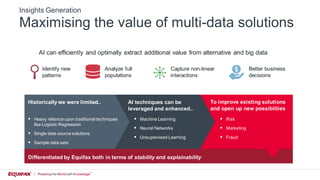

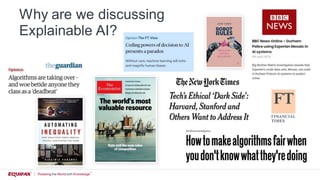

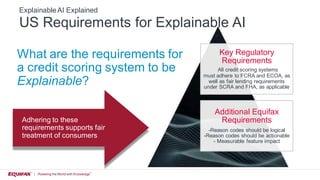

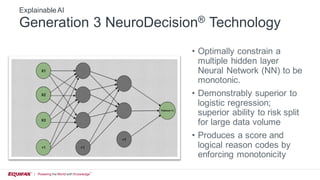

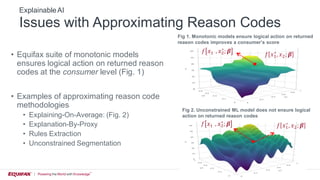

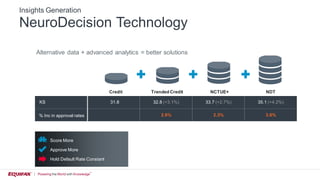

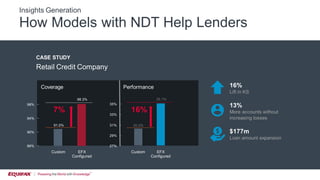

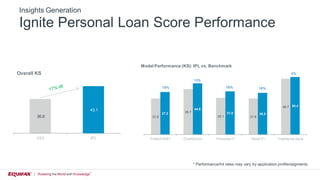

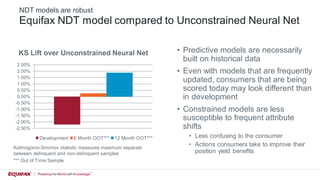

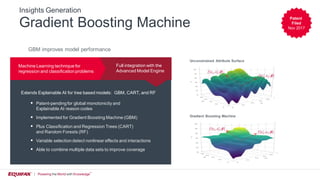

The document discusses Equifax's advancements in explainable AI (XAI) to improve credit scoring and decision-making processes through advanced analytics and machine learning techniques such as monotonic neural networks and gradient boosting machines. It highlights the importance of adhering to regulatory standards while ensuring the interpretability and accountability of AI models, particularly in the context of fair lending and consumer treatment. Case studies and performance metrics illustrate the effectiveness of these new models over traditional approaches, emphasizing better insights and outcomes for consumers and lenders.