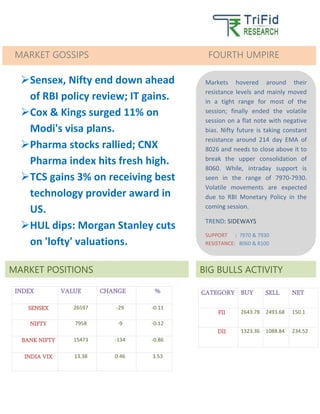

The Sensex and Nifty indices ended lower ahead of the RBI policy review, with the market remaining volatile and in a tight range. Cox & Kings saw an 11% surge due to Modi's visa plans, while pharma stocks reached a new high, and TCS gained 3% after winning a technology award. The market is expected to experience significant movements with upcoming monetary policy decisions.