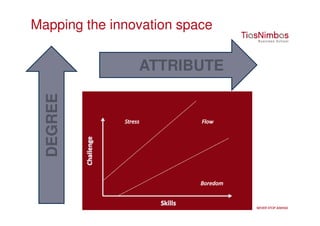

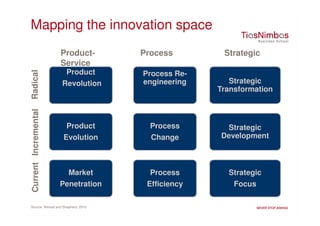

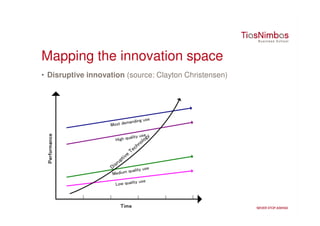

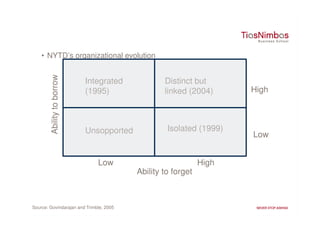

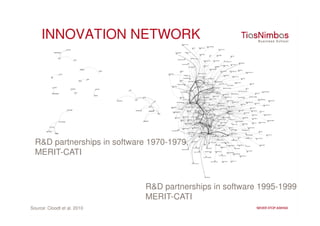

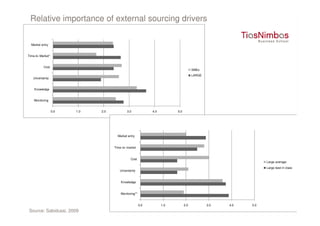

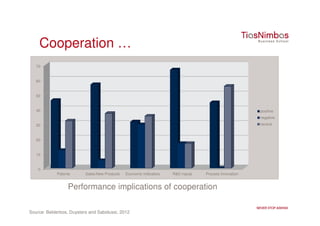

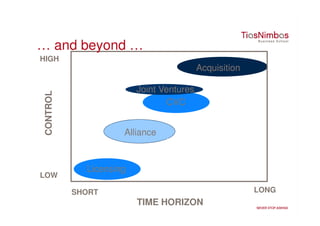

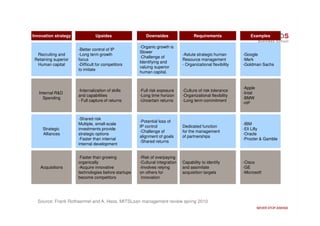

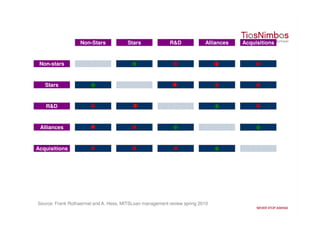

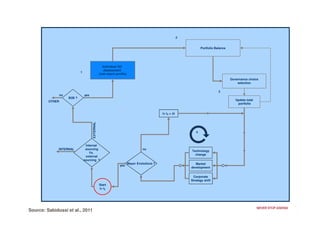

Innovation strategies involve a portfolio of internal R&D spending, strategic alliances, acquisitions, and recruiting/retaining top human capital. Firms must balance the upsides and downsides of each approach, such as controlling intellectual property versus time to market. The document also maps the degrees and types of innovation, and examines factors that influence external sourcing decisions for companies of different sizes.