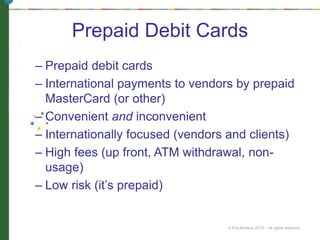

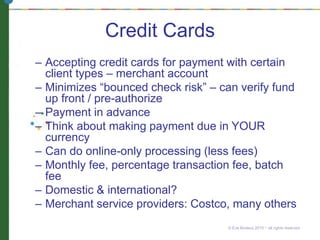

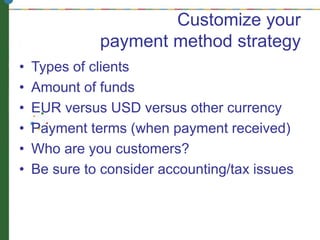

This document discusses various payment methods that can be leveraged to benefit a business, including currency exchange rates, payment processing options, and assessing specific needs. It provides an overview of different currency exchange considerations and payment processing options such as checks, direct deposit, wire transfers, PayPal, currency exchange services, prepaid debit cards, and credit cards. Key factors discussed include exchange rates, fees, processing times, currency control, and customizing a payment strategy based on client types, amounts, currencies, and terms. Resources for further information are also provided.