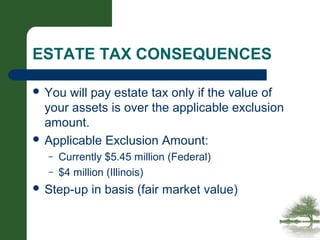

This document provides an overview of basic estate planning documents and concepts. It discusses wills, trusts, powers of attorney, living wills, probate, guardianships, and their purposes. Key points covered include how a will passes property according to instructions but requires probate, while a living trust avoids probate; and how powers of attorney can designate someone to handle financial and medical matters if one becomes incapacitated. The document also summarizes estate tax implications. Overall it serves to explain common estate planning tools and why having an up-to-date plan is important.