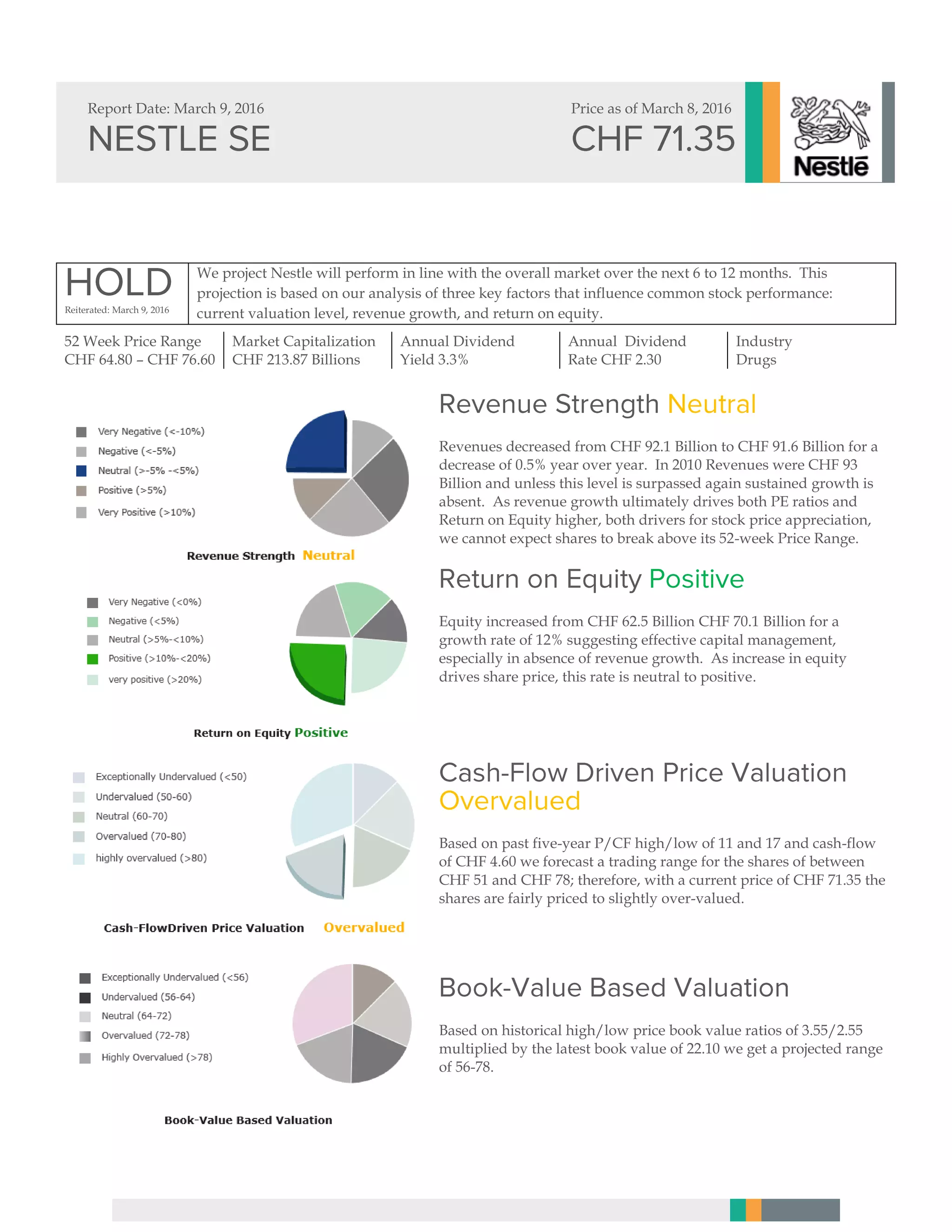

Nestle is projected to perform in line with the overall market over the next 6-12 months based on an analysis of valuation, revenue growth, and return on equity. While revenues have decreased slightly and growth has been absent, equity has increased 12% through effective capital management. The stock is currently fairly priced based on historical valuation ranges.