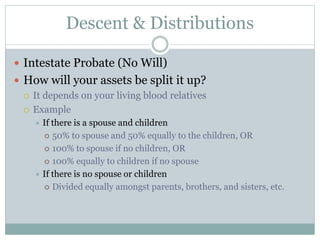

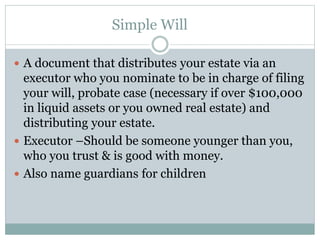

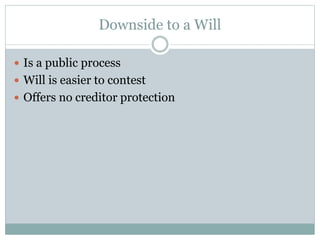

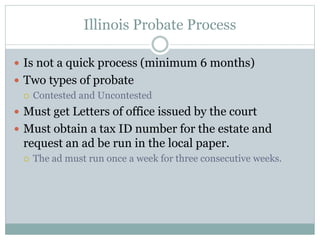

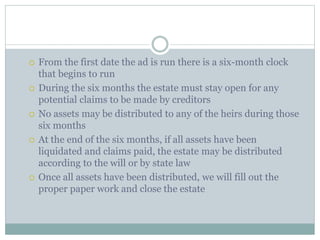

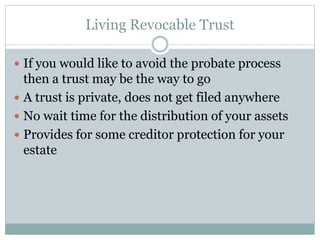

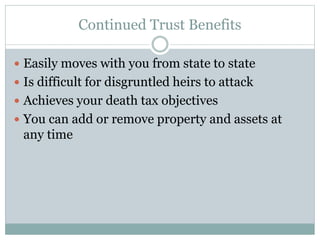

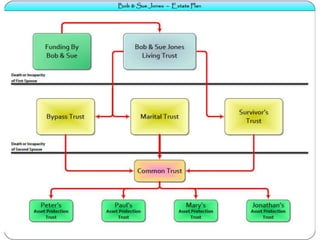

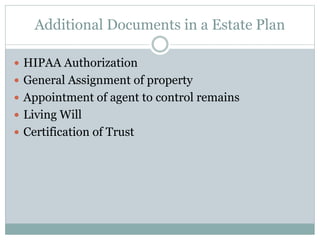

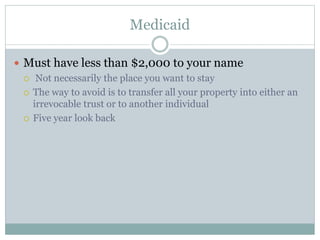

The document outlines estate planning essentials provided by the Law Office of Lauren E. Jackson, covering topics like wills, trusts, and powers of attorney. It discusses the implications of not having a will, the probate process in Illinois, and the benefits of creating a living revocable trust to avoid probate and protect assets. Additionally, it emphasizes the importance of naming trusted agents for health care and property decisions and provides contact information for the law office.