Fundamentally, the economy seems solid with good job growth, rising wages, and optimistic consumers, which supports stocks. However, uncertainties remain around earnings, Fed policy, trade talks, debt levels, and global growth.

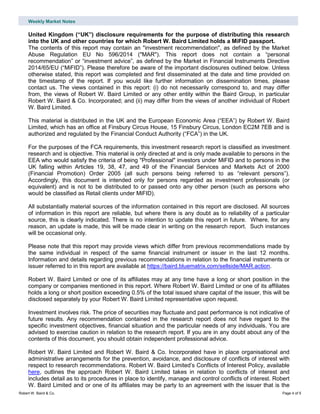

Technically, the market has seen significant improvement, suggesting further upside. Downside momentum has broken and breadth is improving, though a retest of lows is possible.