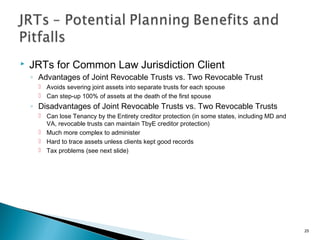

This document provides an overview of joint revocable trusts (JRTs), including:

- What a JRT is and its potential benefits and pitfalls

- Drafting considerations for different estate planning scenarios using a JRT

- Post-mortem administrative issues that can arise

The document discusses various JRT structures and how they impact estate tax planning and basis adjustments at the first spouse's death. It also notes why clients and attorneys may prefer JRTs but cautions they require careful accounting of each spouse's contributions to avoid tax issues.

![11

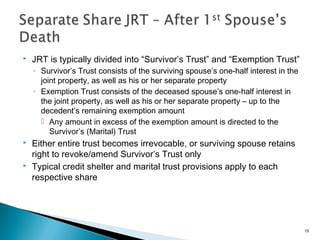

Scenario #3: Equalizing Joint Trust

◦ First spouse to die retains a general power of appointment over

one-half of the trust assets; in default of such exercise, the

decedent’s one-half share of the trust assets (up to his/her

remaining exemption amount) is directed to CST

Surviving spouse has not right to revoke or amend CST

Surviving spouse’s interest in the CST is limited to an

ascertainable standard

Generally, results in stepped-up basis of ½ of the trust assets at

the first spouse’s death

Unless the grantor who contributed the lesser amount of property dies

within 1 year of funding [IRC Section 1014(e)]

CST is not includible in surviving spouse’s estate](https://image.slidesharecdn.com/jointrevocabletrusts-150809193532-lva1-app6892/85/Joint-Revocable-Trusts-Update-11-320.jpg)

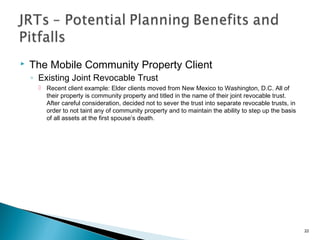

![32

What trust assets are included in the Decedent’s taxable

estate?

◦ Look at the powers retained by the Decedent during lifetime

(power to revoke and general power of appointment (“GPOA”)

over all trust assets)

◦ The power to revoke during results in inclusion of assets over

which Decedent had the power under Section 2038

◦ GPOA over assets at death results in inclusion under §2041

◦ GPOA purposely included to trigger inclusion of all assets in JRT

to fully fund credit shelter

◦ There are PLRs which support the GPOA intended result, BUT

you don’t get step up [Section 1014(e)] for Surviving Spouse’s

Assets in credit shelter

◦ There is a risk that the IRS’ position could change](https://image.slidesharecdn.com/jointrevocabletrusts-150809193532-lva1-app6892/85/Joint-Revocable-Trusts-Update-32-320.jpg)