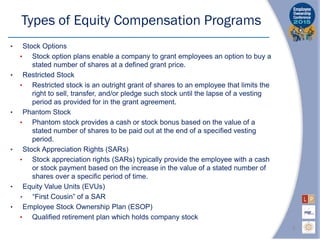

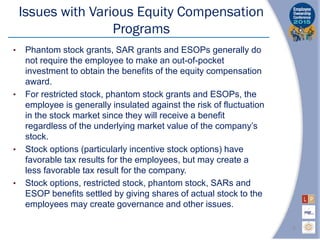

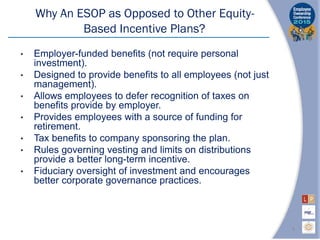

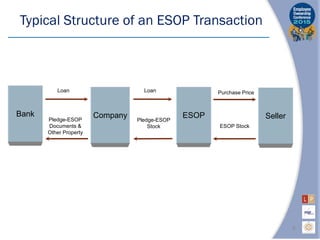

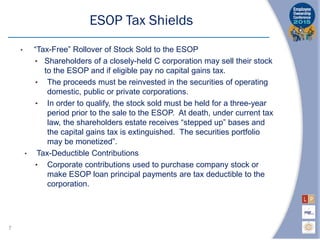

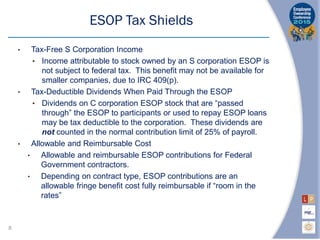

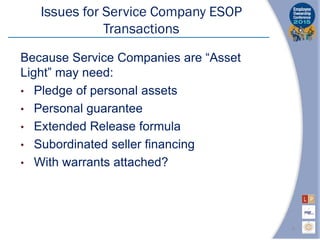

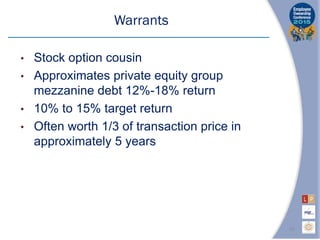

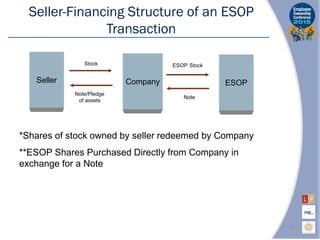

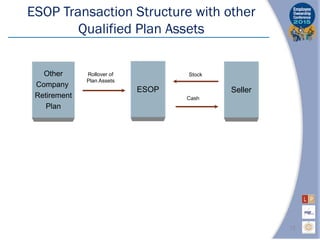

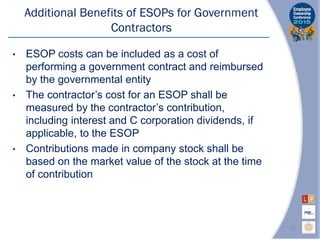

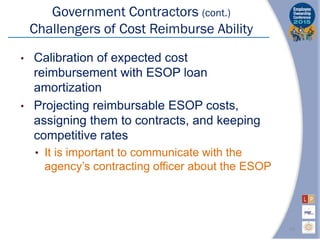

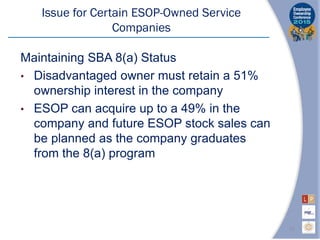

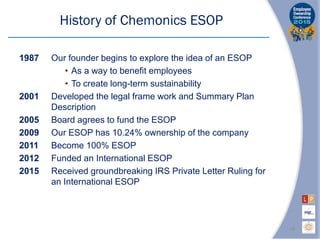

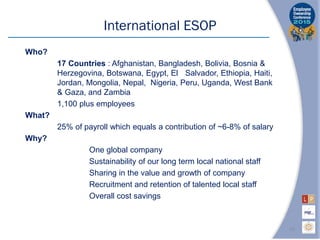

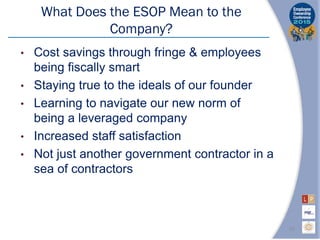

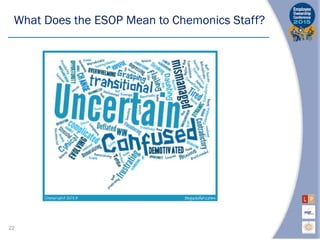

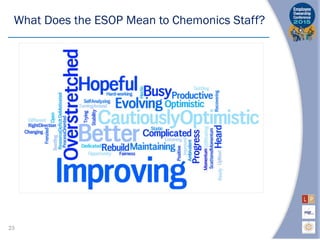

The document outlines various equity compensation programs, including stock options, restricted stock, phantom stock, and Employee Stock Ownership Plans (ESOPs), emphasizing the benefits and unique features of ESOPs for professional service firms. It discusses the advantages of ESOPs, such as tax benefits and employee inclusiveness, and provides a historical overview of Chemonics' ESOP development and culture. Additionally, it addresses challenges faced by service companies in ESOP transactions and the broader impact of ESOPs on employee satisfaction and organizational sustainability.